Ether (ETH) Price: Network Activity Hits Record Highs While Token Falls 21% in Q1

TLDR

- Ether has dropped 21% in Q1 2026, marking its third-worst first quarter performance in history despite strong network fundamentals.

- Tom Lee from Fundstrat attributes the price decline to lack of leverage in the market and capital flowing to precious metals like gold and silver.

- Ethereum’s daily transactions hit an all-time high of 2.8 million on January 15, with active addresses reaching 1 million per day in 2026.

- BitMine purchased 41,788 ETH last week and now holds 4.28 million ETH (3.55% of total supply), though faces $7 billion in unrealized losses.

- ETH dropped to $2,200 on Monday after Kevin Warsh was named as Fed Chair candidate, with futures traders experiencing the second-largest single-day liquidation event on record.

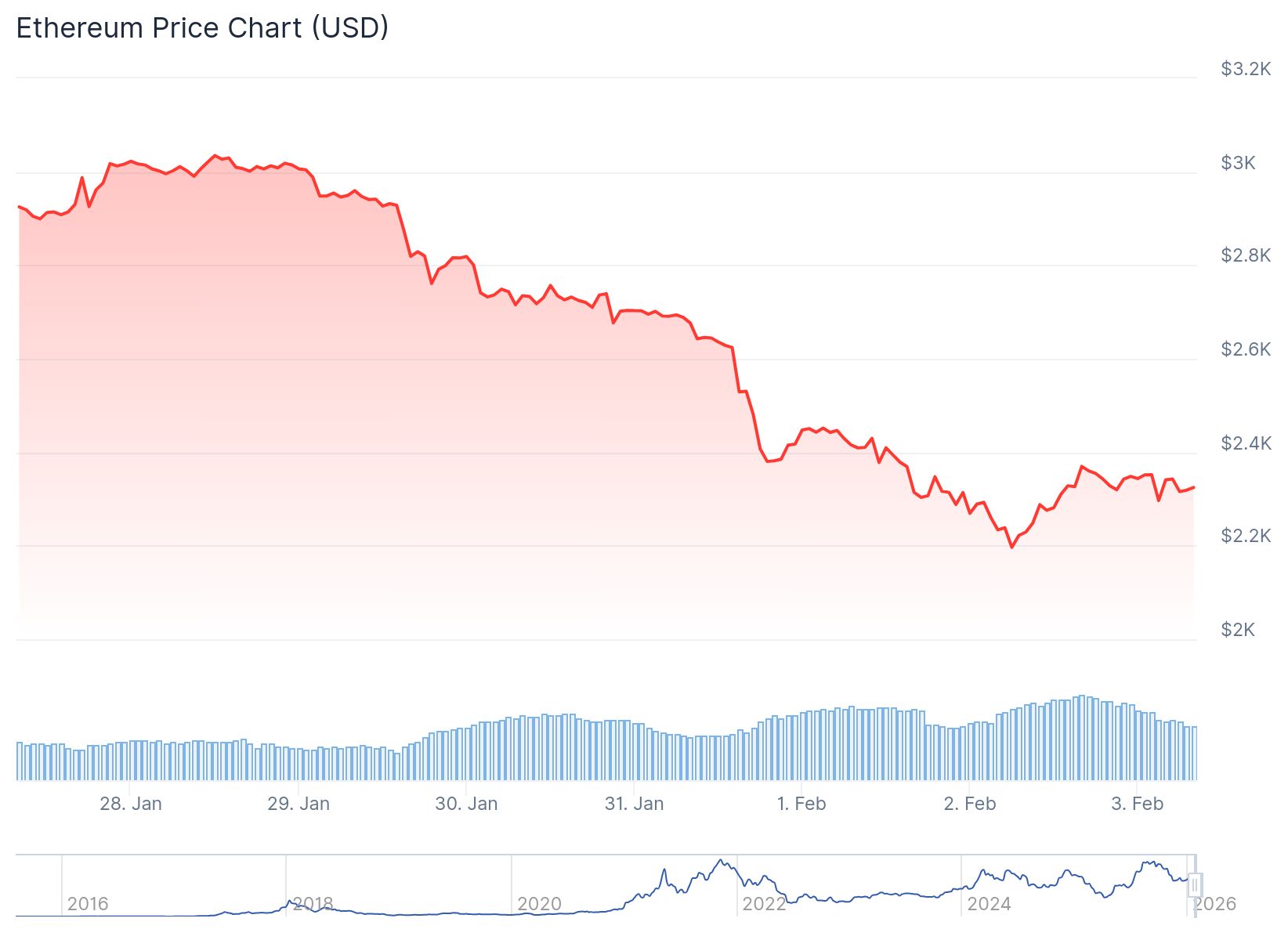

Ether has fallen 21% in the first quarter of 2026, making it the third-worst Q1 performance in the cryptocurrency’s history. The price dropped from around $3,000 to a low of $2,200 on Monday before showing signs of recovery.

Ethereum (ETH) Price

Ethereum (ETH) Price

Tom Lee, head of research at Fundstrat, says the decline doesn’t match what’s happening on the Ethereum network. Daily transactions reached an all-time high of 2.8 million on January 15, according to Glassnode data. Active addresses also peaked at around 1 million per day in 2026.

Two main reasons are keeping Ether’s price down, according to Lee. First, leverage hasn’t returned to the crypto market since the October 10 crash. Second, rising precious metal prices have pulled investment away from crypto as traders moved capital into gold and silver.

BitMine Continues Buying Despite Losses

BitMine, Lee’s Ethereum treasury firm, bought another 41,788 ETH last week. The company now holds 4.28 million ETH, which equals 3.55% of the total supply. BitMine has staked approximately 2.87 million ETH and is working toward a goal of holding 5% of all Ether.

The biggest price drop happened in the past week alone. ETH fell more than 25% after President Donald Trump named Kevin Warsh as his choice for Federal Reserve Chairman to replace Jerome Powell when his term ends in May.

Trading Volume Reaches Extreme Levels

Trading volumes spiked to $55 billion, equal to 20% of Ether’s circulating market cap. These numbers are typically seen in low-cap altcoins and meme coins, not major cryptocurrencies like ETH.

The selloff triggered massive liquidations in the futures market. On January 30, Ethereum saw $1 billion in long positions liquidated in a single day. This was the second-highest daily liquidation on record, only beaten by the October 10 flash crash.

The Fear and Greed Index hit 15, marking “Extreme Fear” for the fourth time in the past 12 months. The index measures overall market sentiment.

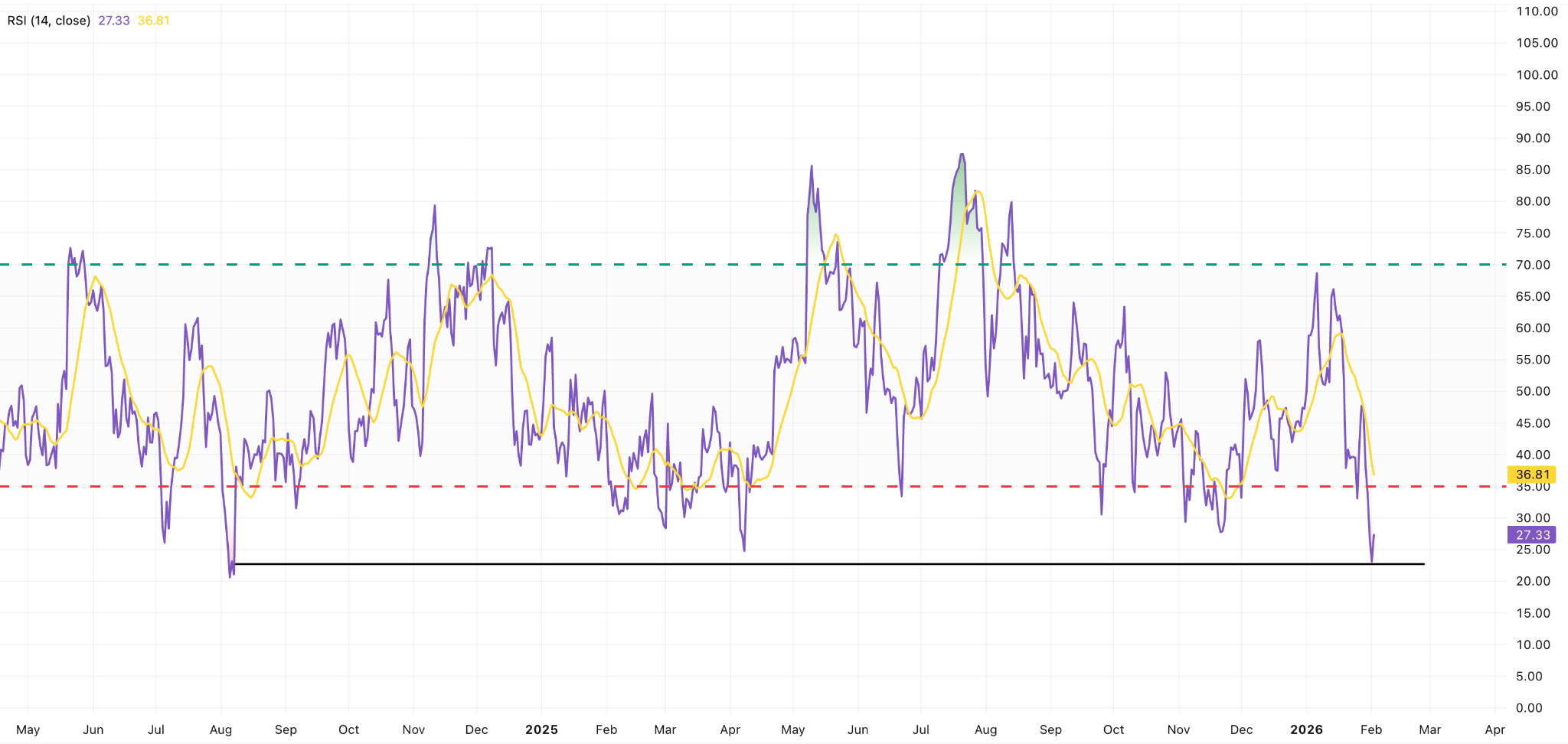

Source: TradingView

Source: TradingView

ETH has bounced off a key support level at $2,200, the same price point from which it rallied to a new all-time high after June 2025. The Relative Strength Index (RSI) reached its lowest oversold reading since August 2024. When ETH hit similar oversold levels in August 2024 at $2,150, it later rallied to $4,000 within a few months.

The post Ether (ETH) Price: Network Activity Hits Record Highs While Token Falls 21% in Q1 appeared first on CoinCentral.

You May Also Like

Galaxy Digital’s 2025 Loss: SOL Bear Market

Why This New Trending Meme Coin Is Being Dubbed The New PEPE After Record Presale