No KYC for Buying Cryptocurrency on StealthEX

Today, transactions within one blockchain or cross-chain swaps are becoming more and more popular in the crypto industry and beyond. Anybody can buy crypto with credit or debit card, however, you will need to share your personal details with the exchange platform and/or verify your identity for larger sums of money.

A few years ago, KYC (Know Your Customer) procedure was introduced to protect both customers and trading platforms. Most crypto exchanges require you to sign up with them, take your selfie, send in your ID, and provide your credit/debit card details to buy or sell crypto coins. As the market is becoming more regulated, it gets more difficult to find an exchange with no KYC for buying crypto.

In general, a KYC procedure may include ID card verification, face verification, document verification such as utility bills as proof of address, and biometric verification. Banks and exchange platforms must comply with KYC regulations and anti-money laundering regulations to limit fraud.

Many customers, especially in the crypto industry, find this inconvenient and believe that KYC or verification contradicts the whole idea of cryptocurrencies and the freedom they provide in the digital world. Crypto users who are extremely protective of their privacy continue to seek out exchanges and swappers that are free from KYC despite the associated risks. That’s why it makes us happy to announce no KYC crypto purchases!

How Does Buying Crypto Without KYC Work at StealthEX?

As StealthEX respects its customers and wants to make your experience with us as comfortable as possible, we introduce no KYC purchases to new StealthEX users. It will be one extra step towards the freedom our customers require and a more user-friendly experience for them. If you’re tired of endless IDs and providing all the platforms with your personal details, StealthEX is for you. The platform gives you a great opportunity to exchange crypto without boring verifications.

Thanks to StealthEX you can now purchase an amount of crypto without KYC if it’s less than $700 or the equivalent of this amount in other currencies. As long as your total purchases don’t exceed $700, you don’t have to verify your identity. You can make one big purchase or several small $20, $50 or $100 transactions. StealthEX allows users to seamlessly exchange their assets across chains in minutes without the need to verify their identity.

By offering an opportunity to buy cryptocurrency up to $700 without KYC, StealthEX aims to simplify the process of entering the world of cryptocurrency. Now, is this even legal? Yes, it is. As a rule, exchanges must identify the customer if they want to buy or withdraw funds over $1000 or more, while purchases under $1K do not require verification checks. Tiresome and long verification processes, even for the smallest amounts of crypto, should be a thing of the past. StealthEX is here for you to smooth out your online crypto purchases

How Can You Benefit from No KYC Swaps?

If you’re a newbie and have little or no experience with cryptocurrencies, you are far more likely to try and make a small purchase via a platform that will provide you with a seamless user experience. Nobody likes verification procedures and nobody likes to wait for their documents to come through. No one seems to have time to do that in the internet, where most things can be accessed instantaneously. A large number of customers are more likely to give up an onboarding process if it’s long and turns those endless minutes of waiting into hours, and you will most definitely be putting the KYC procedure off and could potentially miss the moment to buy your preferred crypto at a great price.

All of this is even more true for crypto enthusiasts that love the digital crypto world for its quick transactions. It’s a fact that swapping your crypto through an exchange is way more tedious, time-consuming and/or expensive than just using an instant non-custodial swapper like StealthEX.

No KYC buyer’s experience lets StealthEX introduce the simplicity of crypto swaps and help their customers stay happy and content. While crypto exchanges provide a lot of extra features, including trading, it’s easier to swap cryptocurrency via platforms like StealthEX: now, you don’t need to collect all that boring paperwork to buy crypto.

How to Buy Bitcoin with Credit Card Without KYC?

Here’s how you can make a crypto purchase on StealthEX:

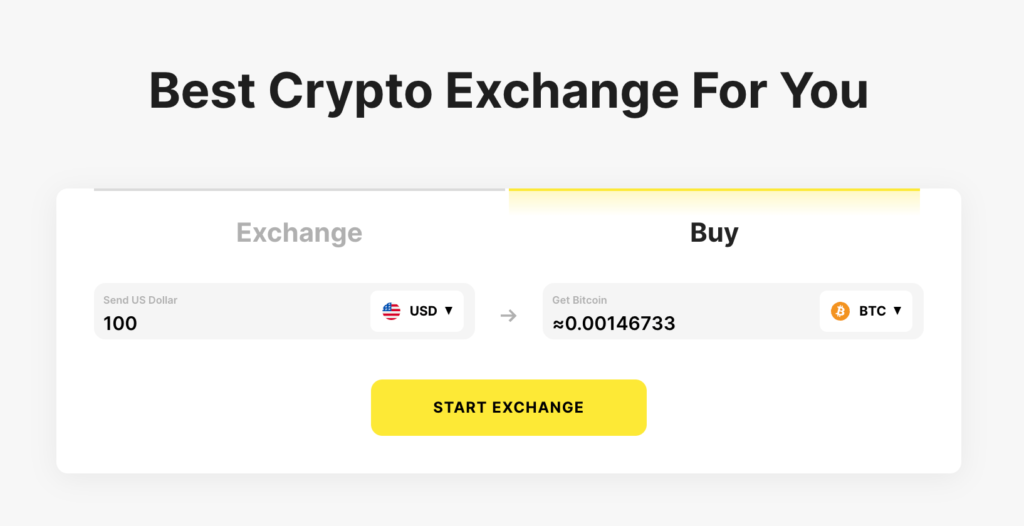

- Just go to StealthEX. Open the «Buy» crypto window instead of the automatically loaded «Exchange».

- Then select fiat currency and choose the cryptocurrency that you want to buy. For instance, USD to BTC.

- Enter your crypto wallet address.

- When buying an amount of crypto under $700 for the first time you won’t need to take the KYC procedure. So just send in the fiat and wait for your purchase to be processed!

Make sure to follow us on Medium, X, Telegram, YouTube, and Publish0x to get StealthEX updates and the latest news about the crypto world. If you need help, drop us a line at [email protected].

Please make sure to always research any cryptocurrency and assess your risks before you invest.

know your customer KYC KYC AML NO KYC non custodial exchangeThe post No KYC for Buying Cryptocurrency on StealthEX first appeared on StealthEX.

You May Also Like

Best Crypto to Buy as Saylor & Crypto Execs Meet in US Treasury Council

BlackRock boosts AI and US equity exposure in $185 billion models