Crypto VC shrank in January — but bankrolls stilled flowed

Crypto VC deals fell in January, but funding exploded as big checks flowed into BitGo, Fireblocks, Ripple’s RLUSD push, DeFi bets, and SOL‑backed credit.

- Crypto VC deals dropped 15% MoM and 42% YoY, while funding jumped 61% MoM and 497% YoY to $14.57b.

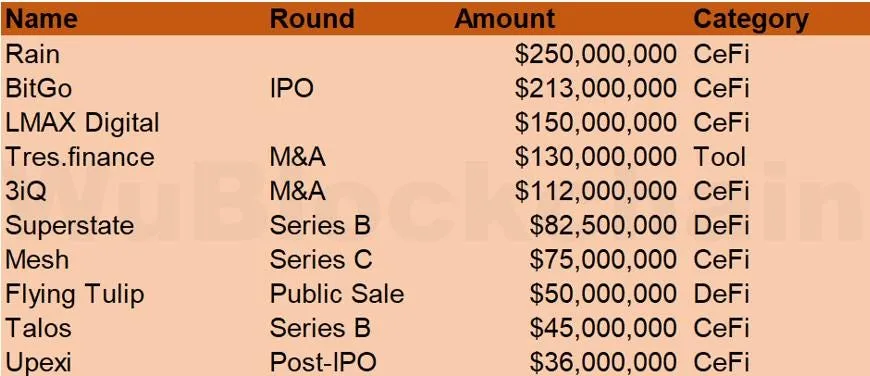

- Flagship deals included BitGo’s $212m IPO, Fireblocks’ $130m TRES buyout, and Ripple’s $150m RLUSD‑LMAX financing.

- From Coincheck–3iQ to SOL‑backed Upexi notes, capital is rotating into scaled, institutional‑grade infrastructure.

Headline shift: fewer deals, much bigger checks

According to RootData, just 52 crypto VC investments were publicly disclosed in January 2026, “down 15% month‑on‑month (61 projects in December 2025) and down 42% year‑on‑year (89 projects in January 2025).” Yet total funding soared to “USD 14.57 billion, up 61% month‑on‑month (USD 9.06 billion in December 2025) and up 497% year‑on‑year (USD 2.44 billion in January 2025),” underscoring a market where capital concentrates into fewer, larger winners. Sector‑wise, CeFi took roughly 15% of disclosed deals, DeFi about 25%, NFT/GameFi 6%, L1/L2 6%, RWA/DePIN 10%, Tool/Wallet 8%, and AI 8%.

That bifurcation mirrors the broader institutionalization trend highlighted in prior infrastructure stories, from BitGo’s public‑market ambitions to custody consolidation and exchange upgrades.

Flagship transactions: IPOs, acquisitions, and stablecoin rails

Custody heavyweight BitGo priced its U.S. IPO at “USD 18 per share, above the previously indicated range of USD 15–17,” selling “a total of 11.8 million shares, raising approximately USD 213 million, implying a valuation of over USD 2 billion.” Jointly underwritten by Goldman Sachs and Citigroup, the deal makes BitGo “the first crypto company to complete an IPO in 2026,” a milestone in the sector’s march into public equity markets.

On the infrastructure side, Fireblocks agreed to acquire crypto accounting platform TRES Finance in a cash‑and‑stock transaction “valued at approximately USD 130 million.” Fireblocks said the deal will “enhance its data analytics and financial management capabilities in the crypto space, helping enterprises more comprehensively manage digital assets spread across multiple platforms and wallets,” its second acquisition in three months.

Meanwhile, Ripple struck a “multi‑year strategic partnership with LMAX Group,” under which Ripple will provide “USD 150 million in financing to support the broad use of the RLUSD stablecoin as margin and a settlement asset within LMAX’s global institutional trading system.” RLUSD will be integrated as a “core collateral asset” across LMAX’s infrastructure, deepening the stablecoin’s role in institutional trading.

Strategic bets: exchanges, DeFi, and SOL‑backed credit

Japanese exchange Coincheck moved to acquire roughly 97% of Canadian asset manager 3iQ at a valuation “of approximately USD 112 million,” issuing 27.1497 million new shares at “USD 4.00 per share” as consideration. 3iQ, founded in 2012, previously launched some of North America’s first Bitcoin and Ethereum funds on the Toronto Stock Exchange and, in 2025, added a Solana staking ETF and an XRP spot ETF.

In DeFi, Andre Cronje‑led Flying Tulip raised “USD 25.5 million” in a private Series A at a “USD 1 billion FDV,” bringing “total institutional funding to USD 225.5 million,” alongside “USD 50 million” raised via Impossible Finance’s Curated platform and a reserved “USD 200 million allocation” for an upcoming public CoinList sale. Crypto payments network Mesh closed a “USD 75 million Series C,” lifting total funding above USD 200 million and valuing the company at USD 1 billion, while market‑maker Talos secured a USD 45 million Series B extension at a USD 1.5 billion valuation with Robinhood joining investors such as a16z crypto, BNY, and Fidelity.

One of the more structurally interesting deals saw Upexi sign a securities purchase agreement with Hivemind Capital Partners for about “USD 36 million in principal amount of convertible notes, backed by SOL as consideration and collateralized accordingly,” at a 1.0% coupon, fixed conversion price of “USD 2.39 per share,” and a 24‑month term; after closing, “the company’s SOL reserves are expected to increase by 12% to over 2.4 million SOL.”

Macro tape: majors still define risk

This parabolic move comes as digital assets continue to trade as the purest expression of macro risk appetite. Bitcoin (BTC) changes hands near $78,500, with a 24‑hour high just above $79,200 and a low in the mid‑$74,000s, on roughly $80B in spot and derivatives turnover. Ethereum (ETH) trades around $2,320, with about $34B in 24‑hour volume as majors consolidate after recent gains. Solana (SOL) hovers close to $104, up roughly 2–3% over the last day, on more than $4.3B in trading volume.

Together, January’s VC tape and the still‑buoyant majors paint a market where cheap money is gone, but deep‑pocketed investors are doubling down on scale, regulation‑friendly infrastructure, and institutional rails rather than spray‑and‑pray token bets.

You May Also Like

Best Crypto to Buy as Saylor & Crypto Execs Meet in US Treasury Council

BlackRock boosts AI and US equity exposure in $185 billion models