Linea releases tokenomics: ETH used for gas, LINEA neither gas nor governance token

Linea, the Ethereum layer 2 network developed by ConsenSys, has officially released its LINEA tokenomics framework, revealing a unique Ethereum-aligned model.

- Linea released tokenomics showing ETH as gas and no governance role for LINEA.

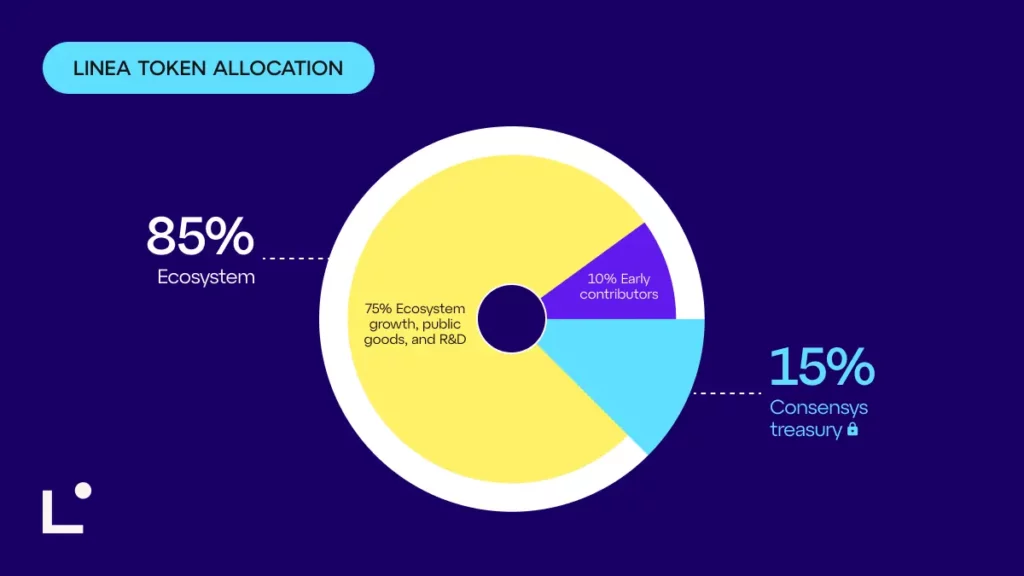

- 85% of LINEA’s 72B supply goes to ecosystem incentives while 15% is reserved for ConsenSys.

- Fee structure burns ETH and LINEA to link usage with long-term value.

The update was shared in a July 29 blog post and arrives ahead of Linea’s anticipated Token Generation Event. ETH will serve as the sole gas token, while the new LINEA token will function as an incentive and funding mechanism.

LINEA not for gas or governance

Unlike typical L2 models, Linea separates utility and value capture by using ETH exclusively for gas while burning both ETH and LINEA from network fees. 20% of layer 2 ETH revenue is burned, with the remaining 80% used to buy and burn LINEA. This dual-burn mechanism is designed to reinforce ETH’s monetary premium while linking LINEA’s value to real usage.

LINEA will not serve as a governance token, and the protocol will not be governed by a DAO. Strategic decisions will instead be managed by the Linea Consortium, a council of Ethereum-native projects including ENS Labs, Eigen Labs, and SharpLink, under a U.S.-based nonprofit entity.

LINEA tokenomics

The total supply of LINEA is fixed at 72 billion tokens, with 85% allocated to ecosystem growth and 15% reserved for ConsenSys treasury. At launch, 22% of the total supply will be circulating, largely through early user airdrops and liquidity programs. No tokens have been sold to investors or employees.

The Ecosystem Fund, comprising 75% of the total supply, will be deployed over a 10-year period. In the first 12 to 18 months, about 25% will go toward community development, builder support, exchange readiness, and liquidity provisioning. The remaining 50% will go toward ecosystem infrastructure, public goods, and protocol research and development.

9% of the supply will be distributed to early users via airdrops and will be fully unlocked at TGE. Eligibility is based on Linea XP and onchain activity that reflects authentic usage and ecosystem engagement.

Another 1% will go to strategic builders, such as key decentralized applications and infrastructure partners, chosen through a curated selection process focused on long-term alignment.

Focused on Ethereum alignment

Instead of framing the LINEA token as a governance tool, Linea positions it as an “economic coordination tool.” Participation, not capital, will determine how it is allocated to users, builders, and ecosystem contributors. The model, which emphasizes decentralized growth and long-term public goods funding, echoes Ethereum’s (ETH) 2015 launch.

Currently, Linea has $155 million in total value locked, as per DefiLlama data, and hosts more than 350 applications. Two major updates that were recently rolled out include native USD Coin (USDC) integration and a fee subsidy partnership with Layerswap to reduce the cost of bridging into Linea.

You May Also Like

Tropical Storm Basyang expected to drench Caraga, Northern Mindanao

Hoskinson to Attend Senate Roundtable on Crypto Regulation