Ondo Price: MetaMask Integrates 200+ Tokenized U.S. Stocks Through Platform

TLDR

- MetaMask integrated over 200 tokenized U.S. stocks, ETFs, and commodities through Ondo Finance on February 3, 2026

- Users can now trade assets like Tesla, Apple, Microsoft, NVIDIA, and gold/silver ETFs directly in their MetaMask wallet without traditional brokers

- Ondo Global Markets platform has grown to over $500 million in total value locked since its September 2025 launch

- The integration was announced at the 2026 Ondo Summit in New York and allows eligible mobile users in supported non-U.S. regions to access these assets

- ONDO token price rose 2.68% to $0.29 while the broader crypto market fell 0.98%

MetaMask announced on February 3 that it integrated Ondo Finance’s tokenized securities platform. The integration brings more than 200 tokenized U.S. stocks and ETFs directly into the MetaMask wallet.

Eligible mobile users in supported regions can now buy and sell tokenized versions of major U.S. stocks. These include Tesla, Apple, Microsoft, NVIDIA, and Amazon. The integration also covers ETFs like IWM and QQQ, plus commodity-linked products including gold, silver, copper, and rare earth metals.

The new feature eliminates the need for users to open traditional brokerage accounts. Users can access these tokenized securities without leaving the MetaMask app or using third-party brokers.

Ian De Bode, President at Ondo Finance, explained the reasoning behind the partnership. He said MetaMask is where millions of users already manage their onchain assets. Integrating Ondo Global Markets introduces a new asset class into that wallet experience.

Joe Lubin, founder of Consensys and co-founder of Ethereum, commented on the integration. He said the move shows how crypto wallets can bridge traditional and onchain finance without sacrificing user control.

Platform Growth and Market Performance

Ondo Global Markets launched in September 2025. Since then, the platform’s total value locked has climbed past $500 million. The platform has processed over $9 billion in trading volume.

While minting and redemption follow traditional market hours, the tokens can be transferred anytime. Transfers work across Ethereum, Solana, and BNB Chain.

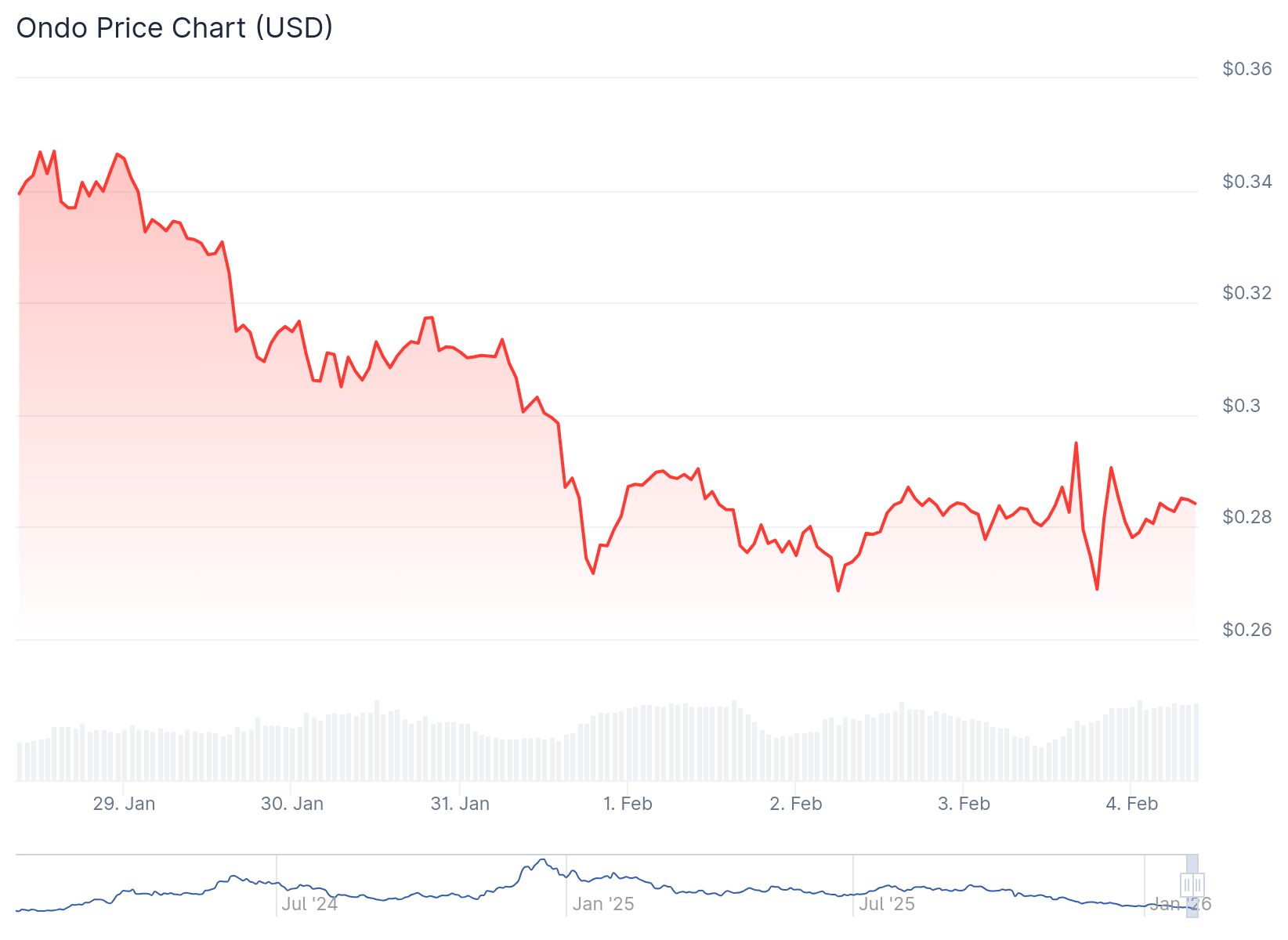

Ondo Price

Ondo Price

The ONDO token traded at $0.29 at the time of reporting, showing a 2.68% gain over 24 hours. This gain came while the overall crypto market dropped 0.98% to reach $2.59 trillion.

Future Plans and Industry Reception

The MetaMask integration was revealed at the 2026 Ondo Summit in New York. The summit brought together representatives from banks, regulators, and financial firms.

During the event, Ondo outlined plans to expand its Global Markets platform. The company aims to include thousands of tokenized securities. These will range from individual stocks to ETFs and mutual funds.

Speakers at the summit discussed how tokenization could speed up settlement and reduce costs. They also talked about extending market operating hours beyond traditional trading times.

Several speakers noted a shift in attitude from traditional finance. Banks and asset managers are becoming more open to regulated, onchain access to traditional financial products. This represents a change from earlier skepticism about blockchain-based securities.

The integration is available to eligible mobile users in supported non-U.S. markets. Users must meet platform requirements to access the tokenized securities.

The post Ondo Price: MetaMask Integrates 200+ Tokenized U.S. Stocks Through Platform appeared first on CoinCentral.

You May Also Like

XAU/USD picks up, nears $4,900 in risk-off markets

Sonic Holders Accumulate Millions as Price Tests Key Levels