Ondo Finance Partners With MetaMask to Bring Tokenized Stocks and ETFs On-Chain

- Ondo Finance’s integration with MetaMask expands on-chain access to tokenized securities.

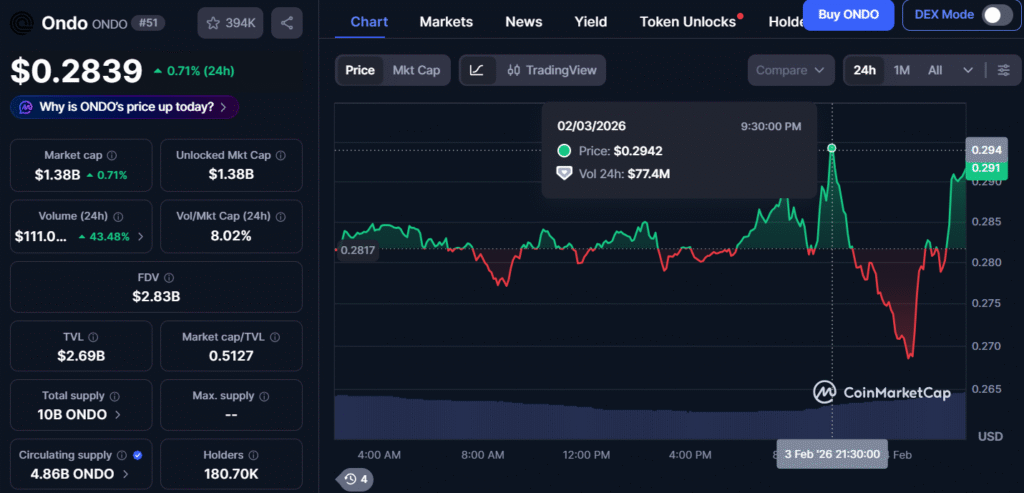

- ONDO is trading near $0.28, showing limited price movement.

Ondo Finance announced a major partnership, as it expands on-chain access with a new integration with MetaMask, allowing millions of users to tap into tokenized stocks and ETFs through Ondo Global Markets. After this announcement, the ONDO token surged and is seeing a pullback amid broader monthly declines.

On February 3, the integration between MetaMask and Ondo Finance was unveiled at the Ondo Global Summit, which happened in New York City. Which “marks one of the first instances of native access to tokenized US stocks and ETFs within a major self-custodial wallet,” mentioned in the official MetaMask blog post.

The official blog post states that more than 200 tokenized U.S. stocks and ETFs, which track gold, silver, and the Nasdaq-100, also the companies like Tesla, NVIDIA, Apple, Microsoft, and Amazon, are now available to valid mobile users within permitted non-U.S. regions without the need to open a traditional brokerage account.

When looking deeper, the tight geographical restrictions mean that users in major financial centers, like the United States, are still not included.

As the integration operates through the MetaMask Swap interface, users can purchase Ondo Global Markets (GM) tokens on the Ethereum network with USDC. These blockchain-based tokens can be traded around-the-clock, every day of the week, and are intended to reflect the value of the underlying stocks or ETFs.

ONDO Market Reaction

Source: CoinMarketCap

Source: CoinMarketCap

As ONDO remains down 35% on the monthly chart, following that, the integration news sees ONDO’s brief surge to nearly $0.294 yesterday before dipping to around $0.26 in early trading hours. The token has since rebounded and is trading near $0.289, up a modest 0.71% over the past 24 hours as market participants continue to assess the impact of the MetaMask integration.

Highlighted Crypto News:

Senate Democrats Plan Closed-Door Meeting on U.S. Crypto Market Structure

You May Also Like

‘Big Short’ Michael Burry flags key levels on the Bitcoin chart

BlackRock Increases U.S. Stock Exposure Amid AI Surge