Exclusive Interview with Solana Mobile General Manager: How does the zero-commission Web3 mobile Seeker start the flywheel effect?

Author: Token Relations

Compiled by Tim, PANews

In this month’s new Solana Sessions interview series, we spoke with Emmett Hollyer, General Manager of Solana Mobile.

Solana Mobile, an innovative project from Solana Labs, is committed to deeply integrating crypto-native functionality into smartphones. The newly released Seeker phone embodies this philosophy. This Android device features a built-in "Seed Vault" crypto wallet, secure storage for private key mnemonics, and native support for decentralized applications (DApps) through the Solana dApp store.

Solana Mobile is building a product that delivers the same smoothness as Web2 devices while incorporating Web3 elements. We will delve into how this project is driving the mobile adoption of the Web3 ecosystem by providing a more user-friendly mobile Web3 experience for crypto users and developers through improved usability, security, and performance.

Exploring the New Era of Web3 Smartphones

Ordinary people are constantly glued to their smartphones, while crypto-native users can’t live without computer monitors. However, a major pain point of Web3 today is that too many applications are not mobile-friendly.

Solana Mobile is trying to solve this problem with the "Seeker," a phone designed to make it easier for people on the go to use crypto apps. Emmet Hollyer, general manager of Solana Mobile, said the new phone comes just over two years after the launch of its flagship Saga model, but it brings new design elements.

This phone introduces a new seed vault technology for protecting digital assets. Users can sign transactions with a double touch + fingerprint scan, and the operation logic is exactly the same as Apple Pay authentication method.

"We want to make this as frictionless as possible," Hollyer said. "When you use internet products, it should feel frictionless, but when you start using crypto products, it often becomes difficult."

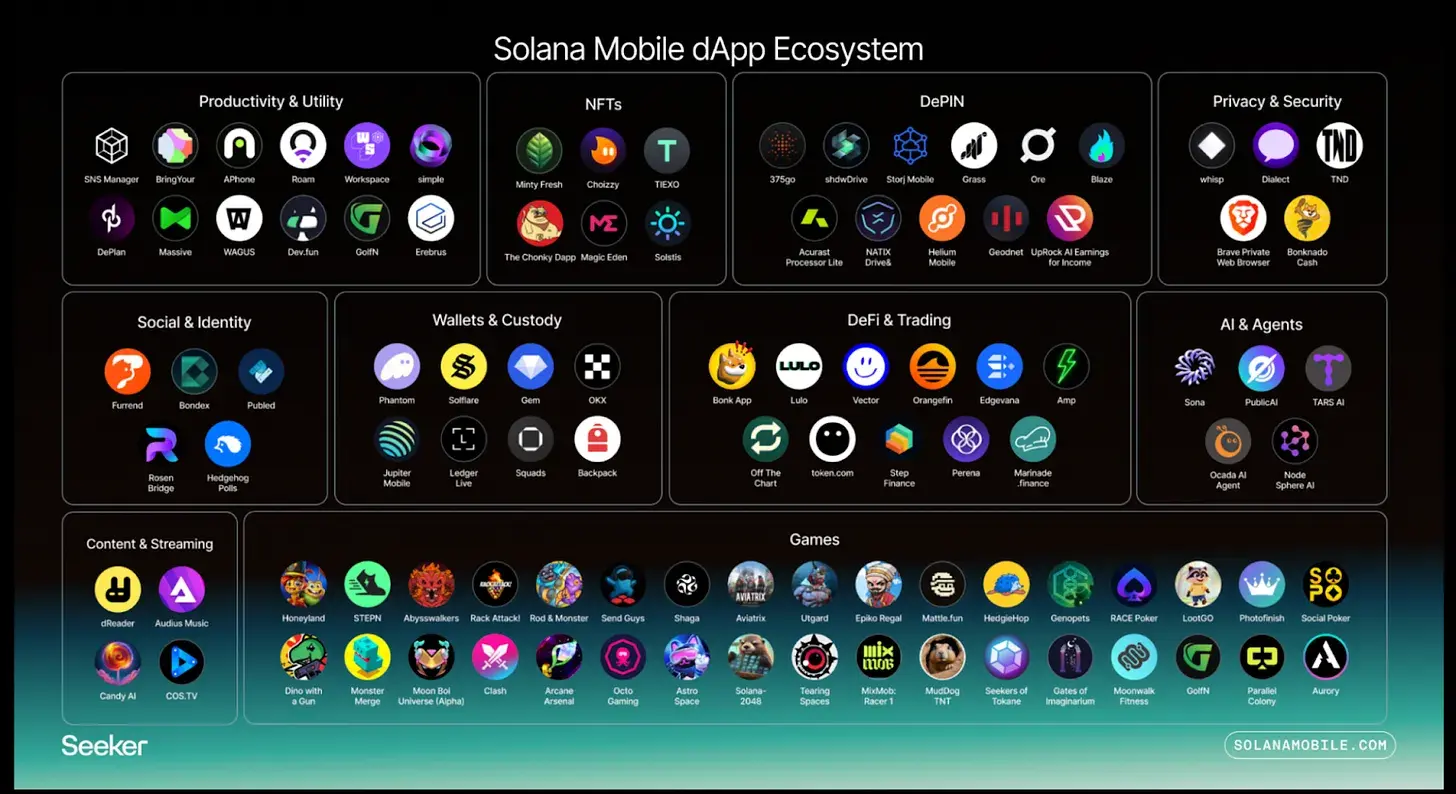

Solana Seeker also aims to make the development experience equally convenient and cost-effective. Hollyer explained that the Solana Mobile dApp Store features nearly 100 mobile apps, with free deployment. Unlike traditional web app stores, which can be restrictive, the Solana Mobile Store breaks the mold, allowing developers to unleash their creativity and truly experience the power of decentralization.

Hollyer added: "Our platform is extremely cryptocurrency-friendly. Developers don't have to worry about marketing or hiding crypto functionality, and we don't charge any fees. Our core focus is supporting development teams in building great apps and getting them on the market."

Seeker Phone also eliminates the fee structure common in other mobile app stores. "A core principle of many cryptocurrency innovations is to eliminate the middlemen between users and businesses," Holler said. "Charging a hefty 30% fee is contrary to the philosophy of our ecosystem, and we firmly believe that this is not the way to achieve our goals."

Solana Mobile is fully committed to transforming Seeker into a "financial infrastructure" platform that goes beyond crypto devices. Operations Director Holler revealed that with the launch of "Seeker Season" in September, more dApps will be launched. Positioned as "financial infrastructure," this phone is expanding inclusive finance by lowering the barrier to entry for developers. Whether acquiring new users or developing applications, the Seeker phone will become a foundational channel for breaking down industry barriers.

“If you can achieve a scenario where there are a bunch of compelling and unique apps that drive more users to their phones and drive more spending, then the resulting flow of money will create economic opportunities for developers, which will attract even more developers,” Hollyer said. This flywheel effect will build a sustainable financial ecosystem for both users and developers, he added.

Solana Seeker Sales Report

- 150,000 pre-sale orders

- 80% of orders come from outside the United States

- 10 tracks, 100 dApps

- Price: $500

Solana Seeker Hardware Configuration

- MediaTek Dimensity 7300 processor

- 8GB RAM

- 128GB storage space

- 6.36-inch AMOLED display, 460 PPI, 120 Hz

You May Also Like

Solana Hits $4B in Corporate Treasuries as Companies Boost Reserves

SHIB Price Prediction: Mixed Signals Point to $0.0000085 Target by February End