Here’s how high Bitcoin price go with 1% pension fund allocation

The new executive order could unlock trillions in retirement funds for crypto, with a 1% shift potentially pushing Bitcoin to $194,000. Still, volatility and regulatory risks may limit quick adoption.

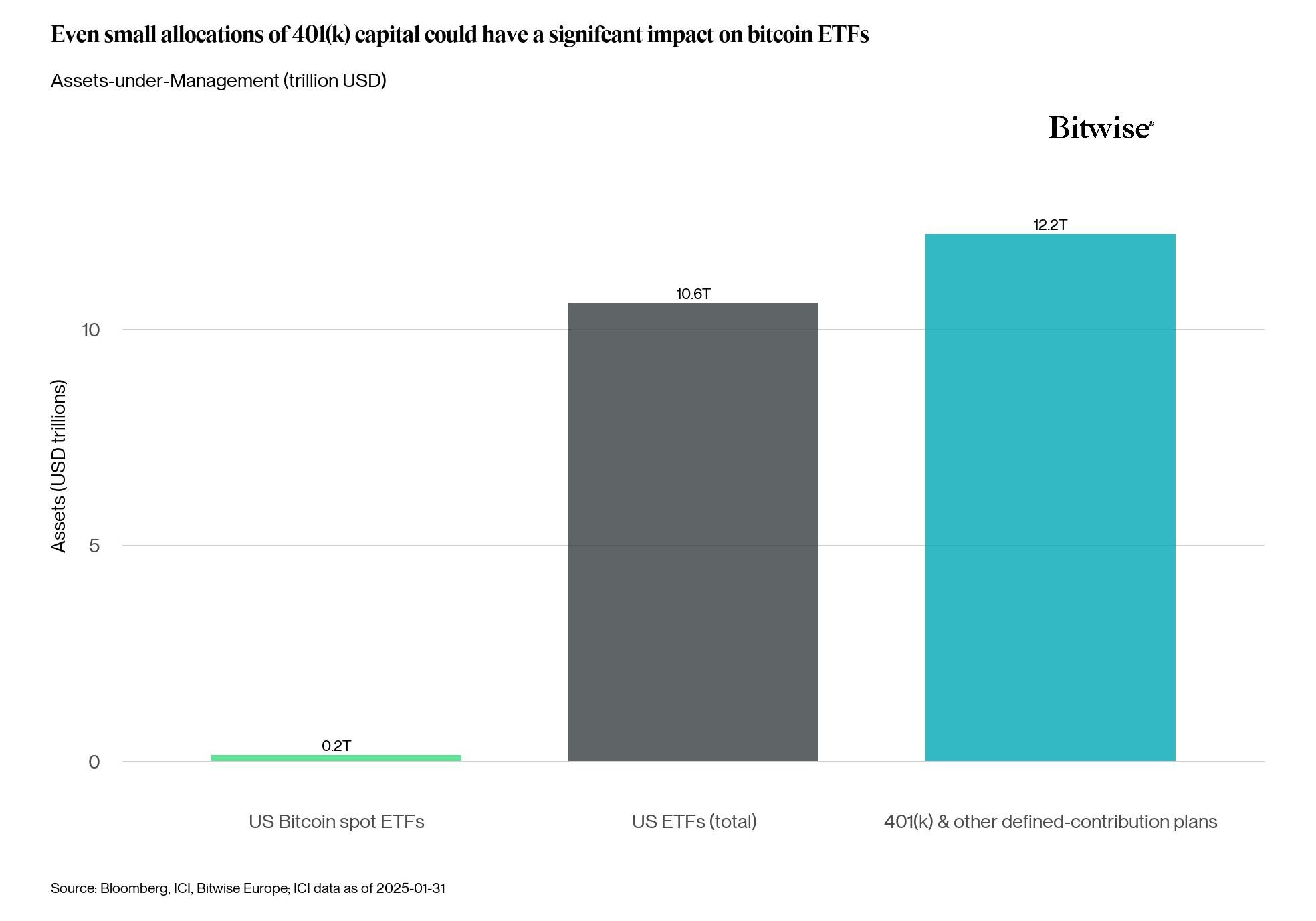

- A recent executive order could enable crypto investments within employer-sponsored retirement plans, unlocking access to $12.2 trillion in assets.

- Bitwise projects that a 1% allocation shift could raise Bitcoin’s price to about $194,000, while a 10% shift might push it toward $868,700.

- Despite this potential, volatility, regulatory uncertainty, and fiduciary responsibilities remain big challenges.

Last week, markets flicked from cautious to almost electric. Ethereum (ETH) surged past $4,300, a level not seen since late 2021, while Bitcoin (BTC) flirted with a breathtaking $121,000, approaching its prior all-time high. Now, some financial analysts suggest an often-overlooked potential accelerant: U.S. retirement savings.

A fresh Bitwise report suggests that today’s 401(k) ecosystem could unleash literally trillions of dollars into crypto, and with it, possibly triggering a near-textbook price explosion.

Table of Contents

- Bitwise’s Bitcoin forecast

- Everything changed

- Demand side

- Volatility and fees loom

Bitwise’s Bitcoin forecast

Bitwise’s “Chart-of-the-Week” lays it all out with razor clarity, saying “approximately $12.2 trillion is managed in 401(k) and other defined-contribution retirement plans,” more than the ~$10.6 trillion parked in U.S. ETFs. The report suggests that even modest reallocations could have a meaningful impact on crypto markets.

Bitwise notes that 401(k) plans typically allocate via ETFs, making a spot-ETF entry all the more plausible, and potent. Using a simplified projection from Bitcoin’s current price of around $119,000, a 1% inflow from 401(k) assets might lift its price to roughly $193,970. A 10% allocation shift, about $1.22 trillion in theoretical buying power, could — if the relationship scaled linearly — push prices toward $868,700.

Everything changed

Until recently, crypto was viewed as taboo in employer-sponsored retirement accounts. That changed when U.S. President Donald Trump signed an executive order Aug. 7, directing the Department of Labor, SEC, and Treasury to expand access to alternative assets in employer 401(k) plans, explicitly naming cryptocurrencies alongside real estate and private equity.

Regulators were urged to clarify fiduciary responsibilities and reduce legal friction so plan sponsors could consider crypto investments while meeting their obligation to act in savers’ best interests.

If implemented as envisioned, such a regulatory change, combined with the sheer scale of assets involved, could mean that plans run by BlackRock, Fidelity, and others might eventually offer spot Bitcoin or Ethereum ETFs, either as standard menu items or via self-directed brokerage windows, potentially opening a new channel for capital.

Per the Investment Company Institute, employer-based defined-contribution accounts hold about $12.2 trillion, with roughly $8.7-$8.9 trillion in 401(k)s. That number towers over the current global crypto market, estimated at $4 trillion. Even a 1% pivot — $87 billion — would be enough to reshape the supply-demand balance.

To put it another way: the entire U.S. 401(k) system now represents more than double the size of all the crypto in existence.

Demand side

Younger investors appear to be leading interest in crypto-based retirement strategies. A 2024 Bank of America Private Bank study found that among high-net-worth individuals under age 44, nearly 50% already own cryptocurrencies, and an additional 38% are interested in owning them, placing crypto just behind real estate as the top perceived growth opportunity.

Meanwhile, evidence suggests that many younger investors prioritize crypto over traditional retirement vehicles. A 2025 YouGov survey, referenced by Money, reports that 42% of Gen Z investors own crypto, whereas only 11% hold a retirement account.

Defaults play a compelling role as well. Most 401(k) contributions are funneled into professional default options like target-date funds. If, following regulatory changes, these defaults begin to include crypto exposure, participation in crypto-linked investments could rise markedly, perhaps requiring minimal action by the plan participants themselves.

Volatility and fees loom

It isn’t all rocket fuel and unchecked enthusiasm. Bitcoin has weathered 70-80% crashes in past bear markets, behaviors entirely at odds with the “safe and steady” goal of retirement investing. Regulatory ambiguity, fiduciary liability, and fee structures also pose hurdles. 401(k) mutual funds often charge ~0.26%, while alternative or crypto structures may have higher fees or less transparency.

Plan sponsors, rightly cautious, will likely wait for clear guidance under ERISA before turning crypto from an optional sidebar into a core component.

And market plumbing seems to be already reacting. Spot crypto ETFs in the U.S. set subscription records in July, while futures open interest hit all-time highs. Liquidity improved, bid-ask spreads narrowed, and macro forces began driving pricing more than viral crypto narratives.

In essence, if retirement inflows become a steady buyer, markets stand to become more resilient and less wild. That structural demand could prevent extreme volatility and broaden legitimacy.

You May Also Like

United States Building Permits Change dipped from previous -2.8% to -3.7% in August

Payward Revenue Hits $2.2 Billion as Kraken Exchange Reports Strong 2025 Growth