Expert Warns Strategy Could Face a Spiral of Doom for Its Bitcoin Bet Following New Equity Guidance

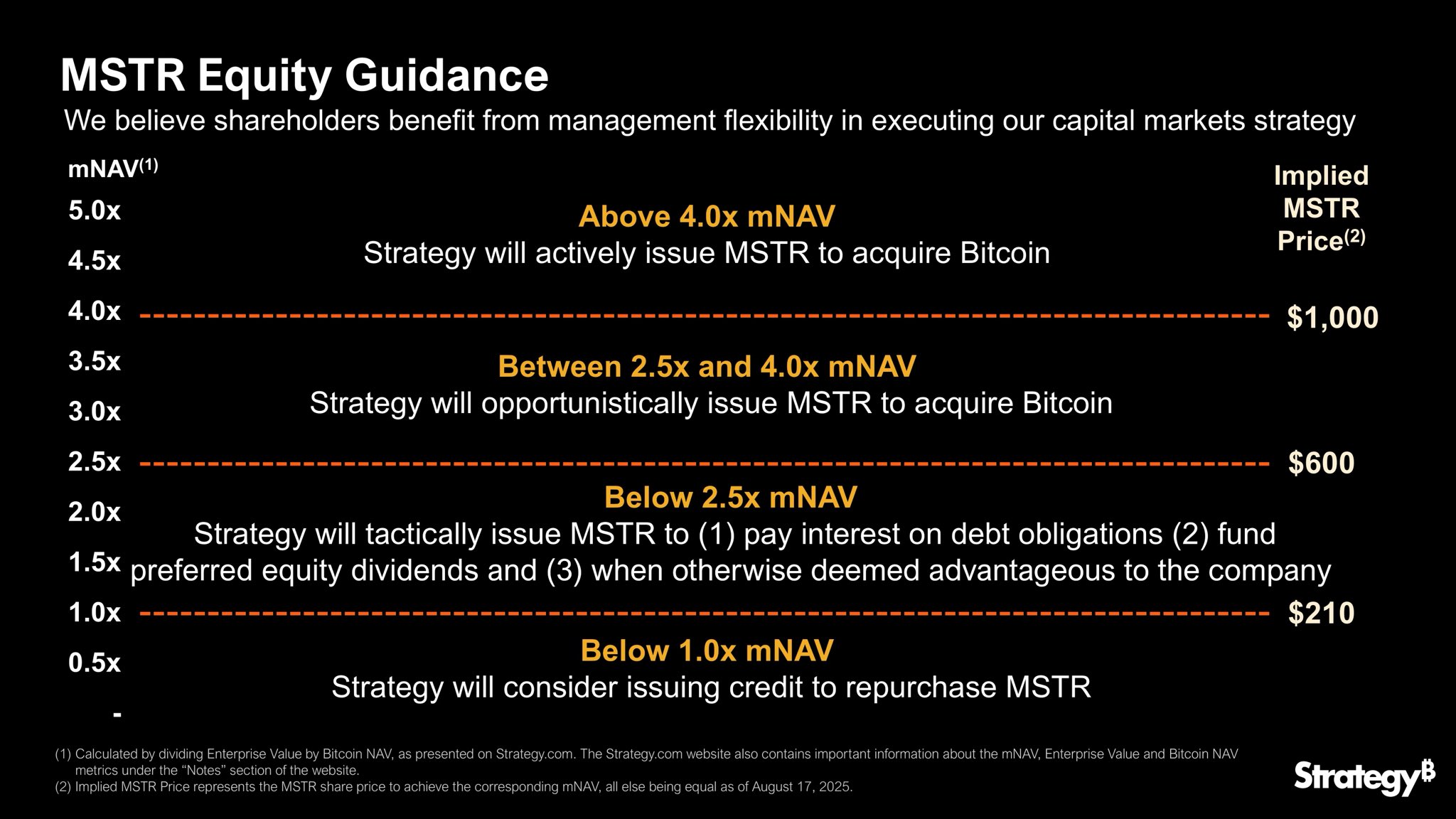

Strategy has again grown its already massive Bitcoin stash, but its latest financial update has triggered worries that the company's approach could eventually backfire. Notably, while Chairman Michael Saylor insists the plan gives the firm more flexibility, a prominent expert believes it could push the company into a dangerous cycle that hurts both shareholders and its Bitcoin strategy. For context, just yesterday, on Aug. 17, Strategy revealed it had purchased 430 more Bitcoin, spending about $51.4 million at an average price of roughly $119,666 per coin. This new purchase lifted the company's total holdings to 629,376 Bitcoin, worth about $46.15 billion in total. The company said its average purchase price sits at $73,320 per Bitcoin and that its Bitcoin investments have delivered a 25.1% return so far this year. Strategy Releases Equity Guidance After Latest Bitcoin Buy Following the announcement, Michael Saylor shared an update about how Strategy plans to manage its stock in relation to the value of its Bitcoin. Notably, he explained that the company uses a measure called mNAV, or market net asset value, which compares the company's share price to the value of the Bitcoin it owns. Depending on where the share price sits relative to that benchmark, Strategy will take different actions. Specifically, if MSTR trades at more than four times its mNAV, Strategy plans to sell new shares aggressively to buy more Bitcoin. If the stock trades between two-and-a-half and four times its mNAV, the company will still issue shares but only when it sees a good opportunity. Meanwhile, the approach changes once the stock drops below two-and-a-half times mNAV. In that range, Strategy would sell shares not just to buy Bitcoin but also to handle debt interest, pay preferred equity dividends, and cover other needs.

You May Also Like

Is Doge Losing Steam As Traders Choose Pepeto For The Best Crypto Investment?

XRPL Validator Reveals Why He Just Vetoed New Amendment