Shiba Inu Burn Rate Plunges 98% as SHIB Price Loses 20-Day Support

Shiba Inu SHIB $0.000012 24h volatility: 5.2% Market cap: $7.13 B Vol. 24h: $223.28 M price shed another 4% on Tuesday, extending its two-day decline to 6% and falling to $0.000012 for the first time in 13 days. As the largest Ethereum-based memecoin, SHIB’s performance is closely tied to sentiment surrounding Ethereum.

The 6% SHIB price drop comes as ETH ETFs entered $255 million in sell-offs, impacting liquidity and weakening sentiment across the broader Ethereum ecosystem.

Further emphasizing this bearish narrative, Shiba Inu’s on-chain activity slumped sharply on Tuesday. Official data from the Shibburn analytics tool showed that the burn rate plunged 98.89% in the last 24 hours, with only 223,914 SHIB removed from circulation.

Shiba Inu Burn Rate, Aug. 19, 2025 | Source: Shibburn.com

Unscheduled token burns occur as part of on-chain transactions and serve to reduce supply over time. Beyond that, they are also viewed as a barometer for tracking economic activity on a blockchain network.

The 98% decline in Shiba Inu burn rate signals reduced market participation, suggesting traders are moving to the sidelines amid uncertain conditions. With fewer tokens being destroyed, the deflationary pressure on SHIB weakens, leaving the asset more exposed to risks of further downswings.

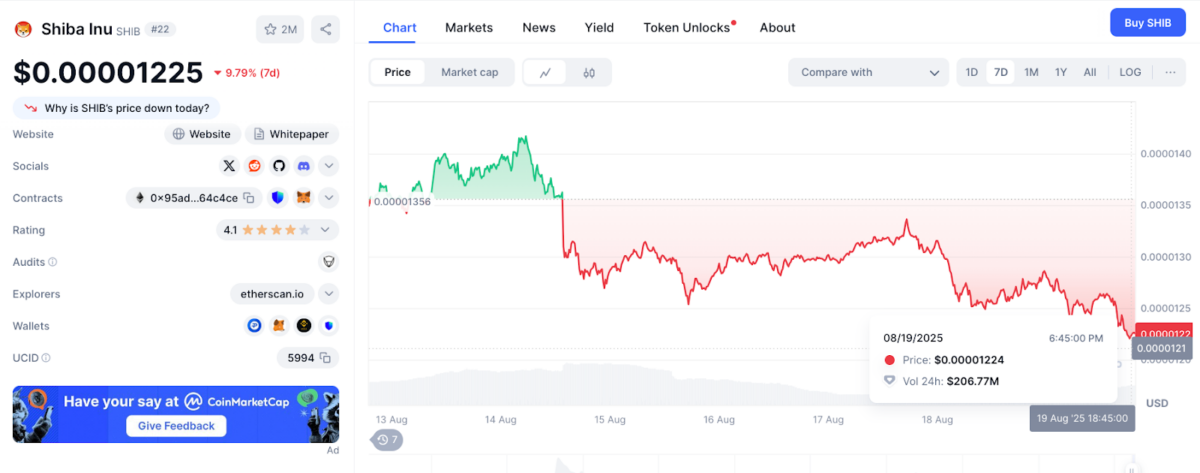

Shiba Inu Price vs Trading Volume | Source: CoinMarketCap, Aug. 19, 2025

On Tuesday, this lack of activity appeared to reinforce downward pressure, contributing to the intraday losses as SHIB spot trading volumes also fell to $206 million at press time, down 50% from last week’s peaks of $418 million recorded on Aug. 14, according to CoinMarketCap data.

Shiba Inu Price Forecast: Technical Risks Mount Below 20-Day Average

Shiba Inu entered Tuesday’s session trading under visible bearish pressure. Trading at $0.00001224, SHIB has now slipped beneath the 20-day moving average, a critical support level for short-term traders. A glance at the chart below shows momentum indicators leaning bearish, with the MACD line extending below the signal line and red candles dominating recent sessions.

Shiba Inu Price Forecast

This technical setup raises the likelihood of forced liquidations if selling pressure accelerates. For short-term SHIB price projections, bears may eye a rapid push toward the nearest support cluster at $0.00001164, aligning with the lower Bollinger Band. A further breach could drag SHIB toward the local low at $0.00001100, last seen in late July.

On the upside, bulls must reclaim the 20-day average at $0.000013 to restore confidence. A sustained move above that level could set the stage for a test of $0.000015, where the upper Bollinger Band capped last week’s gains. Until then, the prevailing sentiment remains bearish, reflecting broader Ethereum ecosystem headwinds and declining SHIB burn activity.

Maxi Doge Presale Gains Momentum Amid Shiba Inu Price Correction

While Shiba Inu grapples with declining on-chain activity, newly launched memecoins like Maxi Doge are capturing traders’ attention. Promoted as a high-leverage community token, Maxi Doge offers trading at 1000x leverage with no stop-loss, amplifying both risk and upside appeal.

Maxi Doge Presale

The presale, currently priced at $0.000253 per token, has already raised more than $1.27 million against a target of $1.53 million. Beyond presale demand, Maxi Doge emphasizes utility through staking pools with daily smart contract payouts, competitive contests rewarding top traders, and partnerships designed to integrate the token into futures platforms and gamified events.

The countdown timer indicates just two days before the next price increase. Visit the official Maxi Doge website to get in early.

nextThe post Shiba Inu Burn Rate Plunges 98% as SHIB Price Loses 20-Day Support appeared first on Coinspeaker.

You May Also Like

American Bitcoin’s $5B Nasdaq Debut Puts Trump-Backed Miner in Crypto Spotlight

Ethereum Price Prediction: ETH Targets $10,000 In 2026 But Layer Brett Could Reach $1 From $0.0058