Top 5 Decentralized Crypto Projects Building the Future of Web3

The rise of Web3 is transforming how the internet functions, shifting control away from centralized corporations and toward user-owned, transparent ecosystems. At the center of this evolution are blockchain-based projects driving decentralization across finance, data, and applications. While established names like Ethereum and Solana lead the charge, newer projects such as MAGACOIN FINANCE are beginning to draw attention for their potential to rival the explosive growth seen in past bull runs.

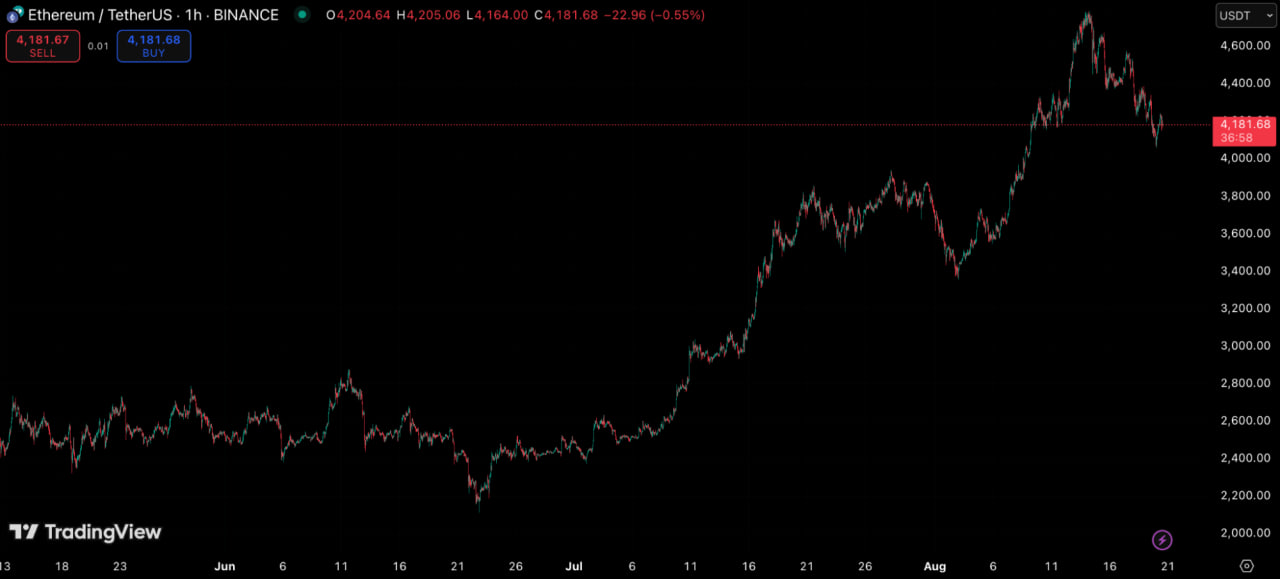

Ethereum (ETH): The Foundation of Web3

Ethereum remains the backbone of Web3, powering decentralized applications (dApps), DeFi, NFTs, and DAOs. Its move from proof-of-work to proof-of-stake has improved scalability and sustainability, positioning it to support the next wave of decentralized adoption.

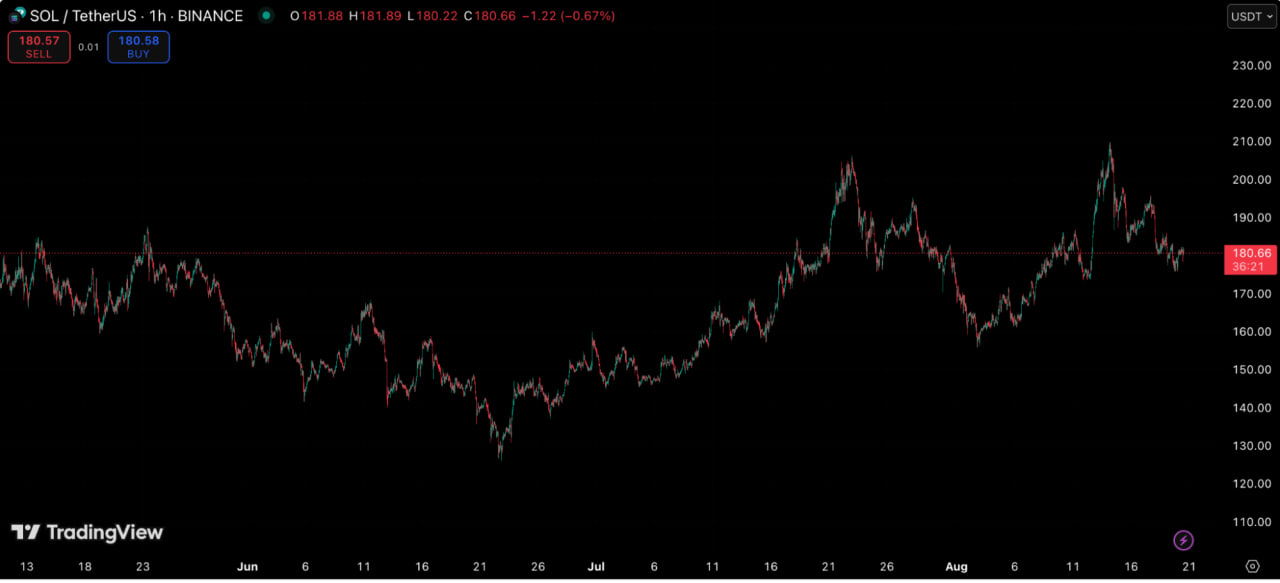

Solana (SOL): The High-Speed Contender

Solana is a go-to network for Web3 gaming and NFT platforms thanks to its unmatched transaction speeds and low fees. Using a mix of Proof of History and Proof of Stake, Solana processes thousands of transactions per second, making it one of the most scalable ecosystems in crypto.

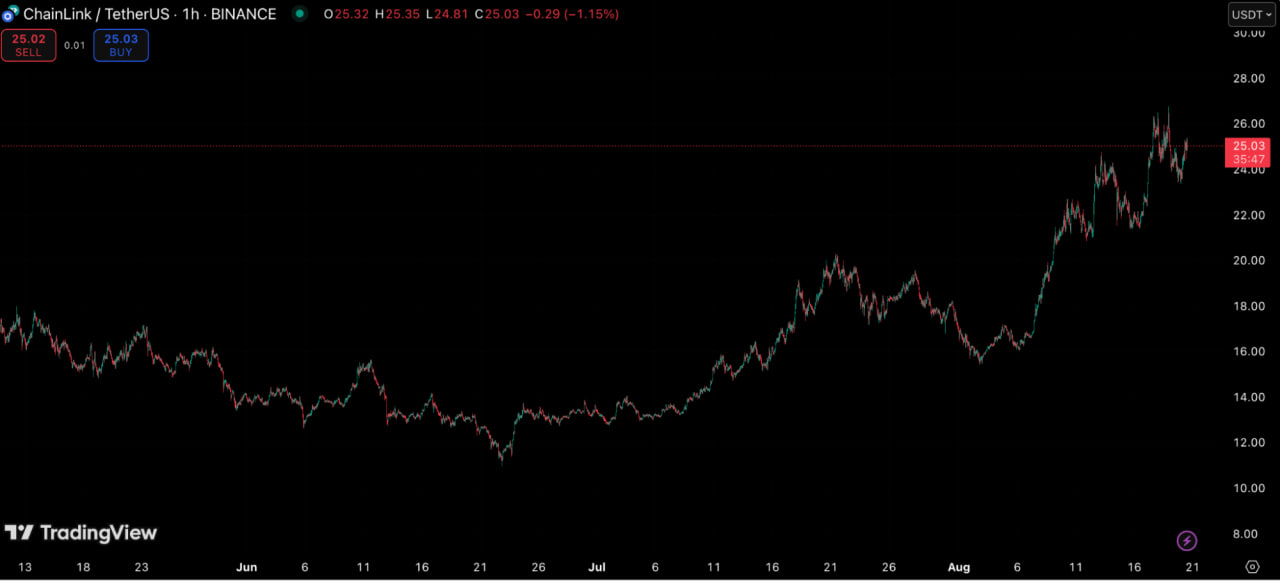

Chainlink (LINK): Real-World Connectivity

Chainlink serves as the bridge between blockchain smart contracts and off-chain data. Its decentralized oracle technology ensures secure access to external data feeds, APIs, and payment systems, enabling advanced use cases in DeFi, insurance, and logistics.

A Rising Force in the Web3 Space

While Chainlink was once hailed as a key piece of infrastructure during the last bull cycle, analysts believe MAGACOIN FINANCE could surpass that. With a fully audited, secure network and expanding utility, the project has already captured investor attention. Early forecasts suggest that MAGACOIN FINANCE’s momentum and scarcity-driven demand could replicate – or even exceed – Chainlink’s last major rally. Experts note that a modest $2,000 allocation could grow into tens of thousands during peak adoption, making it one of the most anticipated projects in Web3.

Uniswap (UNI): The Decentralized Trading Gateway

As the largest decentralized exchange, Uniswap lets users trade directly from their wallets without intermediaries. Powered by liquidity pools and automated market making, Uniswap ensures user custody, governance rights, and full decentralization.

Filecoin (FIL): Storage for the Decentralized Internet

Filecoin tackles data storage by providing a decentralized, censorship-resistant alternative to Big Tech cloud providers. Its peer-to-peer model allows anyone to rent unused space while ensuring secure and verifiable storage for users, making it a critical piece of Web3’s infrastructure.

Conclusion

From Ethereum’s foundational role to Solana’s scalability and Chainlink’s real-world integration, decentralized projects are reshaping the internet. Yet, among them, MAGACOIN FINANCE stands out as a potential breakout, with experts comparing its upside to past legendary rallies. For investors eyeing the future of Web3, positioning early could prove to be the most rewarding move.

To learn more about MAGACOIN FINANCE, visit:

Website: https://magacoinfinance.com

Access: https://magacoinfinance.com/access

Twitter/X: https://x.com/magacoinfinance

Telegram: https://t.me/magacoinfinance

This publication is sponsored. Coindoo does not endorse or assume responsibility for the content, accuracy, quality, advertising, products, or any other materials on this page. Readers are encouraged to conduct their own research before engaging in any cryptocurrency-related actions. Coindoo will not be liable, directly or indirectly, for any damages or losses resulting from the use of or reliance on any content, goods, or services mentioned. Always do your own research.

The post Top 5 Decentralized Crypto Projects Building the Future of Web3 appeared first on Coindoo.

You May Also Like

Three dormant wallets, suspected to belong to the same entity, purchased 5,970 ETH eight hours ago.

BlackRock Increases U.S. Stock Exposure Amid AI Surge