XRP Price Could Explode if the CLARITY Act Passes in April

The post XRP Price Could Explode if the CLARITY Act Passes in April appeared first on Coinpedia Fintech News

XRP is once again at the center of regulatory uncertainty and market pressure. Ripple CEO Brad Garlinghouse recently said there is an 80% chance the CLARITY Act could pass by the end of April, a move that may finally bring long-awaited crypto regulation clarity to the U.S. market.

The bill, currently stuck in the Senate Banking Committee, is designed to clearly define how digital assets are regulated and reduce confusion between agencies like the SEC and CFTC.

Garlinghouse has emphasized that even imperfect crypto legislation is better than ongoing uncertainty. Many institutional investors remain cautious without clear federal guidelines, limiting large-scale capital inflows into assets like XRP.

XRP Price Bottom Outlook Amid Crypto Regulation Update

Timing now plays a crucial role. If lawmakers resolve the deadlock before the spring recess and momentum builds toward passage by late April, the market could react early. XRP has historically shown sharp price movements following major legal or regulatory news. Confirmation of legislative progress could trigger a relief rally.

However, if negotiations stall again, uncertainty could continue to weigh on XRP price action. The coming weeks may determine whether the market forms a strong bottom based on optimism or slides further due to fear.

XRP Price Analysis: Key Support Levels and Downside Risk

From a price chart perspective, caution remains. Analyst CasiTrades points out that XRP faced rejection near $1.65, a key Fibonacci resistance level, signaling weakening buying momentum. After falling below $1.53, the asset may need another pullback before a sustained rally can begin.

She identifies $1.11 as a possible double-bottom support zone. If selling pressure increases, XRP could even retest the $0.90 area. For a confirmed reversal, the next low would need to show clear signs of bullish divergence and improving momentum, indicating that sellers are losing control.

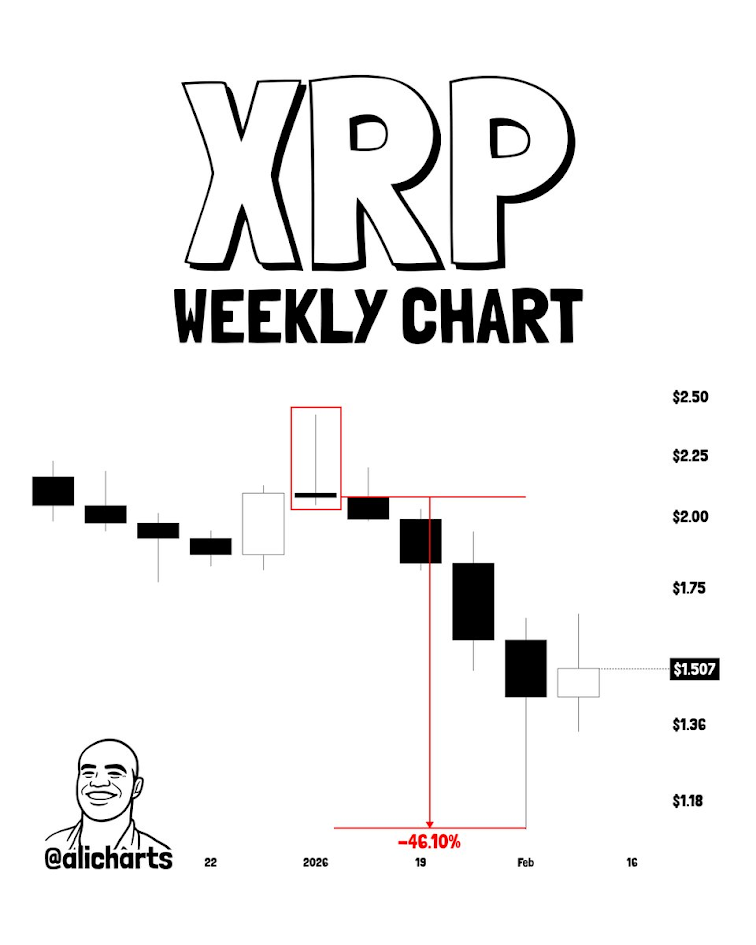

Adding to short-term concerns, analyst Ali Martinez noted a weekly gravestone doji pattern on XRP’s chart. In the past, this pattern was followed by a 46% decline, suggesting downside risks remain if market sentiment weakens further.

- Also Read :

- XRP Rich List Update: 2,200 XRP Now Enough to Enter Top 10% of Wallets

- ,

Can XRP Price Recover if the CLARITY Act Passes?

A strong move back above $1.65 and sustained price stability there would signal that buyers are regaining control. If the CLARITY Act advances in April, XRP could shift from legal uncertainty toward stronger institutional confidence.

In that case, the initial move may begin with a relief rally driven by improved sentiment. Over time, clearer digital asset regulation and broader crypto adoption could support steady upside momentum into 2026.

For now, XRP stands at a critical point, balancing hopes of regulatory clarity with ongoing technical weakness. April could prove decisive in shaping the next major trend for XRP price.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

The CLARITY Act aims to define U.S. crypto rules and clarify SEC vs CFTC roles. Clear laws could boost XRP confidence and attract institutional money.

Yes. Clear regulation may reduce uncertainty and trigger a relief rally, especially if XRP reclaims key resistance near $1.65 with strong volume.

Yes. While courts ruled XRP isn’t a security in some cases, broader federal clarity is pending, keeping institutions cautious.

A sustained break above $1.65, bullish divergence on momentum indicators, and stronger buying volume would signal sellers are losing control.

You May Also Like

How Wheelchair Transportation Transforms Daily Life by Enhancing Mobility, Safety, Independence, and Social Inclusion for Individuals with Limited Mobility

Tom Lee’s BitMine (BMNR) Raises $365M at $70 a Share to Expand Its Massive ETH Treasury