Exclusive interview with DIN founder Harold: How can Web3 data network break the curse of “AI data sweatshop”?

Author: Zen, PANews

With the rapid development of AI technology, data has become the core driving force for its growth, and its importance is no less than that of oil in modern industry. The acquisition, labeling and processing of high-quality data are the cornerstones of AI model training. However, this process relies heavily on manual processing, is inefficient, has high costs and uneven quality, which still poses huge challenges to the existing industrial chain.

As Binance founder Changpeng Zhao (CZ) said, tasks such as AI data annotation are very suitable for completion through blockchain, which can take advantage of low-cost global labor and make instant payments through cryptocurrency, breaking geographical restrictions. CZ also mentioned that more tools are still needed and called on developers to jointly build a decentralized AI data processing ecosystem.

In fact, since the rise of the artificial intelligence boom, there have been many projects that have begun to focus on decentralized AI data business, but few projects have been able to implement a commercial model. DIN, which has performed outstandingly in the BNB ecosystem, is one of them. DIN currently has more than 30 million registered users and millions of daily active users, and has topped the AI Dapp rankings on the BNB Chain several times. More importantly, DIN has not only driven the decentralized AI data economy, but has also begun to truly empower the development of Web2 traditional industries.

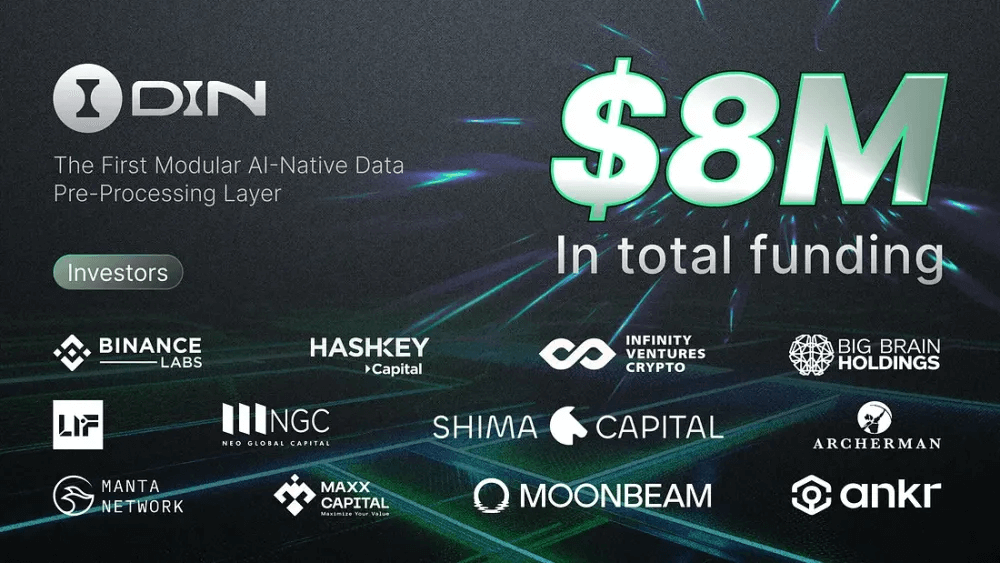

DIN: Work permit for data pipeline workers in the AI era

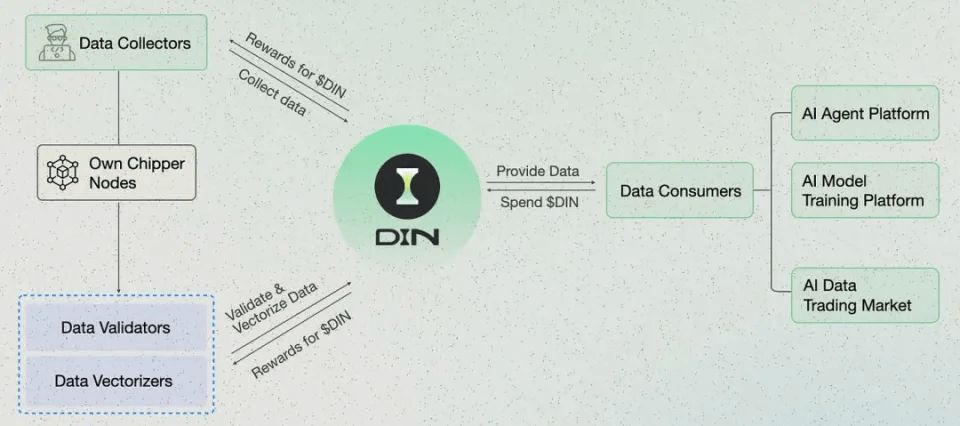

DIN is the first modular AI-native data preprocessing layer, which aims to build a data intelligence network based on the synergy of people, data and AI, so that everyone can process data for AI and get paid. So far, DIN has raised a total of $8 million. It first completed a $4 million seed round led by Binance Labs in July last year, and completed a $4 million pre-listing round in August this year, with Manta, Moonbeam, Ankr, Maxx Capital and others participating.

In the interview, DIN founder Harold said that if DIN is introduced in the most understandable way, it can be called "the job certificate for data pipeline employees in the AI era", so that every ordinary person in the world can participate anytime and anywhere without any threshold, enjoy the borderless and flexible payment brought by crypto, and share the endless cash flow dividends brought by the development of AI. "AI needs a huge amount of data to promote its own development, so everyone should be able to benefit from the data it generates. DIN hopes to act as a bridge in the middle so that the data produced by everyone can be recorded and everyone can profit."

The name DIN comes from the acronym of Data Intelligence Network. In the past three years, DIN has focused on providing products and services around "data", covering off-chain data such as on-chain data and social media content. Its predecessor was Web3Go, a Web3 data intelligence company. Before founding the project, Harold had been engaged in the artificial intelligence industry, and the AI applications such as steel surface defect detection developed by the team he led have also been implemented. Thanks to the team's many years of accumulation and experience in the fields of big data, artificial intelligence and communications, and many years of deep cultivation in the data track, DIN has formed a mature service delivery system and has achieved profitability every year.

Blockchain enables data crowdsourcing revolution

As we all know, algorithms, computing power and data are the three core elements of artificial intelligence, among which data is the foundation of artificial intelligence development. Without sufficient data support, any advanced algorithms and computing power will be out of the question. Therefore, the "data factory" of AI models is becoming increasingly important in the wave of artificial intelligence. Scale AI, the leader in this field, completed its latest round of financing of up to US$1 billion in May this year with a valuation of US$13.8 billion, led by Accel, a top Silicon Valley fund, and participated by a number of technology giants such as YC, Nvidia, Amazon, Meta, and AMD.

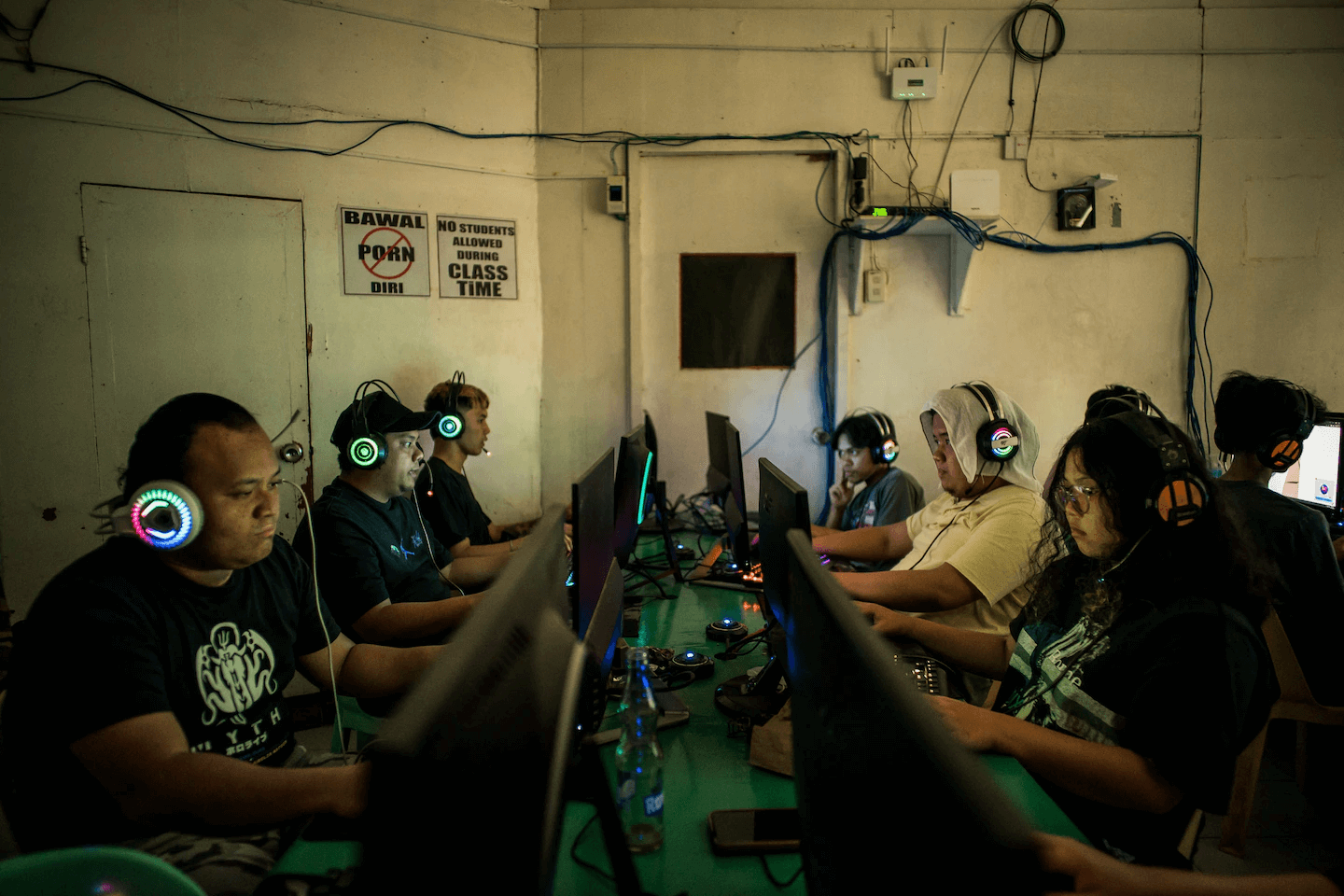

Scale AI's customer base includes medical, defense, e-commerce, government services and other fields. It makes profits by providing high-quality data to customers while transferring most of the quality assurance responsibilities and costs to individual task executors. Scale AI's crowdsourcing platform Remotasks has established dozens of institutions in Kenya, the Philippines, Venezuela and other regions, with thousands of data labelers.

However, this way of profits being mainly concentrated in the hands of centralized companies cannot better motivate participants, nor can it fully liberate the labor force. According to The Washington Post , Scale AI pays workers extremely low wages, often delays or withholds wages, and provides almost no recourse for workers. Human rights organizations and labor researchers say Scale AI is one of many American artificial intelligence companies that fail to comply with basic labor standards for overseas workers. It can be seen that behind the artificial intelligence boom dominated by centralized and monopolistic companies, there is an army of overseas workers in "digital sweatshops" who support the booming AI industry, but are often exploited in labor-intensive work and do not receive due rewards.

"The model of producing and collecting data is completely centralized. We believe that this is not conducive to the long-term development of AI technology because everyone is a producer of data but does not benefit from it." Regarding the issue of data monopoly and high centralization,

Harold said that based on the decentralized, open and transparent characteristics of blockchain, by combining it with AI data, blockchain can be used to manage data, record each person's data production process, and ultimately use blockchain for settlement, so that users who provide data can continue to obtain benefits.

The flagship product xData and Chipper Node connect B and C ends

"DIN provides a full-stack solution covering data collection, annotation, verification and vectorization," Harold introduced. Its core product xData focuses on the collection and annotation of Twitter content data. It can collect content around specific projects or topics and aggregate scattered materials into a complete database. Through xData, on the one hand, users can participate in the collection and annotation of AI data at low cost and low threshold and gain benefits; on the other hand, customers can also gain more exposure opportunities while meeting data collection and processing needs. So far, xData has successfully collected and annotated more than 100 million tweets.

AI models go through multiple iterations, and their training process requires not only a large amount of data, but also high quality data. "High-quality data is the key to improving the accuracy and reliability of the model, while low-quality data may lead to biased or even erroneous results." Harold said that AI models require a large amount of cleaned, verified and qualified data when training and fine-tuning.

In the DIN ecosystem, Chipper Node plays an important role in data "quality inspection" and optimization. Harold pointed out that Chipper Node uses the idle computing power of the user's edge device to verify, classify, clean and vectorize the original data collected by xData. In addition, Chipper Node not only realizes the conversion of rewards within the network, but also promotes the efficient operation of the economic system, allowing users to obtain income through mining anytime and anywhere, and ultimately realize the payment closed loop of AI data contributors.

Through the synergy of Chipper Node and xData, DIN, as a bridge, has opened up the connection channel between B-end enterprises and C-end users. Enterprises can obtain verified high-quality data in a more efficient and low-cost way through the DIN ecosystem, while users can contribute data content and receive rewards through daily participation in a low-threshold way. This model not only achieves efficient matching of data supply and demand, but also significantly improves users' sense of participation and benefit experience, injecting strong impetus into the rapid development of the DIN ecosystem. Harold said that the total number of DIN users has exceeded 30 million, with 700,000 daily active users, and DIN processes 1 million on-chain transactions every day, demonstrating a highly active and scalable blockchain ecosystem.

It is worth mentioning that DIN's data is stored on the decentralized storage infrastructure BNB Greenfield, which significantly reduces storage costs and improves storage efficiency by sharding and storing data on multiple nodes. In addition, thanks to the optimized distributed storage architecture, Greenfield can provide access speeds close to traditional Web2 cloud storage while ensuring decentralized security and reliability. This allows DIN to ensure that while providing incentives to users, it also takes into account the security and privacy protection of data transmission in the network.

Empowering Web2 Traditional industries, DIN has truly realized product implementation

Unlike most AI+Web3 projects that are still at the stage of imagining large-scale adoption, the AI data provided by DIN has begun to empower the development of traditional Web2 industries. Harold revealed that as early as a few months ago, DIN had cooperated with Heshuju, a data annotation company under AISpeech, to annotate and collect voice data for AISpeech's minority languages through BNB Chain.

As a unicorn in the field of voice technology in China, AISpeech is as famous as iFlytek, focusing on core technologies such as speech recognition, speech synthesis and natural language processing. Its technologies are widely used in products such as car navigation and in-vehicle voice assistants, providing drivers with efficient and convenient intelligent interactive experience. In the context of a global market, in-vehicle systems must be able to support multilingual interaction, especially in an environment of cross-border sales and multicultural integration. This requires a large amount of high-quality speech data in small languages and dialects for training speech recognition and synthesis models. Traditional data annotation methods are often costly and time-consuming, and it is difficult to meet the needs of rapid iteration.

However, by leveraging DIN's blockchain network, the task of labeling and collecting minority language speech data can be distributed to a global distributed workforce network, which will significantly improve efficiency and data coverage. On the one hand, DIN's platform ensures the high quality and consistency of the labeled data through a multi-layer verification and audit mechanism, and the multi-language coverage enables AISpeech to quickly build and optimize its minority language speech models; on the other hand, the processing of all data is recorded on the chain to ensure transparency and credibility, and facilitate future audits and traceability, which is crucial for voice technology companies under increasingly stringent privacy protection and data compliance requirements.

DIN's technology and business model not only prove the feasibility of decentralized data networks, but also inject new growth momentum into traditional industries, becoming an important driving force for the integration of Web2 and Web3. Looking ahead, DIN is expected to expand the capabilities of its data intelligence network to industries such as healthcare, education, and retail, and help traditional enterprises achieve intelligent transformation through the application of AI data processing.

Persisting in the bear market and contributing to the development of the BNB Chain ecosystem

In the bear market environment that just passed, problems such as poor market liquidity, low user activity, and lack of user verification products were prominent, and the continuous internal circulation caused the cost of acquiring users to increase significantly. These challenges undoubtedly brought huge pressure to the operation and development of the project. Harold admitted that they were a little jealous when many projects "made quick money" through short-term opportunities, but in the end DIN chose to focus on long-term value creation rather than chasing short-term interests, rushing to cash out or catering to short-term market fluctuations.

"We are a relatively pragmatic and down-to-earth team." Harold added that DIN has always wanted to persist in doing the right thing. The process may occasionally be slow and painful, but this is the norm for entrepreneurship in the cutting-edge technology field. Only by gritting your teeth and persevering can you go further.

From promoting on-chain data analysis to realizing a user-friendly AI proxy platform, and then to creating decentralized AI data pre-processing tools, in addition to the positioning of AI data infrastructure, the DIN team has also insisted on deepening its presence in the BNB ecosystem in recent years, and has further promoted the development of the ecosystem after obtaining its funding, resources and other support. For example, the Chipper node pre-mining and xDIN transactions launched by DIN not only brought significant transaction volume and on-chain activity, but also brought more than 40,000 running nodes and more than 50,000 high-quality node holders. This further activated the on-chain data ecosystem of BNB Chain and increased user participation.

In addition, DIN has recently brought nearly 7.5 million transactions and 400,000 exposures to BNB Chain through node pre-mining, Binance Web3 wallet airdrop activities and Binance Square essay contest in just one week. Not only that, DIN also helped Binance attract more than 260,000 new user registrations in just 10 days.

Upcoming TGE with L2 blockchain based on BNB chain

Coinciding with the bull market, DIN is about to reach a critical node in the development of the project. Harold said that DIN will build an exclusive L2 data chain on the BNB chain to further promote the implementation of the decentralized AI data network concept. The DIN token to be launched soon will serve as the core fuel of this L2 chain, used to pay for gas fees for on-chain operations such as data storage, node operation, and AI agent creation and transactions, becoming the hard currency of this decentralized network.

In addition, DIN tokens adopt a deflation model, and each token consumption will burn DIN, thereby continuously reducing market supply and bringing scarcity value. At the same time, the DIN team plans to regularly use the profits generated by its Web2 business to repurchase tokens to further strengthen its value support. Harold revealed that DIN has achieved profitability two years ago, and its mature Web2 data business provides stable and sustainable support for the development of Web3.

In this round of bull market, as BNB's liquidity has significantly increased and its price has soared to a record high, the market's confidence in its ecological development has reached an unprecedented high. Many practitioners believe that BNB Chain is likely to announce major moves in the short term. The launch of the DIN L2 data chain is timely. Combined with its performance in recent months, it may fully benefit from the ecological dividends of the BNB Chain and jointly promote the development of the Web3 data economy.

In general, with its strong performance in the BNB ecosystem and mature business model, DIN is gradually implementing the vision of a decentralized AI data economy. With the support of the upcoming L2 data chain and token economic system, DIN will not only inject new vitality into the cryptocurrency industry, but will also provide more possibilities for the AI and traditional data industries.

You May Also Like

Botanix launches stBTC to deliver Bitcoin-native yield

Unprecedented Surge: Gold Price Hits Astounding New Record High