A paradise for digital nomads, how does TRON expand its crypto footprint through the Thai market?

Author: Nancy, PANews

Thailand, with its rich tropical atmosphere, is a paradise for digital nomads and a hotbed for Web3 entrepreneurship. In the past week, the core forces of encryption have traveled to this "Land of Smiles" to exchange ideas and share innovative achievements.

Thailand has become one of the major hubs for global crypto development and innovation, and an important node for TRON's global expansion. In this wave of Thailand's blockchain boom, Sun Yuchen's appearance at Thailand Blockchain Week also gradually brought TRON's Thai crypto territory to the surface.

Thailand's crypto ecosystem is rising, and TRON is gaining market share with stablecoins

In the early stages of cryptocurrencies, the Thai government was cautious and even prohibited this emerging field. However, with the increase in market demand and the booming global crypto industry, the Thai government began to re-examine its position and gradually adjust policies to promote the legalization of cryptocurrencies and incorporate them into the regulatory framework.

At the same time, in order to promote the sustainable development of the local crypto ecosystem, the Thai government has taken a series of positive measures, especially stepping up its efforts this year. For example, in February this year, the Thai government announced the exemption of value-added tax on cryptocurrency transactions, hoping to promote it as a new fundraising tool and provide strong impetus for the development of Thailand's digital economy; the Securities and Exchange Commission of Thailand (SEC) announced the amendment of relevant rules to allow qualified investors to invest in US Bitcoin spot ETFs to further broaden investment channels; Thailand lifted restrictions on individual investors' investments in specific digital assets; the Thai government announced this year that it plans to allocate 157 billion baht from the 2025 national budget for digital wallet projects to improve the development of the country's digital economy, and claimed that it could boost GDP growth by 1.2-1.6 percentage points...

In addition to policy support, in order to attract more crypto traders and developers, Thailand has also introduced measures such as a new "digital nomad" visa to attract global crypto innovators and investors to do business in Thailand, injecting continuous momentum into the development of Thailand's digital economy.

This significant shift also reflects the Thai government's gradual change in attitude towards cryptocurrencies and policy adjustments, making the country a strategic location for global crypto innovators to compete for layout.

Thanks to its huge user base and broad market prospects, the rise of Thailand's crypto ecosystem has provided fertile soil for the development of crypto-economy such as TRON. TRON has set its sights on the key field of stablecoins to expand its local market influence in Thailand.

As a new currency carrier, stablecoins have gradually penetrated into the global economy and become an important tool for daily transactions and fund management. Thailand has also started to deploy. For example, not long ago, SCB, a long-established commercial bank in Thailand, has provided customers with stablecoin cross-border payment and remittance services, becoming the first bank in the country to use stablecoins for cross-border payments.

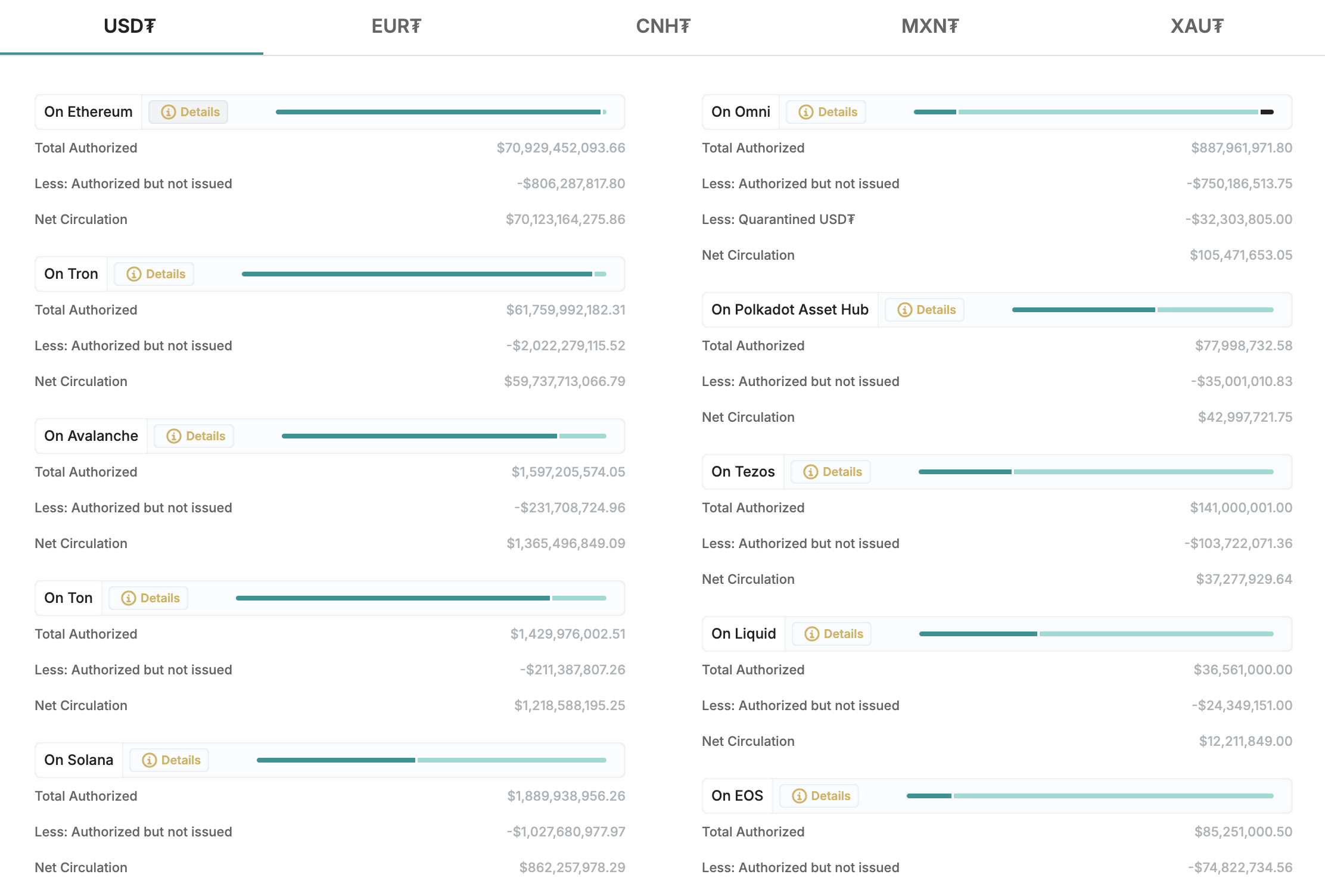

In contrast, TRON already has a strong influence and a broad user base in the stablecoin market, making it easier to gain market recognition. Taking USDT, the world's largest stablecoin, as an example, according to Tether's official website, as of December 2, the market size of USDT has exceeded 134 billion US dollars, of which TRC20-USDT issued by TRON has accounted for half of the market with over 61.7 billion US dollars, becoming the largest USDT issuance base after Ethereum, further reflecting the market's high recognition and urgent demand for it.

"Through TRON's high-performance network, USDT transfers can be performed efficiently and at low cost, which not only significantly improves the user experience, but also provides instant confirmation and low-cost services for cross-border payments and local transfers, meeting users' needs for fast and secure payments." Sun Yuchen revealed at the Thailand meeting that TRON will also explore new models of decentralized finance through the decentralized stablecoin USDD, and will take a series of strong measures, including improving transparency, strengthening technical support, and optimizing collateral management, to ensure that USDD can maintain stable operation amid economic fluctuations.

Currently, USDT on TRON has made progress in its Thai stablecoin layout. In March this year, Grab, an O2O Internet mobile platform in Southeast Asia, announced the launch of a cryptocurrency recharge service, supporting tokens including TRON version of USDT/USDC. Bitkub, the largest cryptocurrency exchange in Thailand, also announced support for TRC20-USDT in September, providing users in Southeast Asia with a more convenient and secure financial service experience. TRON's high-performance network enables efficient and low-cost operations for USDT transfers, meeting users' needs for fast and secure payments.

From this point of view, with its open policies, market demand and digital economic potential, Thailand is gradually becoming a key market in TRON's global strategic map, and has also promoted its global blockchain journey. At the same time, TRON's deep strength in the stablecoin market will also bring new possibilities for the development of the crypto economy in Thailand and Southeast Asia.

Fighting a " mind war" to attract tens of millions of Thai crypto users

As AL Ries, one of the famous marketing strategists, said, marketing competition is a competition of minds. The ultimate battlefield of marketing competition is not the factory or the market, but the mind. To successfully open up a new market, it is far from enough to rely on technology and business layout alone. It is also necessary to establish golden paths leading to the market mind.

In addition to deepening its presence in the Thai market through its business, TRON also plays a big role in attracting the attention of the public. On the one hand, Justin Sun actively participated in major crypto events in Thailand, and by demonstrating TRON's technological advantages and ecological vision, he increased brand awareness and user recognition. On the other hand, TRON further deepened its influence in Thailand by sponsoring BITKUB SUMMIT 2024, Devcon Berkeley Security Summit, and effectively establishing brand exposure in important events such as Community Frens and imToken Devcon7.

For TRON, the increase in brand awareness and influence not only effectively helps it capture the minds of users in the Thai market, thereby achieving a higher customer conversion rate and potential transaction volume growth, but also opens up new growth points for itself and Thailand's encryption development space.

As the second largest economy in Southeast Asia, Thailand has gradually emerged as one of the most dynamic crypto ecosystems in Southeast Asia with the surge in cryptocurrency adoption and trading volume, and has quickly become an important competitor in the global crypto market. According to statistics from Statista.com: By the end of 2023, Thailand will have 13.02 million cryptocurrency users, accounting for about 18.1% of its total population, and is expected to climb to 17.67 million in 2028.

This also means that through a series of strategic layouts in Thailand, TRON will not only be able to help it consolidate its position in the global crypto ecosystem, but will also inject new impetus into the crypto economy in Thailand and Southeast Asia, and help the crypto market further break through its circle.

You May Also Like

Botanix launches stBTC to deliver Bitcoin-native yield

Unprecedented Surge: Gold Price Hits Astounding New Record High