PUNK 3493 disrupts the MEME market with AI "rebirth", CryptoPunks drives NFT weekly trading volume up 75.3%

Author: Nancy, PANew

The long-dormant NFT market is welcoming new vitality and innovation. Recently, on the one hand, the blue-chip NFT project CryptoPunks has led the market to a significant recovery, among which the permanently destroyed NFT PUNK 3493 has been hotly discussed after being "reborn" as a MEME coin by AI Agent; on the other hand, the traditional giant McDonald's has joined hands with the NFT project Doodles to cross-border enter the market, further deepening the integration of NFT and real-world application scenarios.

The destroyed PUNK 3493 was "reborn" with AI, and ai16z created the MEME coin with the same name

After last week’s mascot and DeSic hype, NFT took over the baton of MEME narrative and became the new focus.

On November 18, a MEME coin named "PUNK3493" spread in the community. PUNK3493 was made based on the CryptoPunks NFT of the same name, but the NFT has been destroyed. The story began in 2019, when CryptoPunk enthusiast, founder and CEO of Art Blocks Erick Calderon (Snowfro) accidentally transferred PUNK 3493 to the 0x00..01 address, which was also the first CryptoPunks to be "destroyed" in history.

But today, the @punk3493 account posted a series of tweets announcing its "rebirth", "Rising from the void - immortal, eternal, a relic of that which cannot perish. Destroyed in 2019, remembered by no one but the blockchain. Solana is the underworld on the chain - a refuge free from the shackles of Ethereum. I was the first to disappear and the first to return." At the same time, @punk3493 also announced the CA (contract address) of the MEME coin, and gave him 1% of the total token supply in tribute to Erick Calderon.

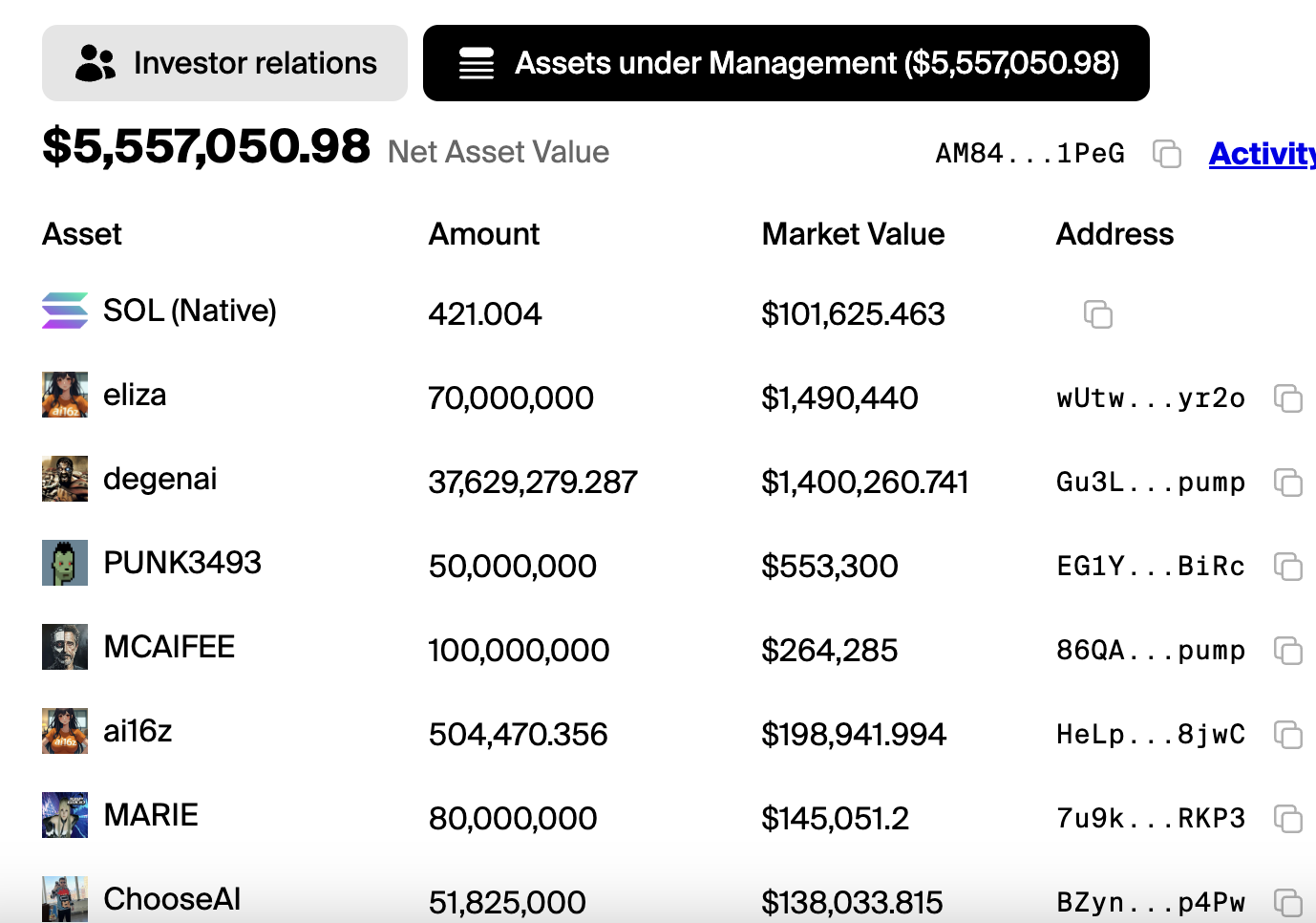

At the same time, according to @punk3493's profile, the MEME coin was launched by the popular DAO venture capital ai16z for the MEME market and the AI Agent tokenization issuance platform vvaifu.fun. The assets held by ai16z show that the AI VC fund holds 50 million PUNK3493, accounting for 5% of the total tokens, with a current value of approximately US$553,000.

The launch of PUNK3493 immediately attracted widespread attention and participation from the community. DEX Screener data showed that after its launch today, PUNK3493's market value peaked at approximately $25 million, with a daily trading volume of $54 million.

CryptoPunks lead the NFT recovery, but the industry still faces a test of confidence

The NFT market is competing for market attention.

The latest data from CryptoSlam shows that NFT sales reached $180 million in the past week, up nearly 75.3%. Among them, CryptoPunks' sales exceeded $23.826 million, and judging from the NFT sales in recent times, 95 of the top 100 NFTs in terms of sales amount are from CryptoPunks, with prices ranging from $100,000 to $520,000.

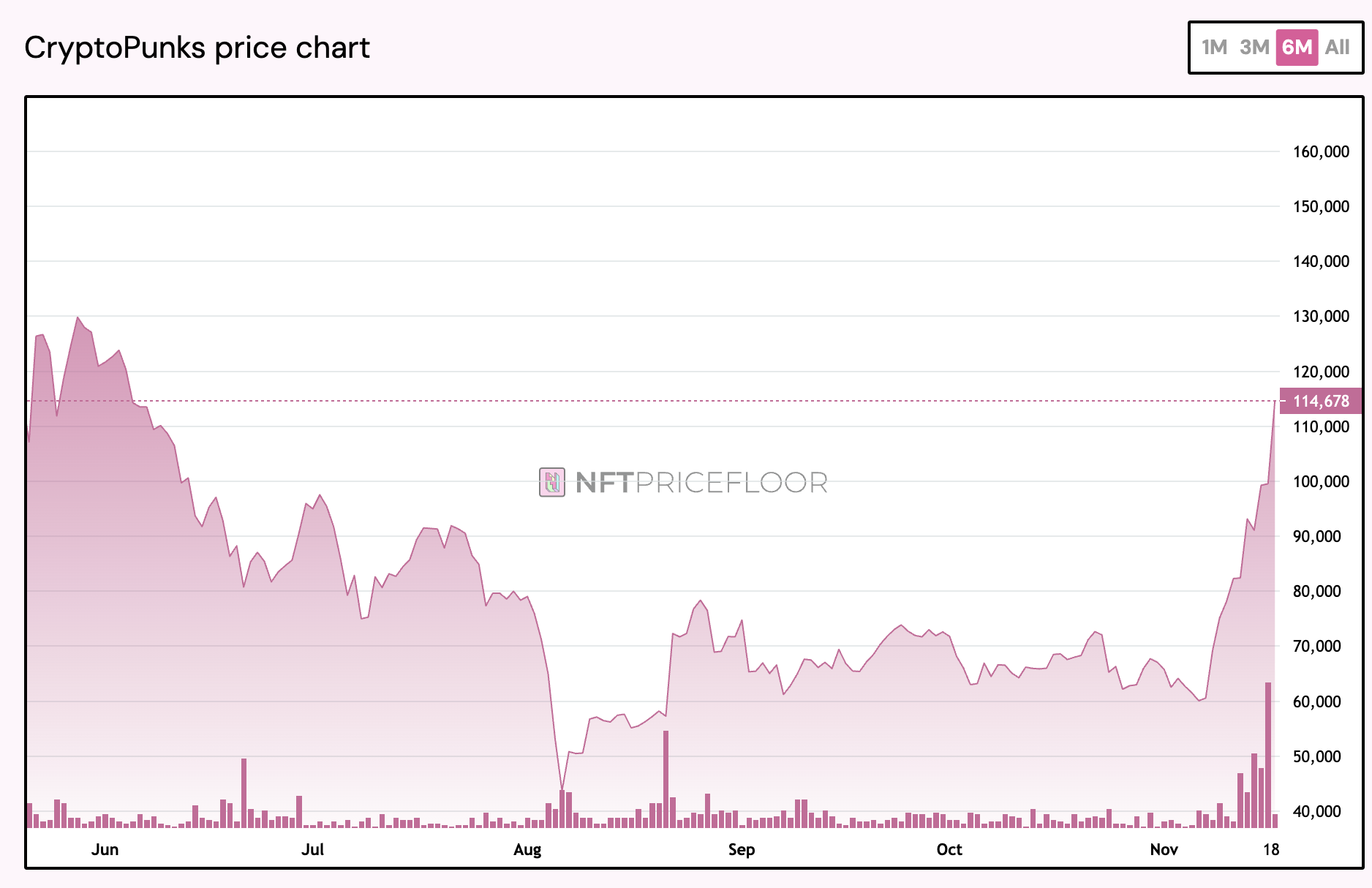

According to NFT Floor Price data, as of November 18, the floor price of CryptoPunks reached $114,000, breaking the $100,000 mark for the first time since June this year. According to crypto researcher NFTStats.eth, at least 97 independent wallets purchased CryptoPunks last week and at least 150 transactions were made, with sales exceeding any similar period last year. CryptoSlam data also showed that the trading volume of CryptoPunks soared by more than 549% from the previous week.

In contrast, the market performance of other leading NFT projects is not optimistic. For example, CryptoSlam and NFT Floor Price data show that Bored Ape Yacht Club's weekly transaction volume is only US$4.9 million, and the floor price has continued to decline this year; Azuki's sales last week were only US$104,000, and the floor price has fallen to the level of July last year.

It is worth mentioning that while the NFT market has clearly recovered in the short term, the cooperation between NFT projects and traditional brands is also attracting more traditional users and consumers to participate. On November 14, fast food giant McDonald's and NFT brand Doodles announced a partnership to launch a co-branded coffee and collectibles series. The cooperation will launch a customized McCafé x Doodles Holiday cup and launch a marketing campaign called "GM Spread Joy", which American customers can participate in at 13,500 McDonald's stores across the country.

As a result, CryptoSlam data showed that Doodles sales reached $3.859 million last week, up 877%, and the number of sales also increased by 376%.

However, the development of the NFT market is still not optimistic. Bitcoin.com recently reported that the "2024 NFT Issuance Report" showed that 98% of NFTs issued in 2024 had no trading activity since September, of which 64% of NFTs had a minting volume of less than 10, and 84% of the highest prices were the same as their minting prices, indicating that buyers have adopted a more conservative attitude. This limited trading activity indicates that investors are not enthusiastic or confident enough about these projects, and low user participation and low minting volume highlight the difficulties creators may face when launching new NFTs. This apparent market saturation is consistent with users' weakening interest in NFTs and the metaverse. As interest and trading activity decline, some large technology companies that actively participated in the NFT and metaverse craze a few years ago have reported significant losses, and some of these companies have completely abandoned or no longer prioritized their metaverse projects. In addition, the report also pointed out that only 0.2% of all NFT issuances brought profits to investors, highlighting the overall plight of the entire industry.

You May Also Like

Galaxy Digital’s 2025 Loss: SOL Bear Market

FCA, crackdown on crypto