Can the popular RWA really make money?

In the cryptocurrency world, consensus is never lacking. To some extent, as the carrier of the dream economy, consensus is the gold of the cryptocurrency world. From the summer of DeFi to the once-popular NFTs, from the glimpse of the future of Web3 to the sudden explosion of AI, the continuous rise of the cryptocurrency world has all stemmed from consensus itself. Now, the wind of consensus is blowing towards RWA.

As institutions continue to bridge the gap between crypto and traditional markets, RWA, the tokenization of real-world assets, is considered the next major trend poised to generate substantial growth. In Hong Kong, internet giants, financial institutions, and major banks appear to be waiting and observing this potential future trend. In mainland China, projects under the RWA banner are also mushrooming, hoping to dispel the industry's stagnation with RWA's momentum.

But after unveiling the veil of “everything can be tokenized”, whether the real RWA is really the gold to be mined as the market imagines is still a big question mark.

01. Current Status of RWA Development: Overseas Focus on Finance, while Mainland China Develops Industry

RWAs, short for Real World Assets, broadly refer to any real-world physical asset that is tokenized and mapped onto a blockchain. Strictly speaking, stablecoins are also a form of RWA. From an asset perspective, RWAs offer numerous advantages. First, divisibility. Compared to traditional assets, which are sold in fixed units, tokenization allows for fragmentation and sale of assets in smaller units. This not only lowers the barrier to entry for financing but also allows for greater trading flexibility for large assets constrained by scale. Second, it offers broader price discovery and liquidity. Under existing financial product trading infrastructure, financial asset transactions are subject to significant time and space constraints. However, on-chain tokenization enables 24/7 trading and global pricing, more in line with the characteristics of a free market. Finally, efficiency is enhanced. On-chain tokenization offers high transparency and reduces intermediary costs and time, making RWAs generally more efficient in issuance.

With these advantages, traditional institutions have flocked to the market. Beginning in 2019, JPMorgan Chase, Goldman Sachs, DBS Bank, UBS, Santander, Societe Generale, and Hamilton Lane, among others, began exploring this sector and testing and issuing some products. But why has RWA only recently exploded in popularity? The underlying reasons are policy and cyclical factors. First, a shift in the policy environment. The United States, in particular, significantly reduced regulatory pressure on tokenized assets this year and even expressed a heightened interest in stablecoins and RWA assets. Hong Kong has also seen this. This relaxed regulatory environment has given previously hesitant institutions the freedom to conduct pilot projects. Second, there are issues related to industry cycles. To date, the core driving force of the cryptocurrency industry has shifted from technology and applications to capital. The prominent problem restricting the cryptocurrency industry is the serious lack of incremental growth. The market can no longer support development by relying solely on the existing resources within the circle. It is necessary to introduce flows of people and funds from outside the circle. The large-scale influx of traditional institutions just corresponds to this solution. Therefore, RWA, as the best entry point for traditional institutions and crypto finance, has also been popular.

As with their current development, the paths of RWA development in China and abroad, like their attitudes toward blockchain, differ significantly. Overseas RWAs, primarily in the United States, focus on finance, with tokenized assets often consisting primarily of government bonds and money market funds. In contrast, domestic RWAs emphasize real-world empowerment, with underlying assets possessing a distinct industrial nature. Currently, due to their early start and maturing development, overseas RWAs are exhibiting a diverse range of underlying assets.

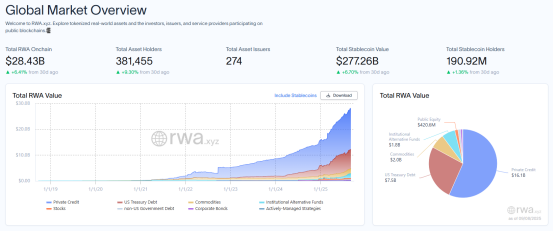

According to Rwa.xyz data, after excluding stablecoins, the total on-chain RWA has reached $28.44 billion, a 14.74-fold increase from $1.929 billion in 2022. The number of asset issuers has reached 274, with total asset holders exceeding 380,000. In terms of asset classes, private credit is the core area of RWA, with a scale of 16.1 billion yuan, accounting for 56.61%. US Treasuries rank second with $7.5 billion, followed by commodities ($2 billion), institutional alternative funds ($1.8 billion), and public equity ($4.2 million). Non-US Treasury bonds and corporate bonds are the least involved, with a combined total of only $600,000.

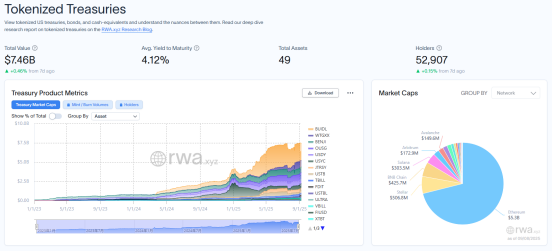

While private lending appears to be leading the way, Figure, an on-chain mortgage lender, alone accounts for $15.5 billion in private lending. However, Figure merely records transactions on the Provenance blockchain after backing its core HELOC mortgage product. Strictly speaking, it merely uploads data to the blockchain and is not a true RWA company. Therefore, the most attractive sector in the RWA sector remains US Treasury bonds.

Institutional investors flock to the U.S. Treasury bond market. The top three holdings are all large institutions. BlackRock's tokenized fund, BUIDL, currently holds $2.283 billion in assets, followed by WisdomTree's WTGXX (US$830 million) and Franklin Templeton's government money fund, BENJI (US$740 million). Together, these three companies hold 37.78% of the Treasury bond market. Precious metals dominate the commodity market, with gold holdings exceeding $1.88 billion, representing over 70% of the market.

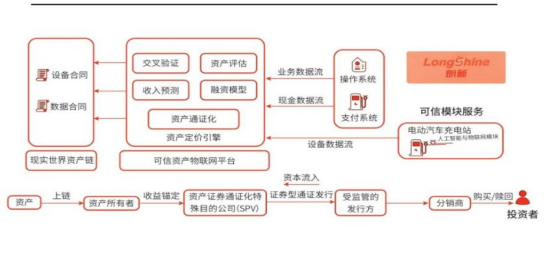

Shifting our focus from overseas to domestically, the target composition shifts. China's RWA practice is still in its early stages, with the industrial chain still evolving. Development pathways are primarily focused on empowering the real economy, with applications currently underway in financial assets, physical assets, trade financing, supply chain traceability, cultural heritage preservation, and tourism. Typical examples include the Longxin Group charging pile asset project, the GCL Energy photovoltaic asset project, the Green Energy battery swap asset project, the Malu grape agricultural product project, and the Greenland Jinchuang real estate project. For example, the first charging pile asset RWA project in China, a collaboration between Ant Digital and Longxin Technology, successfully raised 100 million RMB in tokenized financing, leveraging 9,000 charging piles owned by GCL Energy.

Source: Huaxi Securities

There are also differences in infrastructure. Overseas RWAs are mostly hosted on public blockchains, with Ethereum holding over 57% of the market share. Domestic RWAs, however, adhere to traditional principles, primarily relying on consortium blockchains, supplemented by public blockchains. Currently, blockchain companies such as Ant Digits and Shuqin Technology are developing dedicated RWA platforms.

Despite differences in infrastructure and underlying assets, a preliminary consensus has emerged both domestically and internationally regarding the rush to establish RWAs. According to a joint forecast by Boston Consulting Group (BCG) and ADDX, the global asset tokenization market will reach $16.1 trillion by 2030. Against this backdrop, not only large enterprises are eager to capitalize, but even small and medium-sized businesses are jumping on this new gold mine of wealth. However, despite this seemingly limitless potential, is RWA truly flawless in its current development? Is issuing an RWA truly as easy as taking something out of a bag?

02. The dilemma of RWA: high issuance threshold and liquidity problems

The answer is no. First, despite the slogan "everything can be tokenized," RWAs are not without requirements for their underlying assets. The term "asset" implies that the issued RWA must be an objectively yielding asset. Therefore, a relatively good underlying asset should possess three basic qualities: standardization, high liquidity, and a more attractive return. Essentially, on-chain asset issuance merely provides a new financing and issuance channel. The key to attracting market liquidity lies in the inherent value of the asset. From a scalability perspective, scalable assets must possess stable value, clear legal title, and verifiable off-chain data; otherwise, widespread distribution is difficult. This also explains why government bonds are the largest overseas RWA product: their inherent high liquidity, guaranteed returns, and high compliance certainty naturally align with the RWA concept.

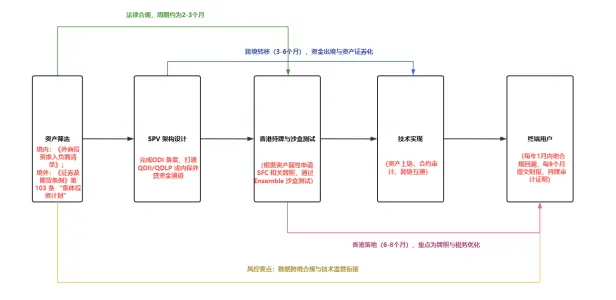

Even if the asset issue is resolved, issuing RWAs is still not an easy task under my country's current environment. Currently, due to the inherent securities nature of RWAs, the RWA issuance process involves both legal compliance and technical complexity. For example, issuing private RWAs in Hong Kong requires initial asset screening to ensure that the assets are clear and tradable. Typically, a special purpose vehicle (SPV) entity is established to connect domestic and overseas markets, facilitating the compliant cross-border flow of funds and assets. License application and sandbox testing must also be completed in Hong Kong. After ensuring compliance, technical implementation must ensure data and asset interoperability. Comprehensive solution providers are now available, focusing on asset on-chain integration, smart contract auditing, and cross-chain interoperability. The entire process, relying solely on private companies to issue RWAs in Hong Kong, would take at least eight months.

The complex process leads to high costs. According to a PAnews report, the cost of issuing a single RWA product in Hong Kong can reach 3-6 million RMB, covering legal compliance, technology integration, brokerage costs, and fundraising and QFLP costs. Brokerages, as the core of RWA transactions, account for the majority of these costs, with channel fees reaching 2-3 million RMB. From a long-term strategic perspective, issuance costs rise even further. Obtaining a Hong Kong license alone can cost over one million RMB, and the extremely challenging Virtual Asset Service Provider (VASP) license can cost tens of millions RMB, making participation accessible only to large, well-resourced players.

More importantly, issuance is just the beginning; liquidity challenges remain. In fact, even in larger overseas markets, the liquidity of RWA products is far from optimistic. Take BlackRock's BUIDL, for example. With a market capitalization of $2.238 billion and monthly transaction volume exceeding $170 million, BUIDL is a market leader overseas. However, it has only 89 holders, 51 monthly transfer addresses, and fewer than 20 monthly active addresses, highlighting the market's high dependence on issuers and a small number of large institutions. This is consistent with the performance of the traditional government bond market, where such assets typically generate interest through scale rather than relying on a trading market. Tokenization hardly changes the underlying nature of these assets. Across the institutional RWA market, these characteristics of high market capitalization, concentrated control, and low liquidity are common. Only products with relatively widespread trading channels, such as gold RWAs, can break this mold.

This shows that the threshold for issuing RWAs is not only high, but also quite high. Companies hoping to achieve huge profits through RWAs and create something out of nothing may need to think twice before taking action. After all, if there is a good asset, there will naturally be no shortage of sellers. However, if the underlying asset cannot be classified as a high-quality asset in the first place, tokenization will not only fail to achieve good results, but may even lead to losses. In fact, a large number of RWA products currently flooding the market are simply skirting the rules, covering junk assets with a conceptual shell to package them as new products. This not only fails to meet the original intention of RWAs, but also poses compliance risks.

Take Hainan Huatie, a project that has recently gained widespread attention in the market, for example. The company, relying on the "Brother Hornet" digital collectible, has tied the collectible to a cash dividend of 50,000 stock income rights each year from 2025 to 2027. As a further development strategy, the company has also officially announced the issuance of a 10 million yuan non-financial RWA product, which will digitize the use and operating rights of all its equipment on the blockchain in the form of "membership cards," allowing users to circulate through on-chain transfers, consignments, and other methods while enjoying certain usage rights or benefits. Although both projects were quite successful, with the Hornet Brother digital collectible seeing its floor price leap from 200 to 15,000 yuan in just three days, a closer look reveals that both NFTs and RWAs have very unclear ownership structures, extremely vague disclosure information, and involve the splitting of securitized proceeds, posing obvious compliance risks.

03. The Future of RWA: A Dialectical Unity of Brightness and Twists

In summary, although RWA has developed rapidly in the past two years driven by both policies and markets, the industrial chain has been steadily extended, the coverage of underlying assets has continued to increase, product types have shown a trend of diversification, and the issuing entities have been continuously expanded, it also faces objective challenges such as insufficient infrastructure, long issuance cycle, high cost, low liquidity, and lack of regulatory chain. If long-term development is to be achieved, it is indispensable to improve infrastructure technically, build an ecosystem for service providers, and create a structure in the market.

Fortunately, the market is taking action. Technically, specialized platforms for RWA issuance are springing up, along with accelerators, organizations, and associations focused on RWA services. The standard system for product issuance continues to improve. Even with the daunting challenge of liquidity, the market is attempting to address it by opening up the DeFi space and developing on-chain distribution. On the regulatory front, both the United States and Hong Kong are providing a better environment for innovation within their rules. Hong Kong's Ensemble Sandbox is a prime example.

The future is bright, but the road ahead is tortuous. Behind the gold rush, there are also obstacles. For RWA, there is still a long way to go.

You May Also Like

FCA komt in 2026 met aangepaste cryptoregels voor Britse markt

United States Building Permits Change dipped from previous -2.8% to -3.7% in August