NFT’s Breakthrough and Rebirth: Finding Innovation Paths and Growth Potential in Turbulence

Author: Nancy, PANews

In the past few years, the NFT market has experienced dramatic fluctuations, from the initial explosive growth to the current sharp decline. In this market storm, the vast majority of NFT projects have failed to withstand the severe test of the market, causing the long-term viability of NFT as a crypto asset class to be questioned.

At the first global NFT developer summit "NFTCON 2024" jointly initiated by PANews and NFTScan, PANews released the latest NFT industry report. This report deeply analyzes the current development status of the NFT market and explores the potential path for the sustainable development of NFT, helping everyone to more fully understand the complexity of the NFT market and gain insight into its possible innovation paths in the future.

NFT's multiple challenges and market changes

Since entering 2024, the NFT market as a whole still faces many challenges and uncertainties. Although multiple key indicators show that the market is gradually stabilizing, the NFT landscape has also changed due to changes in market demand, platform competition, and narrative trends, and its value system is in urgent need of new empowerment.

Sales volume declines, profits rebound, and market potential demand grows

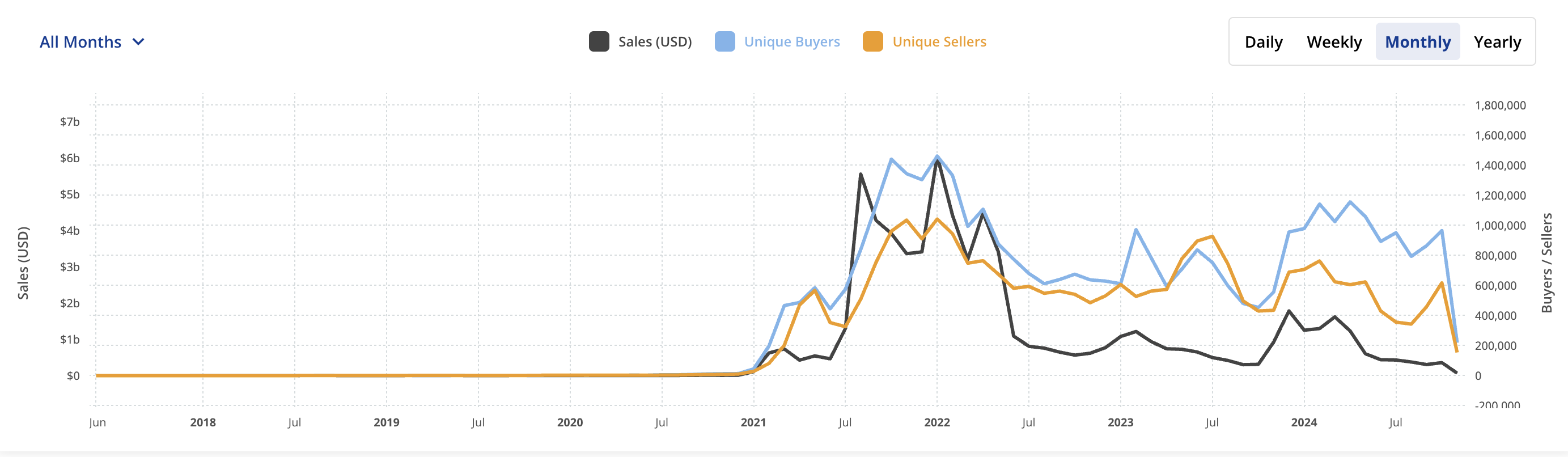

According to the latest data from CryptoSlam, as of November 6, NFT sales this year have approached the $7.43 billion mark, down about 14.8% from the beginning of the year. In terms of average selling price, the average sales amount of NFT this year is $119, which is higher than last year, but still only about a quarter of the historical peak.

Although the overall sales of NFTs are on a downward trend, market profits are showing signs of recovery. So far, the profits of NFT transactions in 2024 have exceeded 33.303 million US dollars, which is in sharp contrast to the negative returns of nearly 250 million US dollars in 2023. In addition, wash trading in the NFT market has also shown a significant downward trend. This year's NFT wash trading volume is only 2.32 billion US dollars, which is only about 8.5% of the total wash volume in 2022.

However, judging from the competition between buyers and sellers, the potential demand for NFT market continues to grow. This year, the number of independent NFT buyers reached 6.878 million, a record high, and significantly exceeded the number of independent sellers, which was 3.611 million.

The cold reception of old projects and the challenge of narrative

Unlike previous years, the NFT market has not yet seen any hot projects that can lead the market in 2024. What is more serious is that the once popular old NFT projects are now facing a collective cold snap, and many former star NFTs are facing the dilemma of shrinking value, and the market enthusiasm and confidence are gradually fading.

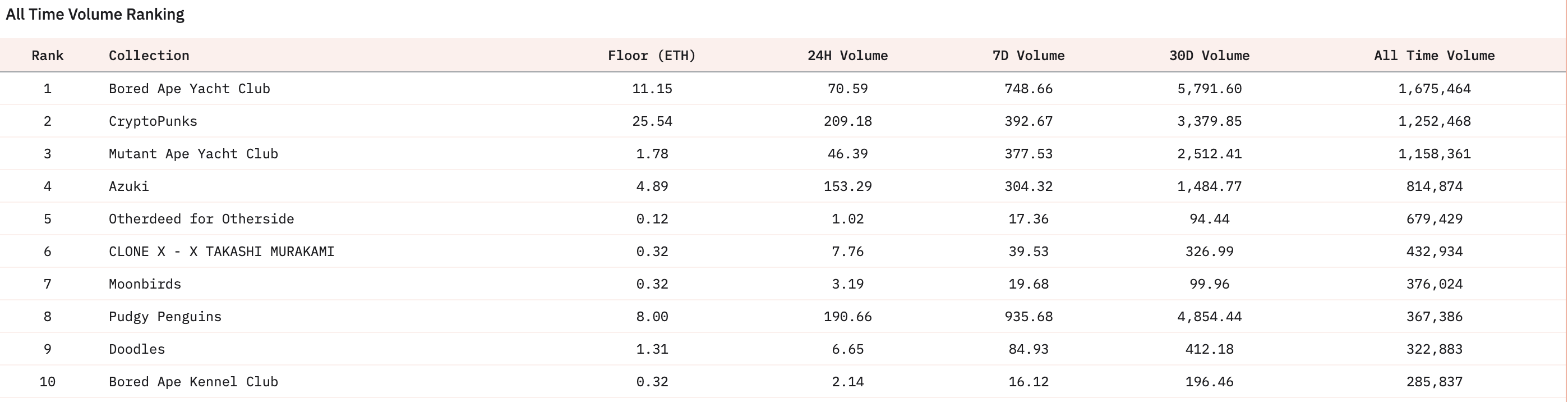

According to Dune's statistics at the beginning of this month, NFT projects have basically experienced a significant drop in floor prices and trading volumes. Even leading NFT projects such as CryptoPunks, Bored Ape Yacht Club (BAYC), and Azuki are not immune, and their prices have hit historical lows in many years. At the same time, in terms of monthly trading volume, there are only a handful of projects that can break through millions of dollars, which further highlights the severe challenges and adjustment pressures facing the current NFT market.

At the same time, some popular narratives in the NFT market in the past (such as collection, art, metaverse, games, etc.) are also facing doubts. The proliferation of low-quality and imitation products, high valuation bubbles, insufficient market liquidity and other problems have made the actual value of some narratives begin to show challenges.

Changes in the dominance of mainstream blockchains: Bitcoin explodes, while Ethereum declines

In 2024, NFT sales were mainly concentrated on the three mainstream blockchains of Bitcoin, Ethereum and Solana, which contributed a total of US$6.53 billion, accounting for 87.9% of the overall market. In this year, Bitcoin's sales performance was the most outstanding, reaching US$2.77 billion, a 1.53-fold increase compared to last year; although Ethereum still occupies a dominant position in the NFT market, completing a transaction volume of over US$2.44 billion, its performance has declined significantly compared to previous years, only about one-tenth of the peak in 2022; Solana's performance was relatively stable, with sales reaching US$1.32 billion, achieving a small annual growth.

Trading platform market pattern: Magic Eden grows against the trend

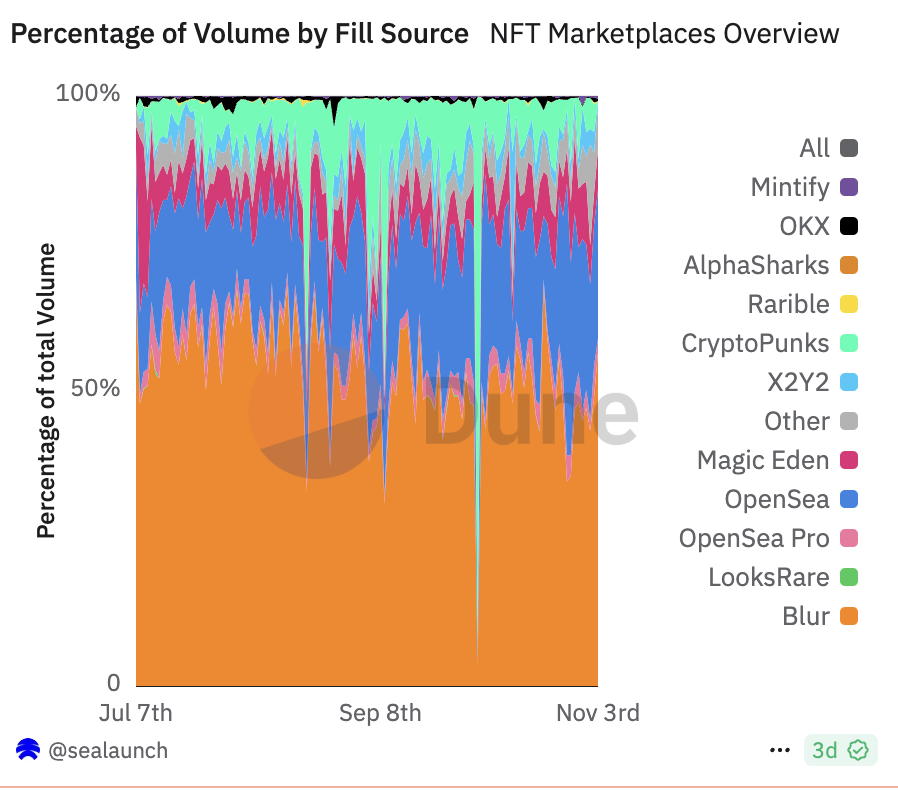

In terms of the trading market, Blur, OpenSea and Magic Eden are the current mainstream trading markets. Dune data shows that as of November 4, Blur occupied 49% of the market share, ranking first; OpenSea followed closely with a market share of 29.2%; and Magic Eden ranked third with a market share of 5.4%. It is worth noting that in this year's overall market downturn, the market share of Blur and OpenSea both declined to varying degrees, while Magic Eden showed a strong growth momentum and its market performance was particularly outstanding.

Regulatory complexity and uncertainty

The development of NFT faces serious regulatory uncertainty, and there are large differences in the definition, classification and regulatory policies of NFT in different regions. The lack of a unified legal framework, especially the vague guidance on intellectual property protection, consumer rights and anti-money laundering, has caused considerable trouble for market participants.

Innovative Paths for Sustainable Development of NFT

The sustainable development of NFT requires not only innovation in the properties of traditional digital collectibles, but also the exploration of new paths to improve asset liquidity and value conversion by integrating multiple fields such as DeFi, RWA, consumer applications and public chains. The following are several possible breakthrough directions:

DeFi

NFTfi is the product of the deep integration of NFT and DeFi financial paradigm. It can provide NFT holders with more financial tools and value-added channels, such as lending, staking, derivatives trading, yield farms, liquidity pools, etc., broadening the application scenarios of NFT, thereby greatly promoting the liquidity and price discovery of NFT, and achieving a significant increase in asset value.

For example, in terms of financial derivatives and lending, NFTs can be used as collateral to provide lending services to users, and can also be used as financial derivatives to create various financial instruments and investment strategies based on the value of NFTs; props, characters, skins, etc. in GameFi games are converted into NFTs, providing game players with more sources of income and promoting the liquidity and value discovery of game assets; art/knowledge product NFTs combined with DeFi can be pledged for financing, providing holders with more liquidity; DeFi can also be combined with NFT insurance to provide insurance services for NFT assets, etc.

RWA

The combination of NFT and RWA (real-world assets) breaks the geographical and time limitations of the traditional financial market, allowing all kinds of real-world assets to be intuitively and conveniently displayed and traded in digital form on the blockchain. Through NFT tokenization, the transparency and efficiency of real-world asset transactions have been significantly improved, which in turn greatly enhances the liquidity of assets, and investors can buy and sell assets more conveniently. In addition, the competitiveness and transparency of the NFT market help to form a more reasonable price discovery mechanism, so that the price of assets can more accurately reflect their true value, thereby providing investors with a fairer and more open trading environment.

For example, after the ownership or use rights of real estate are converted into NFT, buyers and sellers can easily trade through the blockchain platform. This method can not only improve asset liquidity, but also reduce transaction costs and intermediary fees; after the digital ownership or partial rights of artworks are NFTized, they can be transferred and traded through the NFT trading platform, providing a new way for investment and trading of artworks, solving the trust problems and geographical restrictions in the traditional art market; in the field of supply chain management, by recording the identity information of each link and supplier of products in the fields of luxury goods, agricultural products, etc. in NFT, the source and quality of each commodity can be traced; certain financial assets (such as bonds, equity, fund shares, etc.) can also simplify the asset trading process after being converted into NFT, and improve the liquidity and transparency of traditional financial assets; in the insurance industry, by digitizing insurance contracts or policies into NFTs, customers can more conveniently manage, trade or transfer their insurance rights and interests, and improve the transparency of insurance contracts.

However, in addition to dealing with legal and regulatory issues, the application of NFT in the RWA field also faces risks such as market acceptance and technical security, but it provides innovative solutions for the management, trading and financing of real-world assets.

Consumer Applications

As consumers' demand for personalization, uniqueness, and virtual identity increases, NFT has shown great potential in the field of consumer applications, which can fundamentally redefine the interaction and value exchange logic between brands and consumers, effectively promote the growth of the fan economy, and promote the popularization of NFT in the consumer field. Consumer applications of NFT are not limited to digital art or rare items, but can also be applied to digital identity, brand loyalty, membership rights, games, virtual goods and other products.

For example, Web2 brands such as Nike and Adidas can use NFTs as a substitute for membership cards or loyalty points. Consumers can use these NFTs to enjoy exclusive/exclusive offers, activities and services, and even resell these NFTs on the secondary market; Decentraland and The Sandbox allow users to purchase virtual land NFTs, and users can build, develop, lease and sell their own virtual stores, entertainment venues, museums and other digital assets in the virtual world; music platforms such as Audius and Royal also allow NFTs to be used as proof of ownership of music and art works, which not only provides direct benefits to creators, but also allows consumers to own unique versions of music and enjoy rights such as future copyright revenue sharing; NFTs can be used as digital event tickets. After purchasing NFTs, consumers can obtain the qualifications to enter concerts, sports events, art exhibitions and other activities. This method increases the anti-counterfeiting and transparency of tickets and provides consumers with a unique interactive experience; Web2 consumer brands such as Gucci, Balenciaga and Rtfkt have begun to try to use NFTs to participate in virtual fashion and digital clothing activities. Consumers can use NFTs to purchase limited edition virtual clothing, shoes, accessories, etc. to show their personality and identity in the virtual world.

Social Network

NFT has great potential to reshape the interaction model of social media and social platforms, especially in terms of personalization and the construction of virtual identities. For example, NFT can be used as a symbol of personal identity, representing the user's unique achievements, preferences and identity; social platforms can integrate NFT markets to allow users to buy and sell digital goods, artworks or other NFT assets, enhancing the interactivity and social experience within the platform; NFT can also provide a foundation for decentralized social networks to decentralize and decentralized governance, allowing users to truly own and control their own content creation and sharing, while directly obtaining economic returns from platform activities.

Public Chain

Looking at the current development status of NFT on mainstream public chains such as Ethereum and Bitcoin, high gas fees, strict restrictions on block size, slow confirmation speeds, and scalability bottlenecks have all posed significant limitations to the widespread application of NFT. In order to meet these challenges, some projects have begun to seek innovative paths such as cross-chain and L2.

For example, the rise of multi-chain ecology means that NFT is no longer constrained by a single public chain. By breaking down the barriers between chains, a more efficient asset transfer and trading environment will be achieved, injecting new vitality into the liquidity and popularity of NFT. L2 solutions play an important role in expanding NFT's transaction processing capabilities and reducing high transaction costs, making NFT transactions and creations affordable to more users. In addition, emerging public chains such as Polygon and Solana are also constantly optimizing NFT's transaction speed and security with their advanced architecture design and innovative consensus mechanisms, providing users with a smoother, safer and more efficient NFT experience.

Conclusion

The key to NFT's evolution from a simple digital collectible to an asset class with greater diversity, liquidity and market potential is to fully retain and strengthen its unique cultural connotations and personalized social identity attributes. At the same time, the NFT market also needs to actively seek integration with a wider range of asset classes and application scenarios. This will not only help enhance the practicality and investment value of NFT, but also promote its recognition and popularity in a wider range of application scenarios, thereby opening up new growth space.

You May Also Like

Botanix launches stBTC to deliver Bitcoin-native yield

Unprecedented Surge: Gold Price Hits Astounding New Record High