Bitcoin Hyper Tipped as Next Crypto to Explode in 2025 as Analysts Praise Layer-2 Model

Ethereum’s scaling sector has completely changed how people use blockchains. Layer-2s are now doing most of the heavy lifting, with over $57 billion locked up and networks like Arbitrum processing tens of millions of transactions every month.

Those high gas fees that used to price everyone out? They’ve dropped to just cents. And these Layer-2s now have user bases in the tens of millions – meaning Ethereum’s scaling solutions have gone mainstream.

Bitcoin hasn’t seen the same transformation. Despite being the most secure and widely recognized blockchain, it hasn’t had that same scaling breakthrough. The base layer was designed for reliability and decentralization, rather than supporting smart contracts or high throughput.

That’s exactly what Bitcoin Hyper (HYPER) is trying to fix. It’s a new Layer-2 project that wants to bring Solana-like speed and Ethereum-style programmability to Bitcoin. And given that several analysts are tipping it as the next crypto to explode, it’s already one of the most-watched presales this year.

How Bitcoin Hyper’s Layer-2 Model Boosts Bitcoin’s Capabilities

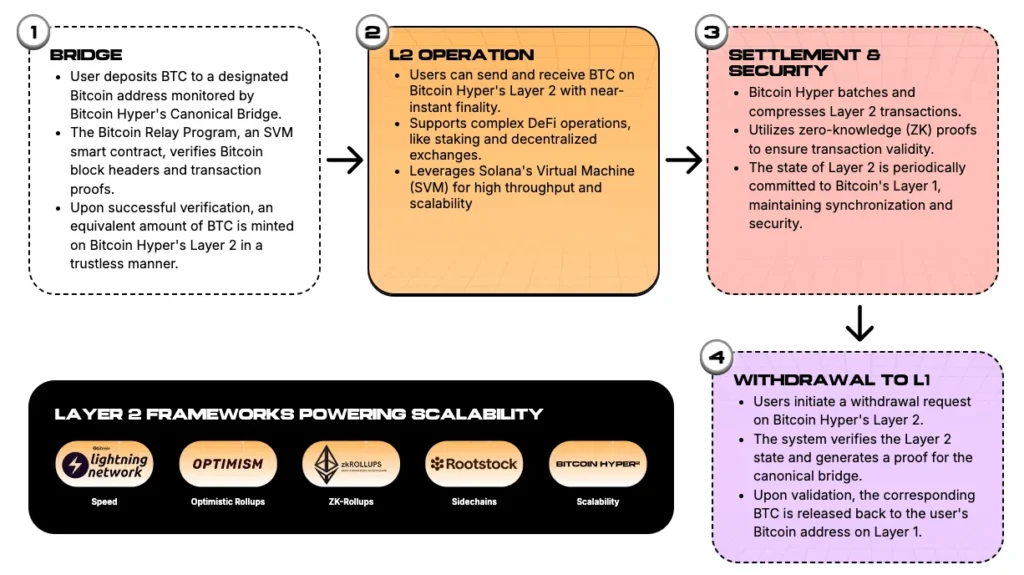

Bitcoin Hyper is designed to do what Bitcoin can’t: scale up massively without losing any of that legendary security. The network runs on a Solana-style execution layer, powered by a modified Solana Virtual Machine (SVM).

That setup means programs already written for Solana – payment apps, DEXs, even meme coins – can run on Bitcoin Hyper with parallel processing and low latency. Plus, moving BTC onto the Layer-2 is pretty straightforward.

You just send your Bitcoin to a monitored address on the main chain, the system checks block headers and proofs, then wrapped BTC gets minted on the Bitcoin Hyper Layer-2. Withdrawals work in reverse after confirmations, keeping the bridge strictly 1:1.

This approach distinguishes Bitcoin Hyper from other Layer-2 attempts, such as Stacks or Lightning Network. It’s promising Solana-style throughput, DeFi-ready smart contracts, and fees paid in HYPER – all while keeping its state anchored to Bitcoin’s base layer.

Analysts and Communities Tip HYPER as Next Crypto to Explode

Bitcoin Hyper is already getting serious buzz from analysts and content creators. Aiden Crypto, who has over 330,000 subscribers on YouTube, called the project “game-changing” in a recent video.

Borch Crypto, another popular analyst with more than 92,000 subs, went even further and labeled it the “best crypto presale” this year. The experts at 99Bitcoins, known for breaking down complex topics in simple terms, have also covered Bitcoin Hyper multiple times.

That early attention is feeding into fast-growing communities on X (Twitter) and Telegram, where thousands of early supporters share memes and build hype for the launch. HYPER has also been ranked in the top three on presale tracking sites CoinSniper and ICOBench.

For a pre-launch project, this kind of early attention can be huge. It builds momentum, attracts liquidity, and sets up the narrative before HYPER even hits the open market. That could be what separates a quiet debut from an explosive launch.

Inside Bitcoin Hyper’s Explosive $15M+ Presale

Bitcoin Hyper’s presale is doing well so far, raising over $15.2 million to date. HYPER tokens are priced at $0.012905, but the price increases in less than two days thanks to their staged pricing model.

The setup is simple: Bitcoin Hyper’s presale runs through multiple rounds, each with a slightly higher token price than the last. That means early buyers get the biggest discounts, while later participants can still get in before the planned DEX and CEX listings.

Investing in the presale is straightforward. The official site accepts ETH, BNB, SOL, USDT, USDC, and even debit or credit cards, so it works whether you’re deep into crypto or just getting started. And you can stake your HYPER tokens right after buying them, with yields currently at 73% APY.

Once the presale ends, everything shifts to the Token Generation Event (TGE). That’s when investors can claim their tokens, with initial trading expected to start on Uniswap. So, with presale momentum building and exchange listings planned, Bitcoin Hyper is setting up for what could be a massive launch soon.

Visit Bitcoin Hyper Presale

This article is not intended as financial advice. Educational purposes only.

You May Also Like

Best Crypto to Buy as Saylor & Crypto Execs Meet in US Treasury Council

Breaking: CME Group Unveils Solana and XRP Options