Tom Lee Under Fire As Short-Seller Slams BitMine’s “Relic” ETH Strategy

Tom Lee and BitMine Immersion Technologies are under fire from short-seller Kerrisdale Capital, which says the company’s ETH treasury strategy is a “relic on the verge of extinction.”

The firm criticized BitMine for issuing billions in new shares to fund Ethereum purchases, arguing the approach erodes investor value and no longer justifies a premium stock price.

BitMine’s market value is converging with the underlying value of its ETH holdings, chipping away at the company’s appeal to investors, it added.

“If you want ETH, just buy it directly, stake it, or invest through one of the new ETFs,” it said. “BitMine’s middleman pitch has run its course.”

BitMine’s Stock Sales To Fund ETH Purchases No Longer Justified

The criticism comes after BitMine transitioned from a company mainly focused on Bitcoin mining to an Ethereum treasury firm earlier this year.

Since performing that pivot, BitMine has become the largest corporate holder of ETH, amassing billions of dollars worth of the token in the process.

To grow its holdings and increase the amount of ETH per share that it offers investors, the company employed a tactic that has been pioneered by Michael Saylor’s Strategy to buy more Bitcoin. This involves selling equity and using the proceeds to buy more crypto.

Kerrisdale estimated that BitMine currently offers nine ETH per 1,000 shares. However, it accused BitMine of excessive stock dilution in pursuit of its ETH accumulation, pointing to $10 billion in new share offerings over just the past three months.

“Every rally is met with more supply,” it said, before adding that the company’s $365 million raise in September was nothing more than “a discounted giveaway disguised as a premium deal.”

Lee Lacks Saylor’s Cult-Like Following

The firm also said that Lee, who chair’s BitMine, lacks the cult-like following that Saylor and Strategy possess.

In order for BitMine’s model to succeed, Kerrisdale said the company “needs scarcity, charisma, and innovation – none of which it currently offers.”

The short-seller said that its criticism of BitMine is not a bet against the Ethereum network and its native ETH token, but rather “against the notion that investors should pay a premium for exposure” that can be easily replicated.

BitMine Stock Takes A Breather From Its Rally

In the past, Kerrisdal has issued similar warnings for investors buying shares in Riot Platform and Strategy.

Riot dismissed Kerrisdale’s criticism and said the firm’s findings were “unsound.” Saylor’s Strategy ignored the report completely.

Kerrisdale’s criticism of BitMine was followed by a more than 3% drop in its share price pre-market trading.

BitMine share price (Source: Google Finance)

That’s after the stock climbed over 1% in the latest trading day, according to Google Finance data. In the last six months, the Ethereum treasury firm’s shares have exploded by more than 16,500%.

Institutional Demand For ETH Soars

The report from Kerrisdale comes amid soaring institutional demand for Ethereum. Treasury firms and ETFs (exchange-traded funds) now hold over 12.48 million ETH, which equates to roughly 10.31% of the token’s total supply.

BitMine itself holds around 2.83 million ETH, according to data from StrategicETHReserve. This is considerably more than the next-biggest Ethereum treasury, SharpLink Gaming, with its holdings of approximately 838.73K ETH.

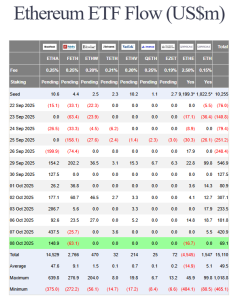

US spot Ethereum ETFs are also currently on a multi-day inflows streak. Data from Farside Investors shows investors poured $69.1 million into the products yesterday, extending the positive flows streak to eight days.

US spot ETH ETF flows (Source: Farside Investors)

BlackRock’s ETHA fund was the only US spot ETH ETF to record inflows on the day, with $148.9 million added to its reserves. Meanwhile, Fidelity’s FETH and Grayscale’s ETHE recorded respective net daily outflows of $63.1 million and $16.7 million. The remaining funds recorded no new flows.

That demand has not translated to ETH’s price in the last 24 hours. During this period, the crypto shed over 3% of its value to trade at $4,340.25 as of 5:10 a.m. EST, data from CoinMarketCap shows.

Ayrıca Şunları da Beğenebilirsiniz

Sport.Fun’s FUN Token Sale Smashes 100% Target In One Day

A Netflix ‘KPop Demon Hunters’ Short Film Has Been Rated For Release