BlackRock’s Tokenization Drive Accelerates as IBIT Bitcoin ETF Crosses $100B

KEY POINTS: IBIT crosses $100B; fastest ETF ever to reach that milestone.

IBIT crosses $100B; fastest ETF ever to reach that milestone. Larry Fink declares the era of ‘tokenization of all assets.’

Larry Fink declares the era of ‘tokenization of all assets.’ Best altcoins to buy include $HYPER and $SNORT.

Best altcoins to buy include $HYPER and $SNORT.

In a landmark moment for institutional crypto adoption, BlackRock’s iShares Bitcoin Trust (IBIT) crossed the $100B assets under management (AUM) threshold for the first time yesterday.

Rather than resting on its laurels, the asset manager is pushing aggressively into asset tokenization, signaling a strategic shift toward embedding blockchain infrastructure into traditional finance.

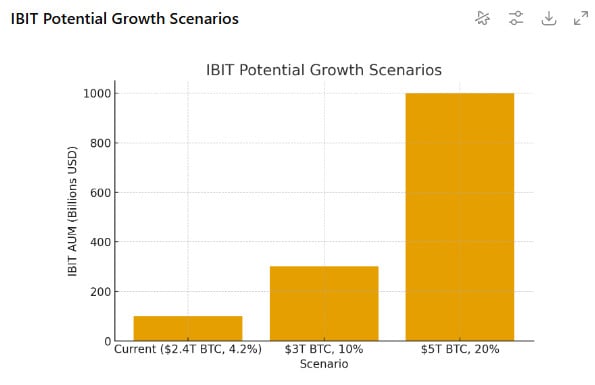

Since its launch on January 11, 2024, IBIT has grown at a blistering pace. It’s now positioned as one of the fastest-growing ETFs ever, racing to a top-20 spot among all ETFs. Vanguard’s S$P 500 ETF is the largest – and it took seven years to pass $100B.

That’s according to recent analysis, which also highlights just how far ahead of its closest competitors IBIT (with around 100B) is; the Fidelity Wise Origin Bitcoin Fund (FBTC) holds $26.1B, while Grayscale’s Bitcoin Trust ETF (GBTC) holds $22.2B.

Nearly $6.5B has poured into IBIT in the past month, moving the fund past $100B and prompting BlackRock CEO Larry Fink to declare the ‘tokenization of all assets,’

That could include:

- Real estate: offering fractional ownership, easier transfers, programmable compliance

- Equities & bonds: unlocking tokenized issuance and on-chain settlement

- Money market & short-term instruments: already in early exploration with BlackRock

- Other securities and structured products: accessed via digital wrappers

There’s another aspect to the tokenization push. As Fink noted, much of the $4.5T ETF market is global. As tokenization progresses, more of that global market becomes easier to access.

The exact AUM varies, but with IBIT right at the $100B mark, one thing is clear: this could be just the beginning of a new convergence between traditional finance and crypto.

That makes it a good time for a closer look at some of the best crypto to buy now, including $HYPER, $SNORT, and $SOL.

1. Bitcoin Hyper ($HYPER) – Bitcoin Layer 2 for Easy $BTC Payments

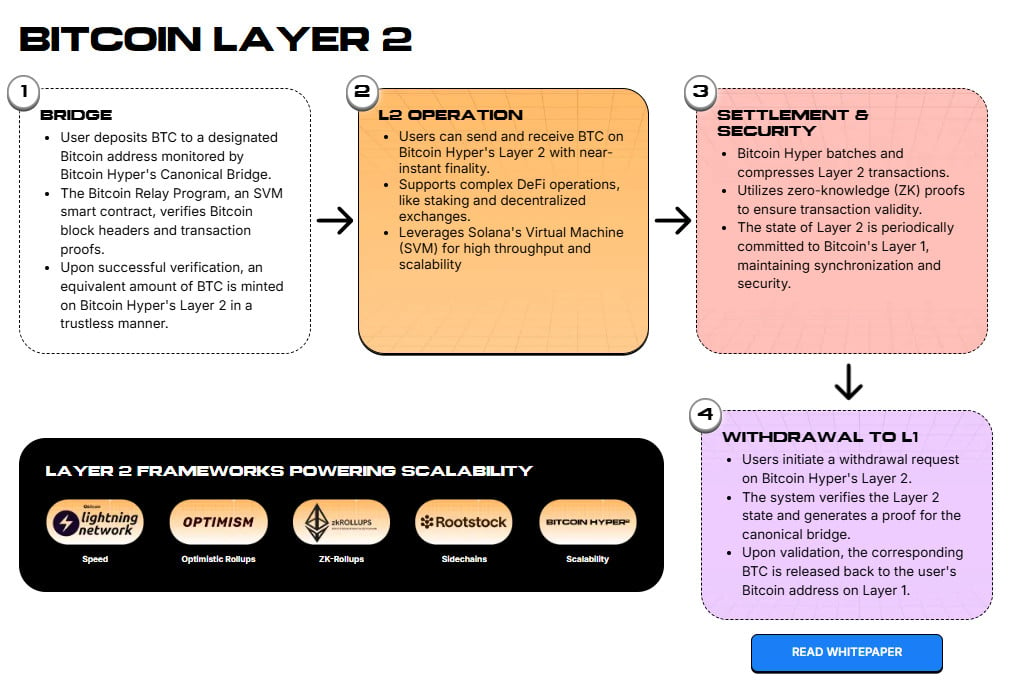

Bitcoin Hyper ($HYPER) is a throwback to the original vision of the Bitcoin whitepaper: a true cryptocurrency, easily usable for payments anywhere.

That’s not the case for Bitcoin right now. A combination of Bitcoin’s utility as a store-of-value and the limitations of the Bitcoin network prevent it from truly achieving widespread utility as a digital payments system. Limitations include:

- Low throughput

- Low TPS (average 6-7)

- Simple smart contracts

Bitcoin Hyper deals with both issues through a Canonical Bridge to the SVM. That allows users to deposit $BTC to the bridge and produce wrapped $BTC on the Solana Virtual Machine. There, Bitcoin Hyper allows both wrapped $BTC and the native $HYPER token to be transacted at the SVM’s several thousand TPS.

And on Hyper, $BTC is fully DeFi native and compatible with the broader SVM.

So far, the presale has brought in over $23.5M. Whale investors are pouring into the project, including noteworthy purchases of $379.9K and $274K. With $HYPER’s price predicted to possibly reach $0.15 by the end of 2025, it’s perhaps no surprise.

Don’t overlook the potential – learn how to buy $HYPER and check out the presale page today.

2. Snorter Token ($SNORT) – Last Chance to Buy Leading Solana Meme Coin Trading Bot

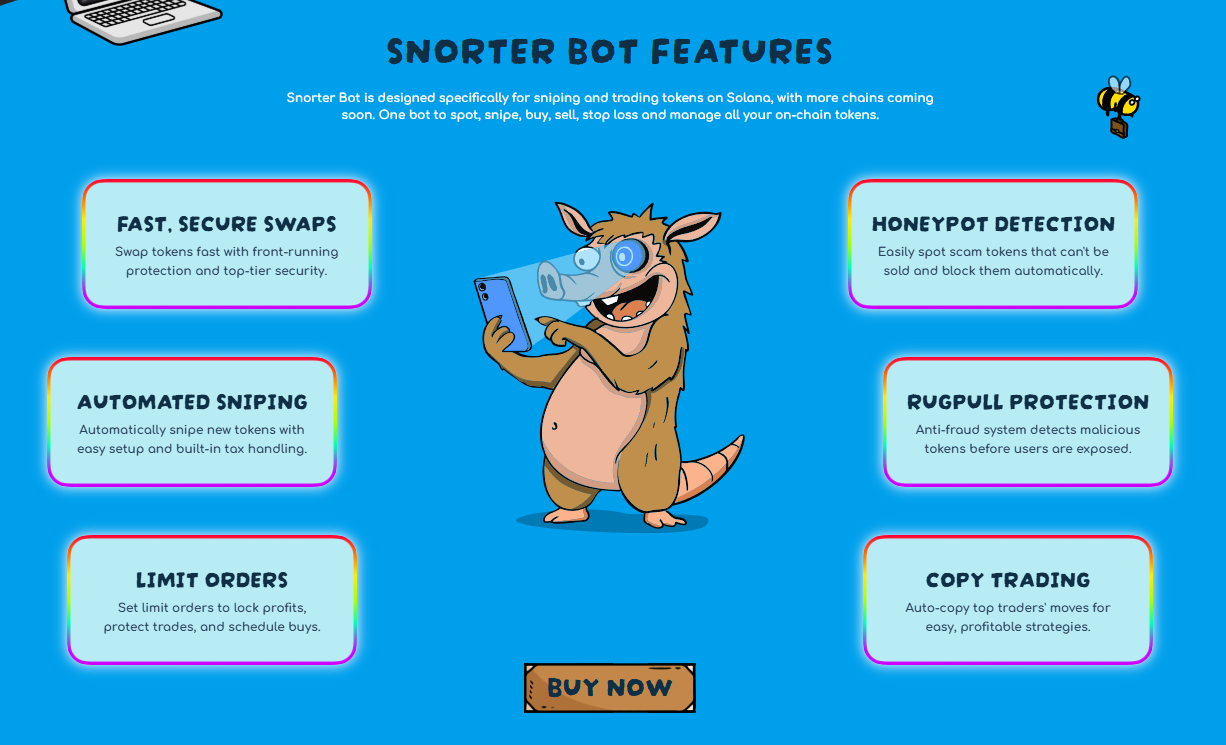

No more hunting fruitlessly for the best meme coins. Running on Snorter Token ($SNORT), the Snorter Bot tracks down the best meme coin trading opportunities and gives you all the tools you need to find the next winner.

Snorter Token provides an impressive amount of utility. With the Bot, you’ll get:

- Automated sniping tools

- Stop loss/take profit order

- Rugpull and honeypot protection built-in

The presale, which has brought in over $4.7M, ends soon. There are only days left to take advantage of $SNORT tokens at the presale price of $0.1079. After the TGE (Token Generation Event), experts predict it could rise to an impressive $1.92 by the end of the year.

Learn how to buy $SNORT to join the project now – but act fast; the $SNORT presale ends in 5 days.

Solana ($SOL) – From Meme Coins to Treasuries, $SOL Up 4% Daily

Solana ($SOL) has been overshadowed by Bitcoin and Ethereum for… forever, really. But quietly, Solana is putting together a strong year.

$SOL is up over 30% for the year, and after the broader market dip over the weekend, has rebounded nearly 3.5% over the past 24 hours.

Solana has also gathered increasing institutional support. CoinGecko lists nine $SOL treasuries holding nearly $2.7B in Solana. It’s not in the same category as Strategy’s $71.8B Bitcoin treasury, but it shows that the expansion of corporate investment strategy includes Solana.

That makes Solana one of the best crypto to buy as the crypto market expands.

If BlackRock continues to grow in tandem with Bitcoin, it could find itself in a unique position to promote tokenization as a narrative. If that happens, look for $HYPER, $SNORT, and $SOL to rise to new heights.

Ayrıca Şunları da Beğenebilirsiniz

Valour launches bitcoin staking ETP on London Stock Exchange

Optum Golf Channel Games Debut In Prime Time