Memecoins Crash to 2025 Lows as $5B Vanishes in One Day

- Memecoins crashed to $39B lowest all year, lost $5B in one day.

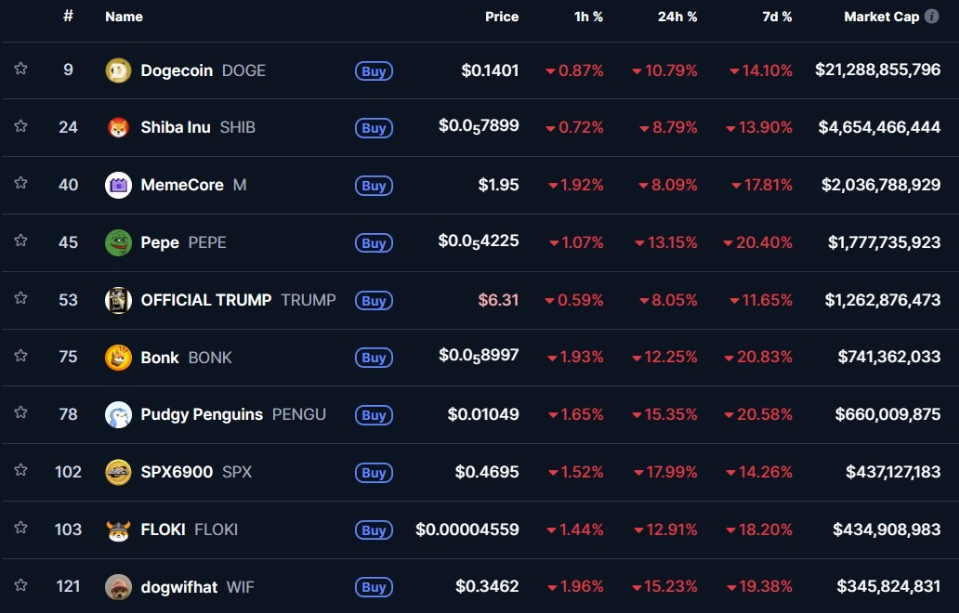

- Every big doge (DOGE, PEPE, BONK, WIF) down 14-20%, even Trump coin bled.

- NFTs back to April lows, most collections down 25-40%, party’s over for now.

Memecoins just hit their lowest point all year, crashing to a combined $39.4 billion market cap on Friday after losing over $5 billion in a single day. That’s a brutal 66% drop from the January peak of $116.7 billion. Trading volume actually jumped 40%, but nobody was buying pure panic selling.

The whole crypto market got wrecked too, shedding $800 billion in three weeks, down to $2.96 trillion. Bitcoin fell 14.7% this week to $82,778, Ethereum dropped 16% to $2,688, and every top memecoin bled double digits. Dogecoin down 14%, Pepe, Bonk, and Dogwifhat each lost around 20%. Even Trump’s own TRUMP coin slid 11.6%.

Top 10 memecoins by market capitalization.

NFTs Back to April Levels

NFTs are hurting just as bad. Total market cap sank to $2.78 billion, the lowest since April and 43% down in the last month. Most big collections got crushed: Hyperliquid’s Hypurr NFTs down 41%, Moonbirds off 33%, CryptoPunks 27%, Pudgy Penguins 26%. Only Infinex Patrons gained 11%, and Autoglyphs barely moved.

It’s a full on risk off mood. Traders are dumping anything speculative memecoins, NFTs, you name it. With Bitcoin and Ethereum leading the slide, the fun money has vanished fast, dragging the wildest corners of crypto right back to spring levels.

Ayrıca Şunları da Beğenebilirsiniz

The Channel Factories We’ve Been Waiting For

Wyoming-based crypto bank Custodia files rehearing petition against Fed