Monero (XMR) Price Prediction 2025, 2026-2030

- Bullish XMR price prediction for 2025 is $440.03 to $598.80.

- Monero (XMR) price might reach $700 soon.

- Bearish XMR price prediction for 2025 is $231.37.

In this Monero (XMR) price prediction 2025, 2026-2030, we will analyze the price patterns of XMR by using accurate trader-friendly technical analysis indicators and predict the future movement of the cryptocurrency.

|

TABLE OF CONTENTS

|

|

INTRODUCTION

|

|

|

MONERO (XMR) PRICE PREDICTION 2025

|

|

| MONERO (XMR) PRICE PREDICTION 2026, 2027-2030 |

| CONCLUSION |

| FAQ |

Monero (XMR) Current Market Status

| Current Price | $402.59 |

| 24 – Hour Price Change | 0.56% Down |

| 24 – Hour Trading Volume | $185.68M |

| Market Cap | $7.42B |

| Circulating Supply | 18.44M XMR |

| All – Time High | $517.62 (On May 07, 2021) |

| All – Time Low | $0.213 (On Jan 15, 2015) |

What is Monero (XMR)

| TICKER | XMR |

| BLOCKCHAIN | Monero blockchain |

| CATEGORY | Public blockchain platform |

| LAUNCHED ON | April 2014 |

| UTILITIES | Governance, Fast Transactions, gas fees & rewards |

Monero (XMR) is a privacy-focused cryptocurrency that offers secure, untraceable, and anonymous transactions. Launched in 2014, Monero uses advanced cryptographic techniques like ring signatures and stealth addresses to ensure that transaction details—such as the sender, recipient, and amount—remain hidden.

Unlike many other cryptocurrencies, Monero’s strong focus on privacy makes it fully fungible, meaning every coin is indistinguishable from another. Its decentralized nature and use of Proof of Work (PoW) consensus make it a popular choice for users who prioritize financial privacy and security.

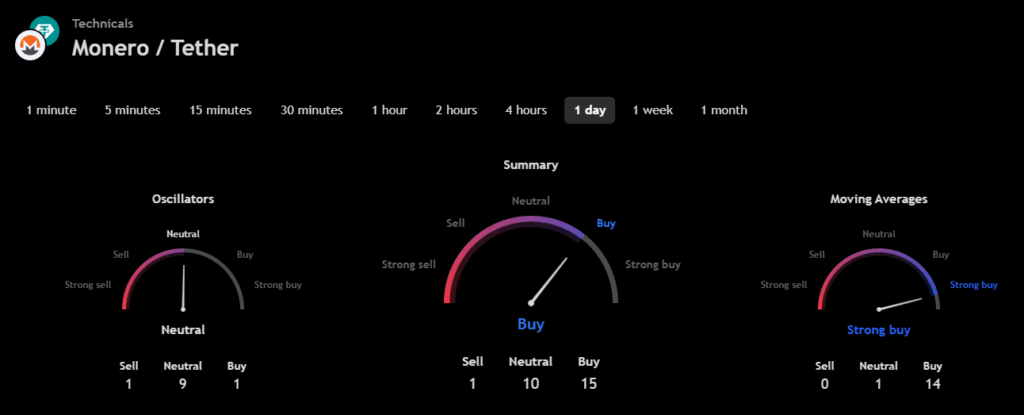

Monero 24H Technicals

(Source: TradingView)

(Source: TradingView)

Monero (XMR) Price Prediction 2025

Monero (XMR) ranks 16th on CoinMarketCap in terms of its market capitalization. The overview of the Monero price prediction for 2025 is explained below with a daily time frame.

In the above chart, Monero (XMR) exhibits a Right Angle Descending Broadening Wedge pattern. A right-angled descending broadening wedge is a bullish reversal pattern. The pattern is an inverted ascending triangle because it is made up of two converging lines with a horizontal line for the resistance and a bearish downward slant for the support.

At the time of analysis, the price of Monero (XMR) was recorded at $402.59. If the pattern trend continues, then the price of XMR might reach the resistance levels of $442.12 and $829.12. If the trend reverses, then the price of XMR may fall to the support levels of $321.68 and $232.35.

Monero (XMR) Resistance and Support Levels

The chart given below elucidates the possible resistance and support levels of Monero (XMR) in 2025.

From the above chart, we can analyze and identify the following as resistance and support levels of Monero (XMR) for 2025.

| Resistance Level 1 | $440.03 |

| Resistance Level 2 | $598.80 |

| Support Level 1 | $319.68 |

| Support Level 2 | $231.37 |

XMR Resistance & Support Levels

Monero (XMR) Price Prediction 2025 — RVOL, MA, and RSI

The technical analysis indicators such as Relative Volume (RVOL), Moving Average (MA), and Relative Strength Index (RSI) of Bitcoin (XMR) are shown in the chart below.

From the readings on the chart above, we can make the following inferences regarding the current Monero (XMR) market in 2025.

| INDICATOR | PURPOSE | READING | INFERENCE |

| 50-Day Moving Average (50MA) | Nature of the current trend by comparing the average price over 50 days | 50 MA = $376.30Price = $401.64 (50MA < Price) | Bullish/Uptrend |

| Relative Strength Index (RSI) | Magnitude of price change;Analyzing oversold & overbought conditions | 54.70 <30 = Oversold 50-70 = Neutral>70 = Overbought | Neutral |

| Relative Volume (RVOL) | Asset’s trading volume in relation to its recent average volumes | Below cutoff line | Weak volume |

Monero (XMR) Price Prediction 2025 — ADX, RVI

In the below chart, we analyze the strength and volatility of Monero (XMR) using the following technical analysis indicators — Average Directional Index (ADX) and Relative Volatility Index (RVI).

From the readings on the chart above, we can make the following inferences regarding the price momentum of Monero (XMR).

| INDICATOR | PURPOSE | READING | INFERENCE |

| Average Directional Index (ADX) | Strength of the trend momentum | 19.02 | Weak Trend |

| Relative Volatility Index (RVI) | Volatility over a specific period | 56.49 <50 = Low >50 = High | High volatility |

Comparison of XMR with BTC, ETH

Let us now compare the price movements of Monero (XMR) with that of Bitcoin (BTC), and Ethereum (ETH).

From the above chart, we can interpret that the price action of XMR is similar to that of BTC and ETH. That is, when the price of BTC and ETH increases or decreases, the price of XMR also increases or decreases, respectively.

Monero (XMR) Price Prediction 2026, 2027 – 2030

With the help of the aforementioned technical analysis indicators and trend patterns, let us predict the price of Monero (XMR) between 2026, 2027, 2028, 2029, and 2030.

| Year | Bullish Price | Bearish Price |

| Monero (XMR) Price Prediction 2026 | $720 | $130 |

| Monero (XMR) Price Prediction 2027 | $830 | $110 |

| Monero (XMR) Price Prediction 2028 | $940 | $90 |

| Monero (XMR) Price Prediction 2029 | $1045 | $70 |

| Monero (XMR) Price Prediction 2030 | $1120 | $50 |

Conclusion

If Monero (XMR) establishes itself as a good investment in 2025, this year would be favorable to the cryptocurrency. In conclusion, the bullish Monero (XMR) price prediction for 2025 is $598.80. Comparatively, if unfavorable sentiment is triggered, the bearish Monero (XMR) price prediction for 2025 is $231.37.

If the market momentum and investors’ sentiment positively elevate, then Monero (XMR) might hit $700. Furthermore, with future upgrades and advancements in the Monero ecosystem, XMR might surpass its current all-time high (ATH) of $517.62 and mark its new ATH.

FAQ

1. What is Monero (XMR)?

Monero is a privacy-centric cryptocurrency based on the CryptoNote protocol, which is a secure, private, and undetectable currency system.

2. Where can you buy Monero (XMR)?

Traders can trade Monero (XMR) on the following cryptocurrency exchanges such as Binance, OKX, Bybit, WEEX, and DigiFinex.

3. Will Monero (XMR) record a new ATH soon?

With the ongoing developments and upgrades within the Monero platform, Monero (XMR) has a high possibility of reaching its ATH soon.

4. What is the current all-time high (ATH) of Monero (XMR)?

Monero (XMR) hit its current all-time high (ATH) of $517.62 on May 07, 2021.

5. What is the lowest price of Monero (XMR)?

According to CoinMarketCap, XMR hit its all-time low (ATL) of $0.213 On Jan 15, 2015.

6. Will Monero (XMR) hit $700?

If Monero (XMR) becomes one of the active cryptocurrencies that majorly maintain a bullish trend, it might rally to hit $700 soon.

7. What will be the Monero (XMR) price by 2026?

Monero (XMR) price might reach $720 by 2026.

8. What will be the Monero (XMR) price by 2027?

Monero (XMR) price might reach $830 by 2027.

9. What will be the Monero (XMR) price by 2028?

Monero (XMR) price might reach $940 by 2028.

10. What will be the Monero (XMR) price by 2029?

Monero (XMR) price might reach $1045 by 2029.

Top Crypto Predictions

Sui (SUI) Price Prediction

Algorand (ALGO) Price Prediction

KuCoin Token (KCS) Price Prediction

Disclaimer: The opinion expressed in this article is solely the author’s. It does not represent any investment advice. TheNewsCrypto team encourages all to do their own research before investing.

Ayrıca Şunları da Beğenebilirsiniz

SEC Backs Nasdaq, CBOE, NYSE Push to Simplify Crypto ETF Rules

SHow ShowTime Advanced Supports Healthy Skin, Coat, and Digestion