Bitcoin Price Can Crash 80% to $25,240 Says Peter Brandt, Here’s Why

Despite Fed rate cuts and the end to quantitative tightening (QT), Bitcoin BTC $89 857 24h volatility: 0.2% Market cap: $1.79 T Vol. 24h: $34.57 B price has been under strong selling pressure and trading under $90,000 once again.

This week will be crucial with the announcement of the US CPI numbers for November, as well as the Bank of Japan’s rate hike decision.

Peter Brandt Predicts Bitcoin Price Crash

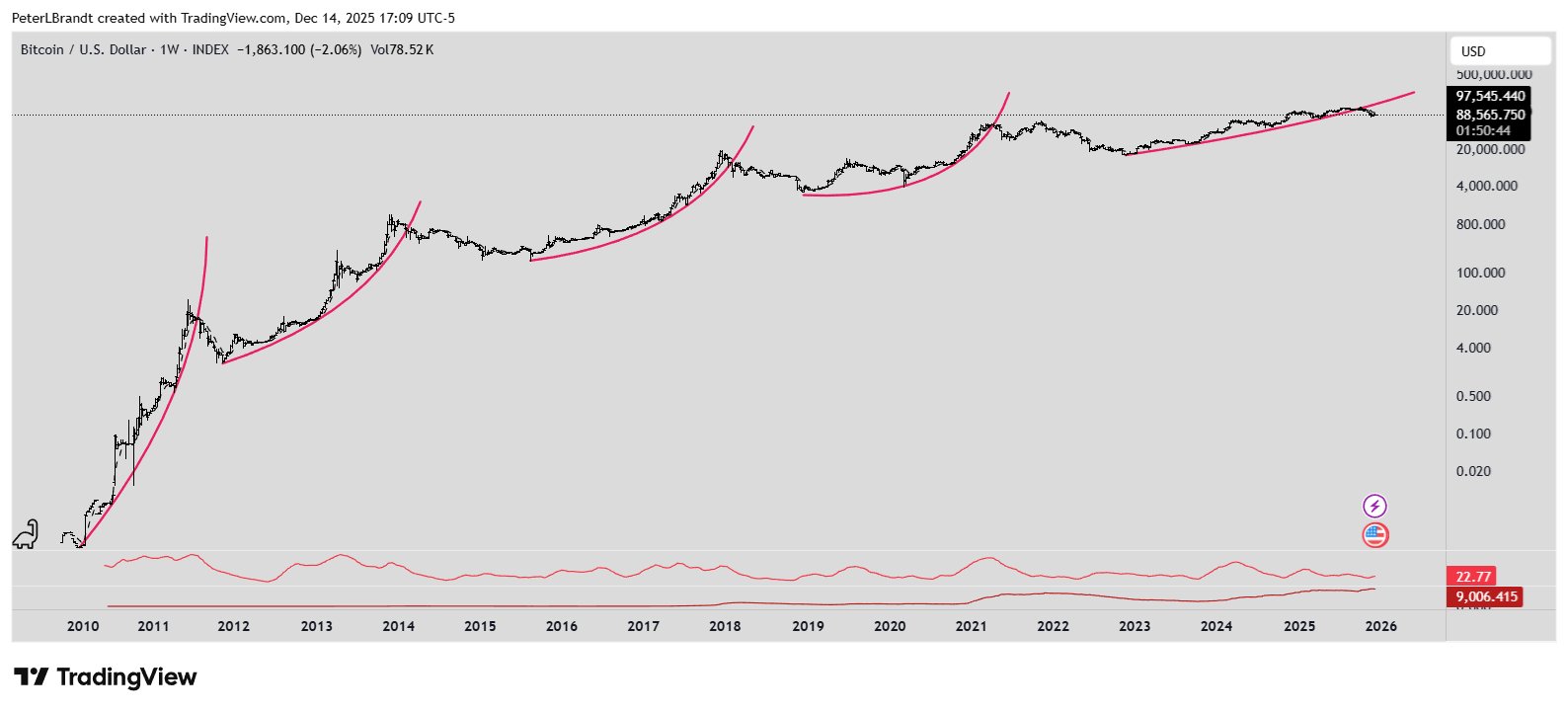

Veteran trader Peter Brandt warned that Bitcoin may be entering a deeper correction, based on historical market cycles. Brandt noted that Bitcoin bull cycles have typically followed parabolic advances. However, once BTC broke the parabolic trend, the Bitcoin price crashed by nearly 80% from the peak.

Bitcoin breaks under parabolic trend | Source: Peter Brandt

According to Brandt, the current parabolic structure has now been violated, as shown in the image above. This further raises the risks of a substantial drawdown. Based on historical behavior, Brandt suggested that a decline of roughly 80% from Bitcoin’s all-time high would imply a price level near $25,240.

The majority of the selling pressure in BTC has been coming from retail investors. Bitcoin price has been facing strong rejection at $93,000, with bulls failing to break past it.

Over the week, BTC has once again slipped under the $90,000 level and is testing support at $88,000. Despite this, some market experts continue to be bullish about BTC.

Market analyst Captain Faibik said that a Bitcoin price breakout may be approaching. However, he stressed that bulls must reclaim the $93,000 resistance level to restore upside momentum.

Faibik noted that while buyers have struggled to break past the $93,000, repeated retests are gradually weakening the resistance.

On the other hand, Strategy CEO Michael Saylor has hinted at more BTC purchases coming ahead. Being the largest Bitcoin treasury firm, the company already holds 660,524 BTC worth $58.5 billion.

US CPI and Bank of Japan Rate Hike Decision Looming

Ahead on Thursday, Dec. 18, the US will release the CPI (Consumer Price Inflation) numbers for the month of November. Recent forecasts for US consumer price inflation in November 2025 point to a year-over-year increase of about 3.1% and a month-over-month rise of roughly 0.4%. These numbers could potentially impact the upcoming Fed rate cut decisions.

On the other hand, Bank of Japan’s (BoJ) interest rate decision is looming on Dec. 19.

Popular market analyst Ted Pillows noted that the last three times the BoJ announced a rate hike, Bitcoin price dropped 20-30%. If history repeats, a drop to $70,000 can’t be ruled out.

nextThe post Bitcoin Price Can Crash 80% to $25,240 Says Peter Brandt, Here’s Why appeared first on Coinspeaker.

Ayrıca Şunları da Beğenebilirsiniz

Golden surge in practical shooting propels PH past Malaysia in SEA Games medal tally

Here are Two Major Milestones for Saylor as Strategy Acquires 10K+ Bitcoin in Latest Scoop