J.P. Morgan to Launch First Tokenized Money Market Fund on Ethereum

Key Takeaways

- J.P. Morgan Chase is launching its first tokenized money-market fund on Ethereum, dubbed My OnChain Net Yield Fund or ‘MONY’, with an initial $100 million seed investment.

- MONY offers similar benefits to traditional money-market funds with added blockchain advantages.

- The fund adds to the growing trend of bringing traditional investment products on-chain, following new regulations and earlier institutional tokenization efforts.

J.P. Morgan Chase (NYSE: JPM) is launching its first tokenized money market fund, which will operate on the Ethereum blockchain. The banking giant made the announcement on Monday with an initial $100 million seed investment from its own capital and plans to open it to outside investors on Tuesday this week.

Dubbed My OnChain Net Yield Fund or ‘MONY’, the fund is supported by J.P. Morgan’s Kinexys Digital Assets tokenization platform and is intended for only qualified investors defined as those individuals with at least $5 million in assets and institutions with a minimum of $25 million. However, the fund itself requires a $1 million minimum investment.

Qualified investors can access it by subscribing through the firm’s portal, Morgan Money, where they will receive digital tokens representing their holdings in their crypto wallets. MONY, much like traditional money-market funds, holds diversified baskets of short-term debt securities and pays interest daily. Investors can redeem their shares using either cash or stablecoins.

Money market funds have historically been a central component of investment. The launch of MONY reflects the industry’s growing shift toward tokenization of assets on public networks, making J.P. Morgan the largest GSIB, or Global Systemically Important Bank, to launch such a fund on a public blockchain.

Tokenization Booming in the U.S.

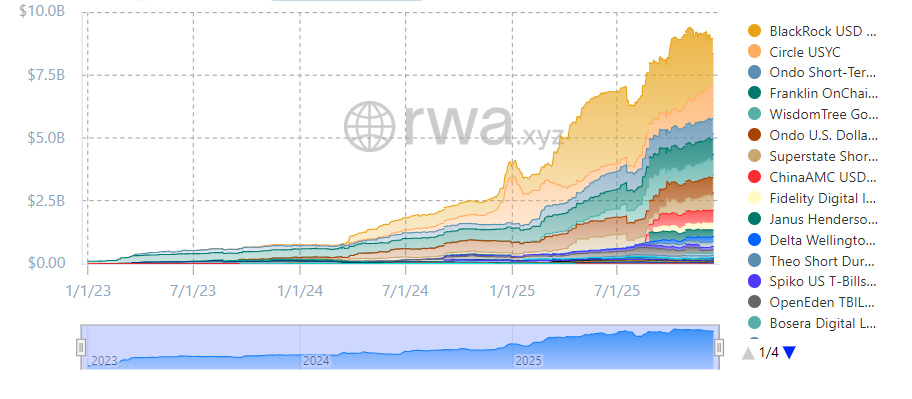

The move by J.P Morgan follows a growing interest in tokenization in the US among other major asset managers like BlackRock and Franklin Templeton in recent years. In 2025 alone, tokenization of U.S. treasuries has grown from as low as $3 to $9 billion according to data from RWA.xyz and is projected to grow to $18.9 trillion by 2033, according to a report by BCG and Ripple.

-

- Tokenized U.S. Treasuries

This growth can be attributed to the growing clarity from U.S. policymakers on how digital asset activity fits within the existing financial system through the GENIUS Act and recent developments around the Clarity Act.

This article was originally published as J.P. Morgan to Launch First Tokenized Money Market Fund on Ethereum on Crypto Breaking News – your trusted source for crypto news, Bitcoin news, and blockchain updates.

Ayrıca Şunları da Beğenebilirsiniz

Why the Testing Method Developers Prefer Is Rarely Ever the One That Finds the Most Bugs

CME Group to launch options on XRP and SOL futures