Critical Shift: Russia’s Permanent Cryptocurrency Mining Ban Targets Siberian Power Crisis

BitcoinWorld

Critical Shift: Russia’s Permanent Cryptocurrency Mining Ban Targets Siberian Power Crisis

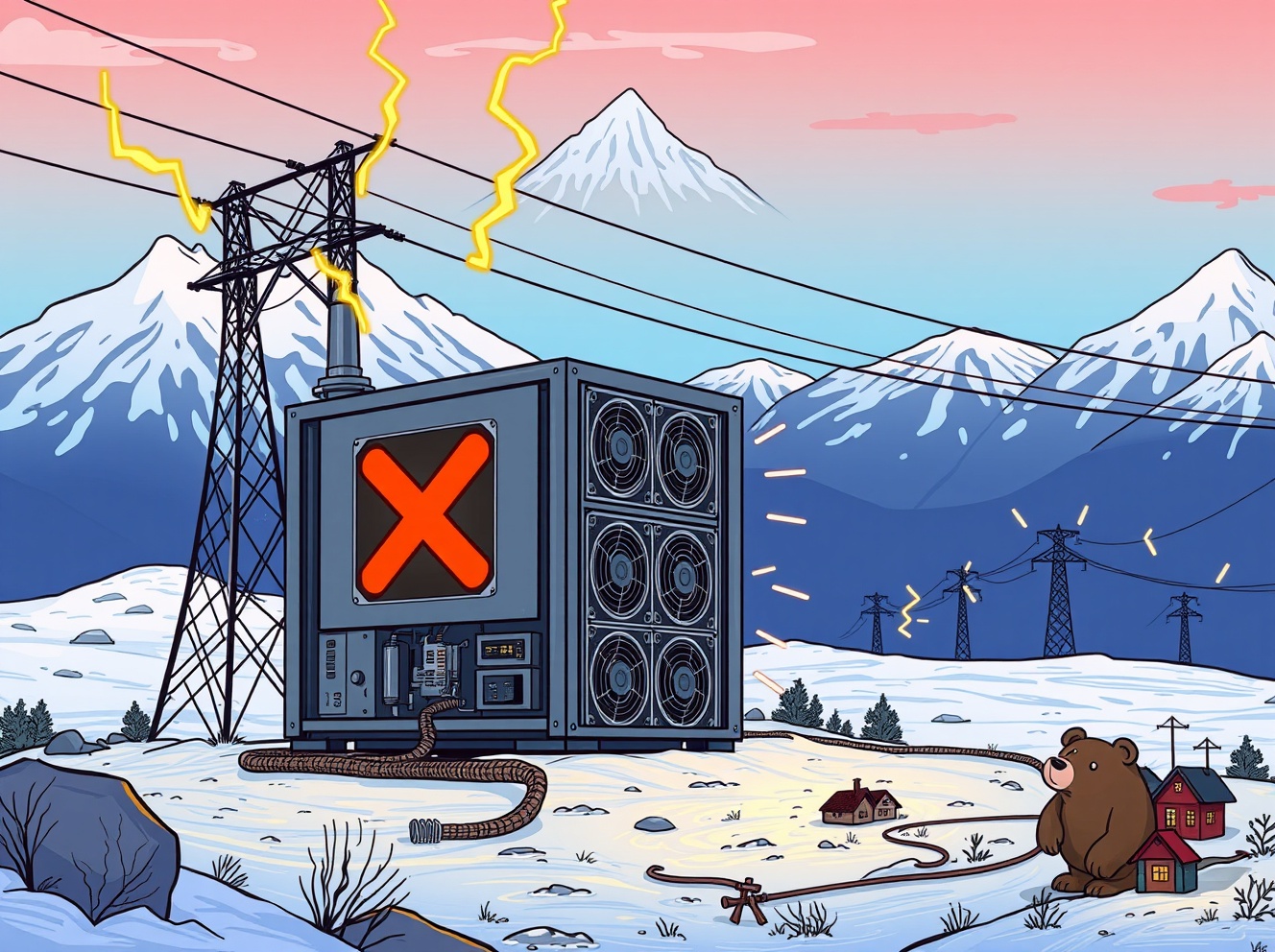

In a decisive move that signals a major policy shift, Russia is preparing to implement a permanent cryptocurrency mining ban in two Siberian regions starting next year. This dramatic escalation from seasonal restrictions aims to tackle severe power shortages that have plagued these energy-rich areas. For cryptocurrency enthusiasts and miners worldwide, this development represents a significant regulatory hardening in one of the world’s most important mining regions.

Why Is Russia Implementing a Permanent Cryptocurrency Mining Ban?

The Russian government’s decision stems from growing concerns about energy infrastructure strain. Cryptocurrency mining operations, particularly those using proof-of-work consensus mechanisms, consume enormous amounts of electricity. In Siberia’s Irkutsk and Krasnoyarsk regions—where cheap hydroelectric power initially attracted miners—the local grids simply cannot handle the demand. Authorities report that residential areas have experienced blackouts during peak mining periods, creating public discontent and safety concerns.

This permanent cryptocurrency mining ban expands upon existing seasonal restrictions that already affect 10 Russian regions annually from November to March until 2031. The seasonal bans were implemented as temporary measures, but the government now believes permanent action is necessary in the most affected areas. The move reflects a broader global tension between cryptocurrency development and energy sustainability.

What Does This Mean for Global Cryptocurrency Mining?

Russia has emerged as a major player in global cryptocurrency mining following China’s 2021 mining crackdown. The country’s cold climate and abundant energy resources made it an attractive destination for mining operations seeking lower operational costs. However, this new cryptocurrency mining ban could significantly alter the global mining landscape:

- Reduced hash rate contribution: Russia currently contributes approximately 4-5% of Bitcoin’s global hash rate

- Relocation pressure: Miners must now consider moving operations to other regions or countries

- Increased operational costs: Remaining Russian miners face higher energy costs in permitted regions

- Regulatory uncertainty: The ban creates questions about Russia’s long-term crypto stance

The Siberian regions affected by the permanent cryptocurrency mining ban were particularly popular due to their exceptionally low electricity rates—sometimes as little as $0.01 per kWh. This made them economically viable even for smaller mining operations. With this advantage disappearing, the economic calculus for mining in Russia changes fundamentally.

How Will This Impact Russia’s Crypto Economy?

Russia’s approach to cryptocurrency regulation has been notably ambivalent. While the central bank has advocated for strict controls, other government bodies have recognized the potential economic benefits of embracing digital assets. This permanent cryptocurrency mining ban represents a victory for energy security advocates but may come at an economic cost:

- Lost tax revenue: Mining operations generate significant electricity consumption taxes

- Reduced foreign investment</strong: Crypto mining companies may hesitate to invest in Russia

- Informal mining growth: Bans often push activities underground rather than eliminating them

- Technology sector impact: Related businesses like hardware sales and maintenance may suffer

Interestingly, the ban appears geographically targeted rather than nationwide. Other Russian regions with surplus energy capacity might continue to host mining operations. This suggests the government is attempting to balance energy management with economic opportunity—a challenging tightrope walk that other nations are also attempting.

What Can Cryptocurrency Miners Do Now?

For miners currently operating in the affected Siberian regions, several practical steps should be considered immediately. First, assess whether operations can be relocated to other Russian regions not covered by the cryptocurrency mining ban. Areas with energy surpluses and cooler climates might offer viable alternatives within the country.

Second, explore international relocation options. Countries like Kazakhstan, Canada, and the United States have become increasingly popular mining destinations, though each presents unique regulatory and operational challenges. Third, consider diversifying into less energy-intensive blockchain activities or alternative consensus mechanisms that don’t face the same regulatory scrutiny.

Finally, stay informed about potential legal challenges or exceptions. The Russian cryptocurrency regulatory landscape remains fluid, and industry advocacy groups may challenge the scope or implementation of the cryptocurrency mining ban.

The Bigger Picture: Energy vs. Innovation

Russia’s permanent cryptocurrency mining ban highlights a fundamental tension facing many nations: how to balance innovative technologies with infrastructure limitations. As cryptocurrency adoption grows globally, more countries will face similar decisions about allocating finite energy resources. This development serves as a cautionary tale for miners about geographical concentration risk and the importance of regulatory diversification.

The Siberian situation also underscores the need for more energy-efficient blockchain technologies. While proof-of-work mining faces increasing scrutiny, alternative consensus mechanisms like proof-of-stake continue to gain traction. The long-term solution may not be banning mining but rather encouraging technological evolution toward sustainable models.

Conclusion: A Watershed Moment for Crypto Regulation

Russia’s decision to implement a permanent cryptocurrency mining ban in two Siberian regions represents a watershed moment in global crypto regulation. It demonstrates how local infrastructure limitations can drive national policy decisions, even in resource-rich nations. For the cryptocurrency industry, this development reinforces the importance of energy efficiency and regulatory engagement. As the sector matures, finding sustainable models that balance innovation with practical constraints will be essential for long-term viability.

The coming months will reveal how effectively Russia enforces this ban and how miners adapt to the new reality. One thing is certain: the global cryptocurrency mining map continues to evolve, with energy considerations increasingly driving geographical distribution.

Frequently Asked Questions

Which Siberian regions face the permanent cryptocurrency mining ban?

The ban specifically targets the Irkutsk and Krasnoyarsk regions, where power shortages have been most severe due to mining operations straining local grids.

When does the permanent ban take effect?

The permanent cryptocurrency mining ban is scheduled to begin next year, though exact implementation dates may vary by locality within the affected regions.

Does this mean all cryptocurrency mining is banned in Russia?

No, the ban is geographically limited to two Siberian regions. Other Russian areas may continue to host mining operations, particularly those with energy surpluses.

What about the existing seasonal mining bans?

Seasonal bans in 10 regions from November to March will continue until 2031 as previously planned. The permanent ban in Siberia is an additional, more severe restriction.

Can miners apply for exceptions to the ban?

Current reports suggest the ban will be comprehensive, but the Russian government has sometimes created exceptions for registered industrial operations. Miners should consult local authorities for specific guidance.

How will this affect cryptocurrency prices?

While any major mining disruption can theoretically affect network security and potentially prices, Russia’s 4-5% share of global Bitcoin mining means the direct price impact may be limited unless other countries follow with similar restrictions.

If you found this analysis of Russia’s cryptocurrency mining ban helpful, please consider sharing it with others in the crypto community. Regulatory developments in major markets affect us all, and spreading awareness helps the industry prepare and adapt.

To learn more about the latest cryptocurrency regulation trends, explore our article on key developments shaping global cryptocurrency policy and institutional adoption.

This post Critical Shift: Russia’s Permanent Cryptocurrency Mining Ban Targets Siberian Power Crisis first appeared on BitcoinWorld.

Ayrıca Şunları da Beğenebilirsiniz

Sport.Fun’s FUN Token Sale Smashes 100% Target In One Day

A Netflix ‘KPop Demon Hunters’ Short Film Has Been Rated For Release