Top 9 Crypto Sectors Coinbase Ventures Is Betting On in 2026

Coinbase Ventures has unveiled nine key investment areas it believes will define crypto’s next growth phase, ranging from real-world asset perpetuals to AI-powered robotics, as the firm seeks to deploy capital in an increasingly sophisticated blockchain ecosystem.

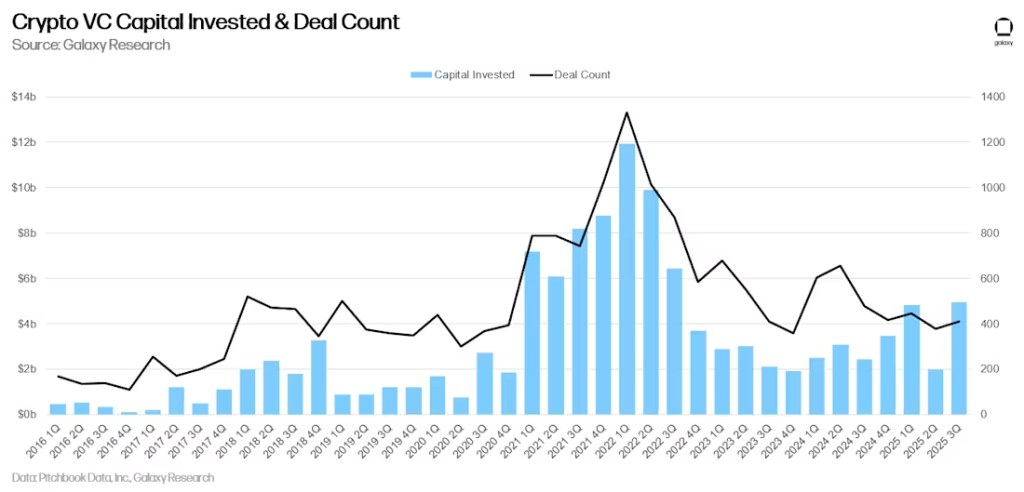

The venture arm, which manages a portfolio of 422 companies across 618 total investments since its 2018 founding, released its 2026 priorities as the crypto venture market experiences its strongest fundraising period since the FTX collapse.

This release came as third-quarter funding reached $4.65 billion, marking a 290% surge from the previous quarter.

Perpetuals and Trading Infrastructure Lead Investment Themes

Coinbase Ventures identified real-world asset perpetuals as its top priority, with General Partner Kinji Steimetz describing the category as enabling “synthetic exposure to offchain assets through perpetual futures contracts.”

The firm expects markets to form around everything from private companies to economic data prints, a phenomenon Steimetz termed the “perpification of everything.“

Specialized trading infrastructure represents another core focus, particularly prediction market aggregators that could consolidate over $600 million in fragmented liquidity across venues like Polymarket and Kalshi.

Next-generation DeFi protocols also captured attention, with composability in perpetual markets allowing traders to earn yield on collateral while maintaining leveraged positions, as perpetual DEX volumes hit $1.4 trillion monthly.

Unsecured Lending and Privacy Solutions Draw Focus

Unsecured credit markets emerged as what General Partner Jonathan King called “DeFi’s next frontier,” with the U.S. alone holding $1.3 trillion in revolving unsecured credit lines that crypto infrastructure could potentially capture.

King emphasized the challenge lies in designing sustainable risk models that blend onchain reputation with offchain data.

Privacy-preserving technologies gained renewed emphasis, with General Partner Ethan Oak noting that mainstream adoption may require users to maintain financial confidentiality.

The firm is also tracking privacy-focused assets and DeFi applications using advanced cryptography, including zero-knowledge proofs and trusted execution environments.

AI-powered onchain development tools represent what King described as smart contract development’s “GitHub Copilot moment,” potentially enabling non-technical founders to launch onchain businesses within hours through automated code generation and security reviews.

Robotics Data and Digital Identity Round Out Priorities

Physical robotics data collection emerged as a longer-term bet, with Steimetz identifying a critical gap in training data for robotic systems, particularly fine-grained physical interaction data involving grip pressure and manipulation of deformable materials.

Decentralized physical infrastructure networks could provide a framework for scaling high-quality data collection.

Proof of humanity solutions closed out the list, with General Partner Hoolie Tejwani warning that digital content is approaching a tipping point where AI-generated material becomes indistinguishable from human creation.

Coinbase Ventures backs Worldcoin as one approach, though Tejwani indicated the firm would support multiple solutions.

In summary, the nine priority areas include:

- RWA perpetuals

- Proprietary AMMs

- Prediction market trading terminals

- Perpetual markets composability

- Unsecured lending

- Onchain privacy

- Robotics data collection

- Proof of humanity

- AI development tools.

President and COO Emilie Choi stated, “If you’re building in these areas, get in touch,” with Chief Business Officer Shan Aggarwal also adding that “the next wave of capital markets innovation will be built onchain.“

Venture Funding Surges Despite Market Volatility

The investment priorities come as crypto venture funding roared back in the third quarter, hitting $4.65 billion, the second-highest level since FTX’s collapse sent shockwaves through the industry in late 2022.

The 290% surge from Q2 reflects the strongest quarter since early 2023’s $4.8 billion tally, according to Galaxy Digital data.

Source: Galaxy

Source: Galaxy

Capital flowed mainly into stablecoins, AI-driven crypto tools, blockchain infrastructure, and trading technology throughout the quarter.

Despite the headline jump, deployment remained heavily concentrated across 414 venture deals, with just seven accounting for half of all money invested.

Revolut led with a $1 billion round, followed by Kraken’s $500 million and Erebor’s $250 million.

Galaxy’s head of research, Alex Thorn, said the rebound shows venture appetite for digital-asset startups remains stronger than expected, though activity remains below the 2021-2022 bull-market pace.

The United States captured 47% of invested capital and 40% of completed deals, with Thorn expecting “US dominance to increase, particularly now that the GENIUS Act is law and especially if Congress can pass a crypto market structure bill.“

You May Also Like

Wormhole’s W token enters ‘value accrual’ phase with strategic reserve

Wall Street sets AMD stock price target for next 12 months