Index

Share

A crypto Index provides a way for investors to gain diversified exposure to a specific basket of digital assets through a single tokenized product. These indices often track specific sectors, such as DeFi, DePIN, or RWA, and are automatically rebalanced via smart contracts. In 2026, AI-managed thematic indices have become the gold standard for passive investing, allowing users to track the "blue chips" of the Web3 economy without manual portfolio management. This tag covers index methodology, rebalancing frequency, and the benefits of diversified crypto baskets.

25400 Articles

Created: 2026/02/02 18:52

Updated: 2026/02/02 18:52

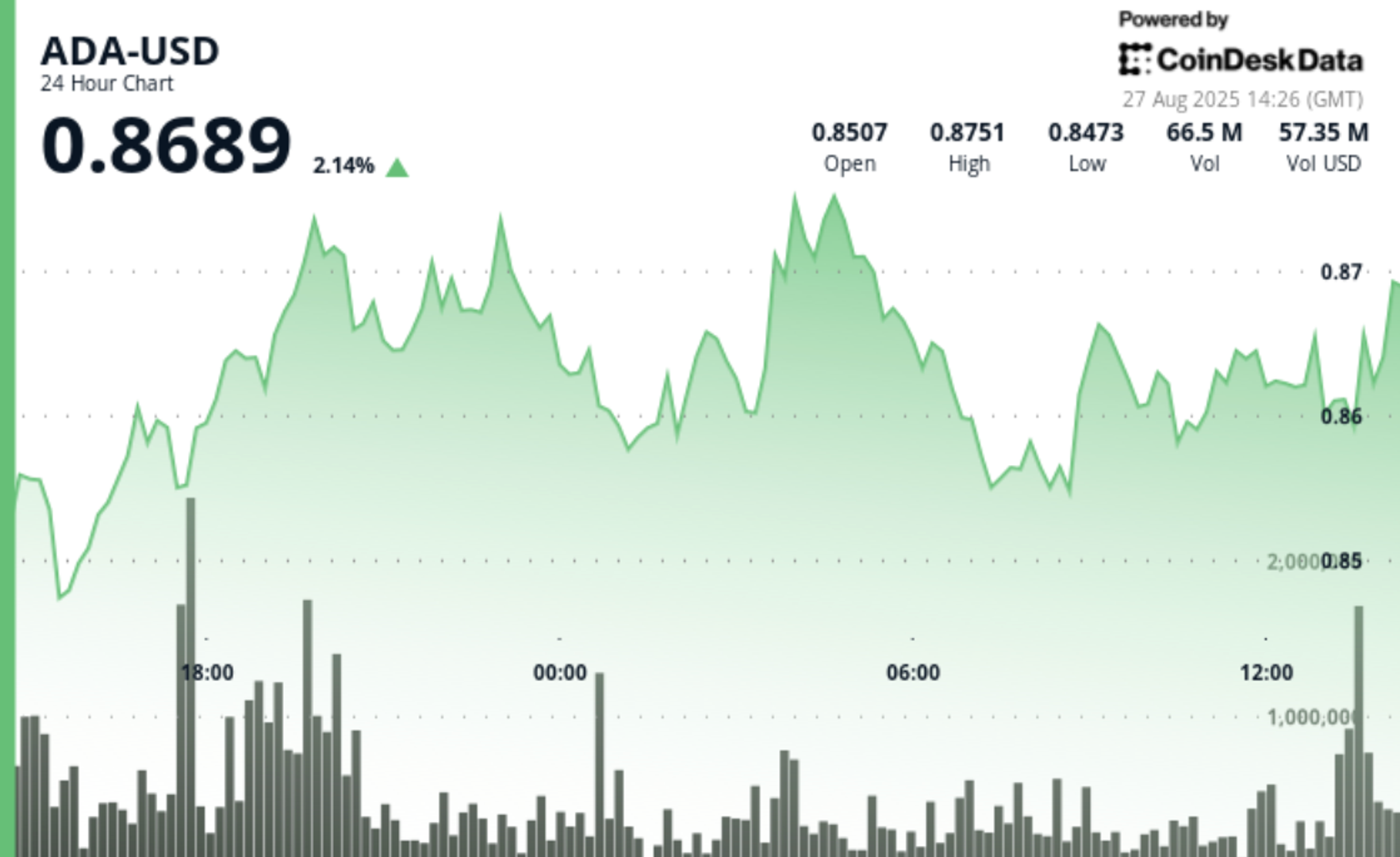

Cardano Gains 2%, Shrugs Off ETF Delay

Author: Coinstats

2025/08/27

Share

Recommended by active authors

Latest Articles

Gemini Exits UK, EU, and Australia in Strategic U.S. Pivot

2026/02/06 03:41

Top 3 Safe Havens While ETH Hits $1932: Digitap ($TAP) is the Best Crypto Presale

2026/02/06 03:24

G-P Names Aamir Khan as Chief Revenue Officer and GK Konduri as Chief Product Officer

2026/02/06 03:16

‘Big Short’ Michael Burry flags bitcoin pattern that predicts drop to low $50,000s

2026/02/06 03:13

WLFI Drops 20% Weekly as Price Tests the Crucial $0.113 Support

2026/02/06 03:00