Lending

Share

Lending protocols form the backbone of the decentralized money market, allowing users to lend or borrow digital assets without intermediaries. Using smart contracts, platforms like Aave and Morpho automate interest rates based on supply and demand while requiring over-collateralization for security. The 2026 lending landscape features advanced permissionless vaults and institutional-grade credit lines. This tag covers the evolution of capital efficiency, liquidations, and the integration of diverse collateral types, including LSTs and tokenized RWAs.

15325 Articles

Created: 2026/02/02 18:52

Updated: 2026/02/02 18:52

Recommended by active authors

Latest Articles

The Howard and Georgeanna Jones Foundation for Reproductive Medicine announces new $75,000 Bridge Funding Award

2026/02/13 04:45

Senate Republican shares NSFW story about late-night Trump phone calls

2026/02/13 04:43

UAE’s Central Bank Approves the DSSC Stablecoin Launch by IHC, FAB, and Sirius

2026/02/13 04:30

Unyielding Challenges Stall US Crypto Bill Progress

2026/02/13 04:04

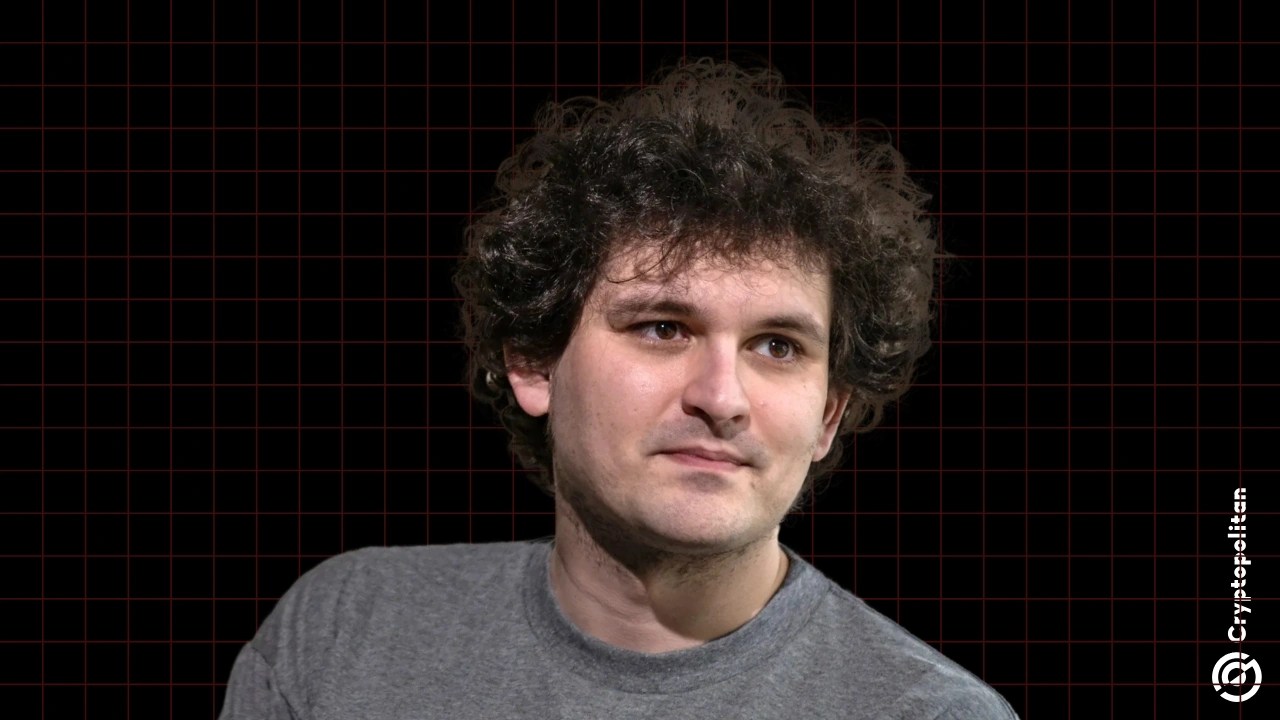

SBF enters fourth day of challenging Biden DOJ conviction, courting Trump admin

2026/02/13 03:53