Lending

Share

Lending protocols form the backbone of the decentralized money market, allowing users to lend or borrow digital assets without intermediaries. Using smart contracts, platforms like Aave and Morpho automate interest rates based on supply and demand while requiring over-collateralization for security. The 2026 lending landscape features advanced permissionless vaults and institutional-grade credit lines. This tag covers the evolution of capital efficiency, liquidations, and the integration of diverse collateral types, including LSTs and tokenized RWAs.

14300 Articles

Created: 2026/02/02 18:52

Updated: 2026/02/02 18:52

Recommended by active authors

Latest Articles

eurosecurity.net Expands Cryptocurrency Asset Recovery Capabilities Amid Rising Investor Losses

2026/02/06 17:24

The $1 Billion Liquidation: Bitcoin’s Brutal Moves

2026/02/06 17:18

PA Daily News | Bitcoin plunges 15.48% in a single day, marking the largest drop since the FTX crash; MSTR reports a net loss of $12.4 billion in Q4 2025.

2026/02/06 17:15

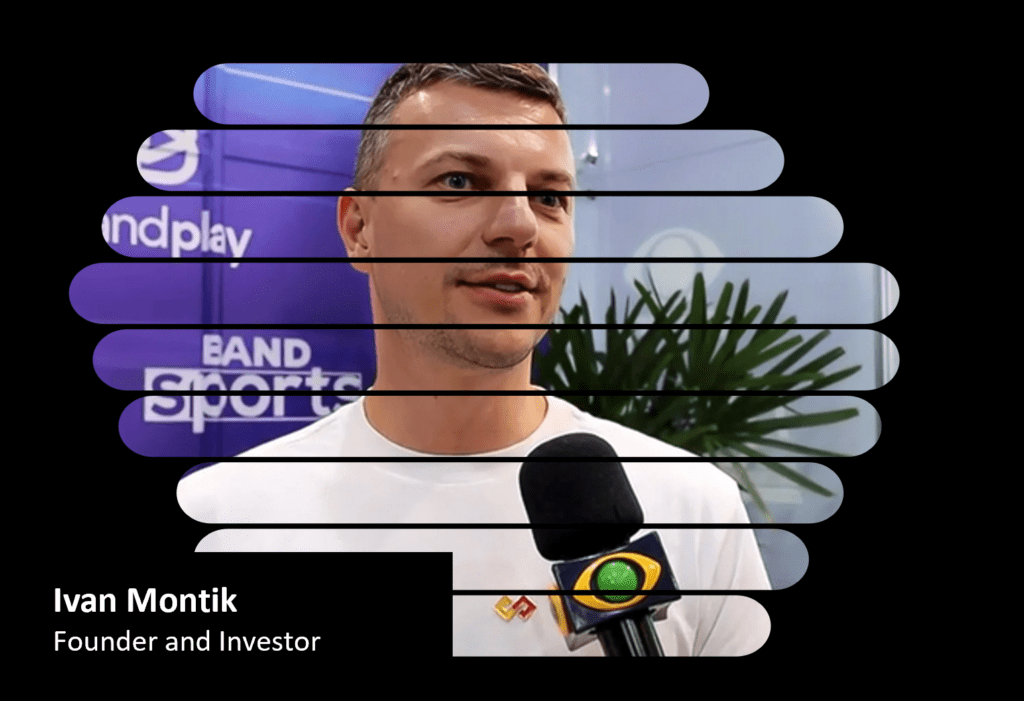

THE WIRECARD SMOKING GUN: SoftSwiss Founder Ivan Montik Unmasked in Munich Court as Judge Flattens PSP Denials

2026/02/06 17:04

What Triggered the Latest Bitcoin and Altcoin Crash?

2026/02/06 16:45